Introduction

Cardano (ADA) recent price action has been anything but comforting. After five straight days of bleeding red, ADA found itself at a low of $0.65—the weakest point since early May. It’s now down over 21% from its May high and has shed a staggering 50% since its November 2024 peak. So what’s behind this dramatic slump?

Well, the whales may be packing their bags.

Recent on-chain data from Santiment confirms a significant sell-off by big players. Whales holding between 100 million and 1 billion ADA coins have trimmed their holdings to 3.02 billion—down sharply from 3.4 billion back in April. And it’s not just the super-whales. Those with 1 million to 10 million coins have also sold off, reducing their stash from 6 billion ADA to 5.7 billion. Clearly, even the seasoned holders are no longer feeling bullish.

Cardano Situation Fewer Holders, Fewer Profits, Fewer Cheers

As ADA slides, the network’s overall investor base is thinning out too. The number of ADA holders dropped to 4.49 million, down from 4.55 million in May. That may not sound like much, but in crypto—momentum is everything.

Also alarming: the total number of ADA tokens currently in profit has slipped from 27 billion to just 22.69 billion. Translation? Fewer people are making money holding ADA, and when profits vanish, so does the excitement.

The Harsh Reality: Others Are Winning

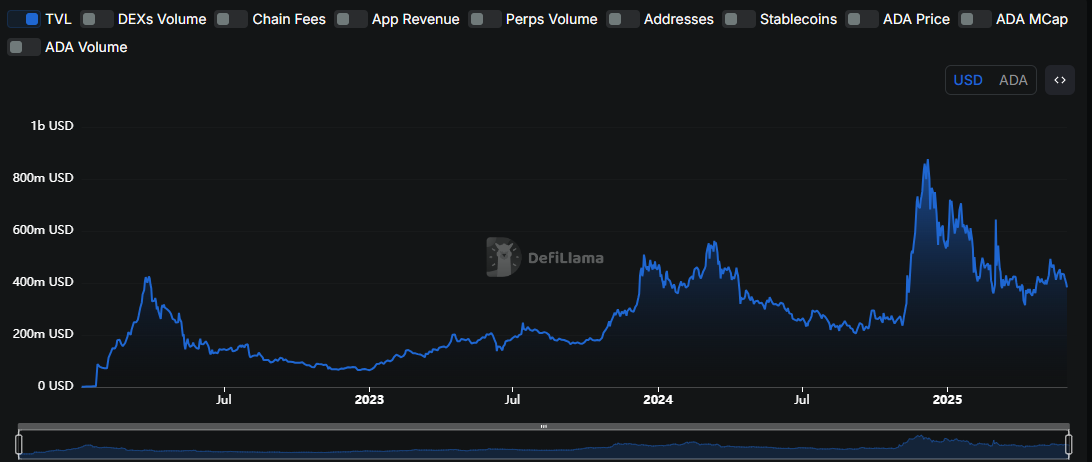

While Cardano wrestles with an identity crisis, newer players are eating its lunch. Its total value locked (TVL) has shrunk to $383 million, while DEX volume remains flat at just $4 billion.

Compare that with Unichain—a newer kid on the block that already boasts a $702 million TVL and DEX volume soaring past $14 billion. Yes, that’s more than three times Cardano’s volume, and it did it in a matter of months.

A Bitcoin Lifeline—Or Just Wishful Thinking?

Trying to turn the tide, Cardano is pinning its hopes on a new Bitcoin integration. The grand idea? Bring BTC into the fold, allowing holders to stake and earn rewards on the Cardano network. Sounds futuristic… until you realize others are already doing it.

Platforms like SolvProtocol and Lombard Finance have a head start, already managing billions in staked Bitcoin assets. So while Cardano’s plan may sound ambitious, it’s also kind of late to the party.

Looking Ahead: Can Cardano Make a Comeback?

It’s not game over for Cardano just yet—but it’s certainly not business as usual. With whale exits, investor capitulation, and fierce competition from newer, faster platforms, ADA has its work cut out.

If the Bitcoin staking pivot gains real traction, perhaps it can re-enter the race. But until then, it’s going to take more than good intentions to push ADA back into the spotlight.