In about 10 days, members of the crypto community will witness the next Bitcoin BTC halving. This important event will result in the reward for mining a block being halved – from 6.25 to 3.125 BTC – which will have an impact on the profitability of miners.

Bitcoin miners face difficulties

According to a recent report by CryptoQuant, the hash price of miners has dropped by 30% over the past 4 years. Currently, this figure is estimated at $0.11 per terahash per second, but subject to stable market conditions, it could fall to $0.055 after halving.

“The hash price is the average profit that a miner receives for each attempt to find a valid block of Bitcoin,” explained CryptoQuant.

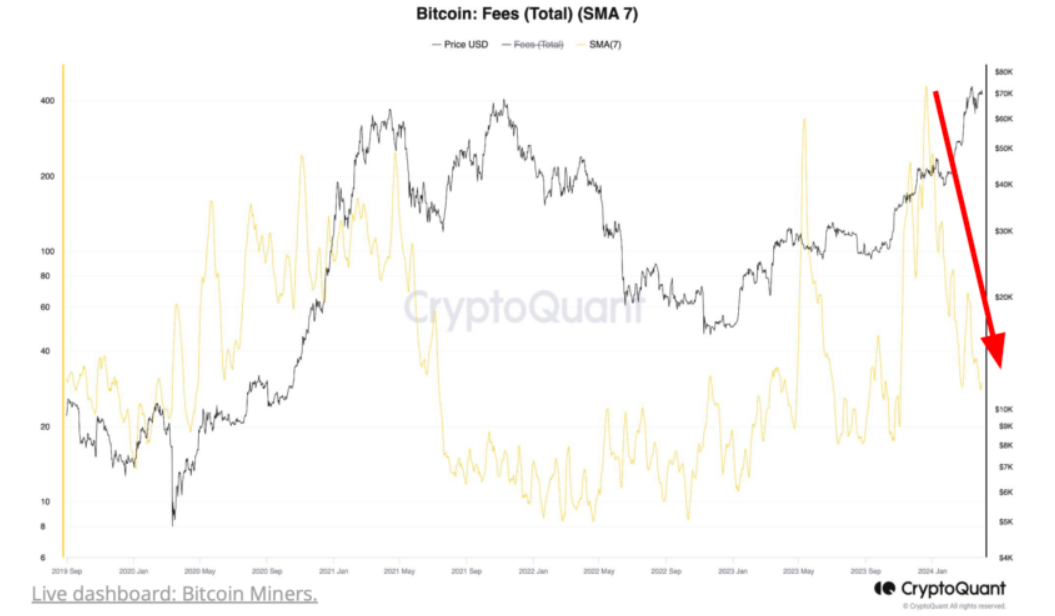

The volume of commissions on the BTC network has also dropped sharply. In mid-December 2023, it dropped from 412 to 29 bitcoins per day, which means a decrease of 90%. Currently, transaction fees are only 3% of the total block reward, which is significantly less than 37% in mid-December 2023.

Moreover, competition between miners has reached unprecedented levels. The Bitcoin network hashrate has risen to around 600 EH/s, up from 116 EH/s since the last halving. This jump means that miners now require significantly more effort and resources to mine the same amount of BTC.

In response to these problems, some miners began to actively sell off the mined coins. Thus, at the end of March, daily sales on over-the-counter platforms reached 1,600 bitcoins, which was the highest figure since August 2023.

Some companies are successfully coping with problems

Despite the difficulties, some miners are still successfully staying afloat. While major players such as RIOT Platforms, Core Scientific, Bitfarms and Marathon Digital reported a decrease in production volumes, CleanSpark’s similar figure only increased. This difference highlights the different impact of market dynamics and operational challenges on mining companies.

However, Sheraz Ahmed, managing partner at Storm Partners, offers a different perspective. He argues that the mining industry does not need to prepare specifically for the halving as market forces will eventually stabilize the situation.

“Miners are getting less Bitcoin for the same amount of mining, but the price needs to reflect this or the hashrate could level off, becoming a near-perfect market. Any discrepancy can be balanced. It’s like gold, so I don’t think you need to prepare for that any more than anything else,” he commented.

Past events surrounding the halving support Ahmed’s opinion. In 2024, the total daily revenue of the BTC mining industry reached new highs: a record $79 million on March 6 and $67 million currently. This is 3.5 times more than revenue before the 2020 event.