Ethereum Holds Support as Whale Activity and Liquidity Hint at Recover

Ethereum fell by nearly 4% in the past 24 hours following partial profit-taking from large holders, yet on-chain data suggests conditions may be forming for a short-term rebound. Despite selling pressure, ETH remains within a price range that could trigger renewed upward momentum.

Profit-Taking From Whales

According to OnChain Lens data, a major Ethereum holder sold 3,000 ETH on Binance, realizing gains of roughly $14.7 million. The same address had accumulated 8,009 ETH for $18.25 million about two and a half months earlier.

While this partial sell-off weighed on short-term sentiment, the trader still retains over 2,000 ETH, an indication that some whales remain confident in Ethereum’s longer-term trajectory.

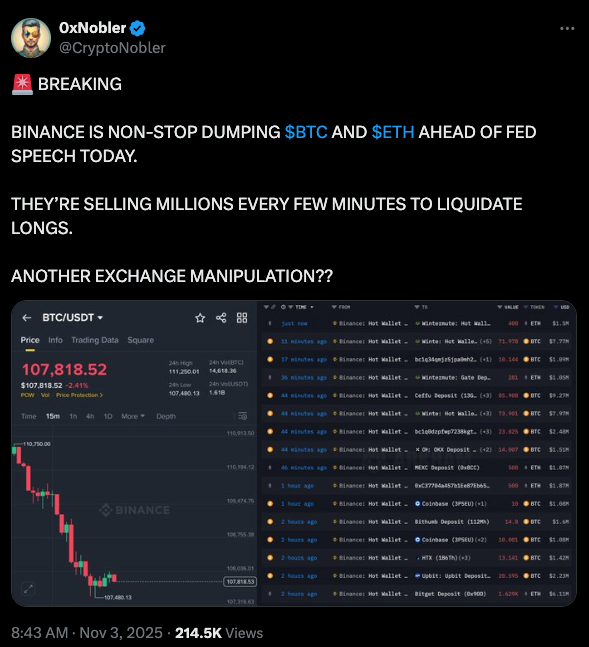

Additional wallet movements show Binance transferring ETH and Bitcoin from its hot wallet, including a $6.1 million transfer to Bitget and several smaller transfers averaging $1.5–$1.8 million each to Wintermute.

Liquidity Clusters Hint at a Reversal Zone for Ethereum

Market data shows that most long positions below $3,800 were liquidated, concentrating new liquidity above that level. Analysts note that liquidity pockets between $3,600 and $3,800 could still be absorbed before a reversal begins, as a temporary dip often precedes fresh bullish momentum.

If Ethereum takes liquidity in that zone and holds, upside targets lie between $3,900 and $4,800, aligning with key resistance clusters visible on higher time frames.

However, if liquidity continues to build below $3,800, price consolidation may persist within the $3,600–$3,800 range before a decisive move forms.

Fear and Greed in Balance

Ethereum’s Market Value to Realized Value (MVRV) ratio currently stands near 1.5, indicating that holders remain in profit but sentiment is cautious. The price continues to trade between $2,560 and $5,760, a zone reflecting equilibrium between fear and greed.

This neutral sentiment phase often precedes market expansion. Combined with accumulation by select holders and reduced volatility, Ethereum could be nearing conditions suitable for a short-term rally.