Solana ETF Ends Historic Run but Institutional Trend Holds

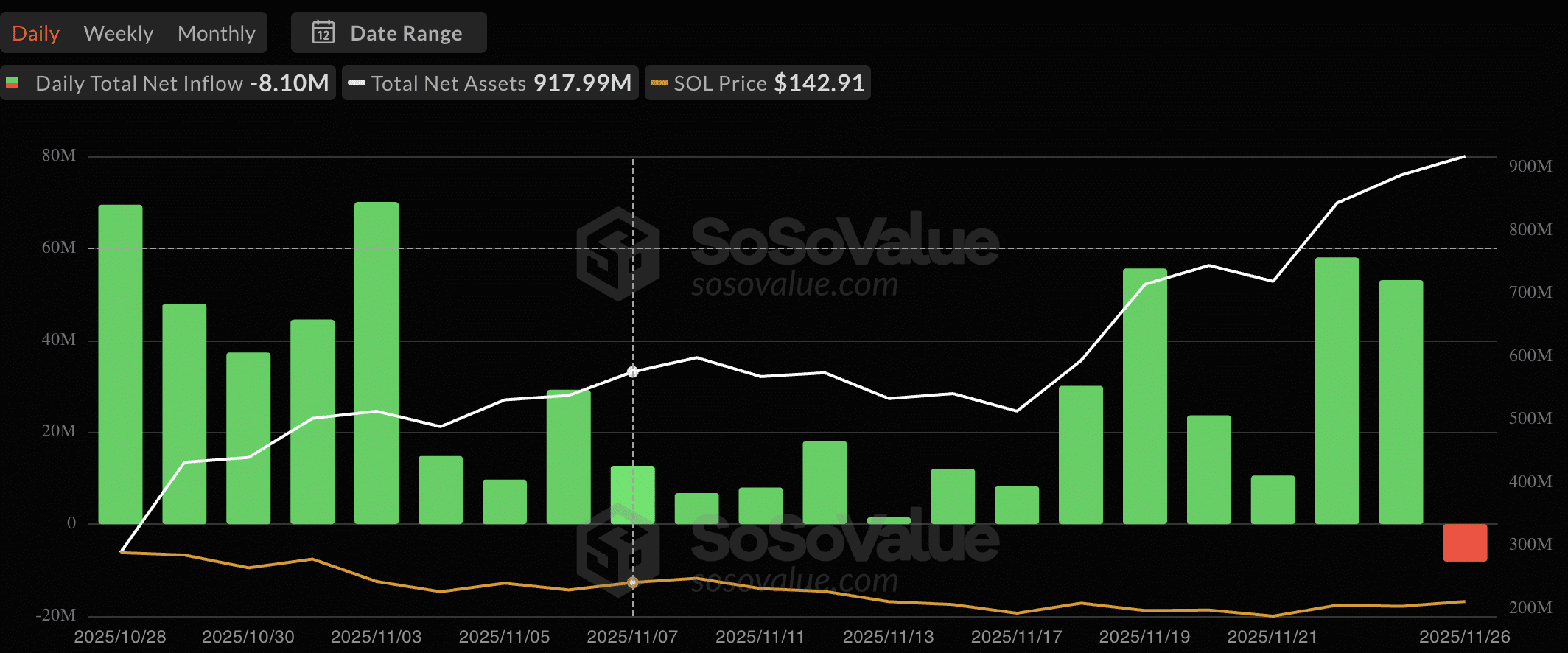

Solana spot ETF has posted its first daily outflow since its October launch, ending a historic 21-day run of uninterrupted inflows. Despite the pullback, the fund remains one of the fastest-growing crypto ETFs of the year, with total assets still close to $1 billion.

First Red Day After a Historic Run

New SoSoValue data recorded a –$8.1 million net outflow on 26 November, the first negative day since trading began on 28 October 2025.

Before this, Solana had surpassed the launch-phase streaks of both Bitcoin and Ethereum ETFs, which previously capped out at 20 consecutive days of inflows.

The streak pushed Solana’s ETF net assets to $918 million before the recent dip, cementing it as a standout performer during a volatile market period.

Temporary Pause or Emerging Trend?

Throughout its first month, the ETF recorded multiple inflow days above $40 million, and two sessions exceeded $55 million, evidence of strong institutional appetite.

The single –$8.1 million outflow is modest compared to earlier inflows and may reflect short-term rebalancing rather than a shift in structural demand.

The fund’s net assets remain close to the $1 billion mark, indicating the broader trend remains intact unless outflows continue over several weeks.

Solana Price Stabilizes After Recent Decline

Solana’s price fell sharply earlier this month, sliding from the $190–$200 range down to near $125.

However, SOL has since recovered above $140, showing signs of stabilization even as the ETF logged its first outflow.

This rebound suggests that spot buyers stepped in after the nearly 30% drawdown, countering any ETF-related selling pressure.

Does the Outflow Change the Outlook?

Analysts emphasize that a single outflow does not signal a reversal of trend. ETF flows frequently fluctuate due to month-end adjustments, profit-taking, or portfolio rotation among institutional desks.

With 21 consecutive inflow days still forming the core of its launch performance, Solana’s ETF remains structurally net-positive.

A return to inflows in the coming sessions would confirm that the 26 November print was likely just a brief pause.