Institutional Flows Shift Toward Solana, but Momentum Lags

Institutional flows show a clear divergence between Solana and Bitcoin, with Solana ETFs seeing substantial inflows while Bitcoin products faced heavy outflows. Still, technical and on-chain indicators suggest that the momentum shift remains incomplete.

Solana Gains ETF Ground as Bitcoin Sees Withdrawals

In the past week, Solana’s first U.S. spot ETFs, Bitwise’s BSOL and Grayscale’s GSOL, collectively attracted $199 million in inflows over four trading days. BSOL led all crypto exchange-traded products (ETPs), recording $417 million in weekly inflows, according to data shared by Bitwise’s President.

At the same time, Bitcoin ETFs saw significant outflows totaling $799 million, with BlackRock’s IBIT accounting for over half of the losses. Analysts have framed this divergence as a sign of shifting investor sentiment, with some institutions rotating capital toward Solana-based funds as a potential diversification play.

Price Momentum and Liquidity Lag Behind

Despite the positive ETF data, Solana’s market performance has yet to reflect a major shift in trend. The SOL/BTC ratio fell by roughly 8% this quarter, and Solana’s momentum remains about four times weaker than Bitcoin’s.

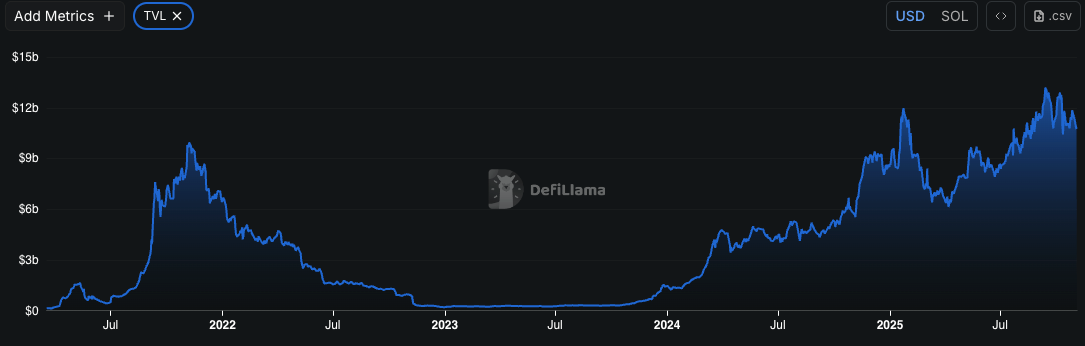

This gap highlights that, while ETF inflows show growing interest, price and network activity have not yet caught up. Solana’s total value locked (TVL) has remained flat throughout Q4, signaling that liquidity in its decentralized finance (DeFi) ecosystem has not expanded in step with institutional inflows.

Market Context and Outlook

The mixed picture suggests that Solana’s ETF debut is an important milestone but not yet a definitive turning point. Bitcoin continues to dominate both market capitalization and institutional conviction, even as alternative assets like Solana attract growing attention.

If Solana’s inflows sustain and its on-chain metrics begin to rise, the shift could strengthen over time. For now, ETF interest marks early adoption rather than a full-scale rotation.