Introduction

1Inch DeFi Trading is like a smart helper in the world of DeFi, It helps people who want to trade different types of cryptocurrencies, like cryptocurrencies, find the best prices and pay lower fees.

Think of 1Inch as a one-stop shop. However, instead of checking many different places to find good deals for trading, it brings all the best options from places like Uniswap and SushiSwap into one easy-to-use spot. This makes it simpler and quicker to trade.

1Inch was created in 2019 by two tech-savvy people, Sergey Kunz and Anton Bukov. It quickly became a big deal in the online money world, especially after starting its own special cryptocurrency for users. This move made 1Inch DeFi Trading not just a tool for trading but also a key player in the DeFi world.

Why Use 1Inch?

Here’s why 1Inch is an excellent choice, especially if you’re into trading cryptocurrencies:

Best Prices: 1Inch looks at lots of different digital marketplaces (called DEXs) to make sure you’re getting super good deals when you trade.

Less Price Jumping: Sometimes, prices change a lot when you’re trading, but 1Inch has a smart way to spread out trades and keep these changes small.

Lots of Choices: 1Inch lets you trade many different kinds of cryptocurrencies, giving you lots of options to choose from.

Safe and Private: When you trade on 1Inch, you don’t have to worry about sharing personal info, and you stay in control of your cryptocurrency.

Easy to Use: Whether you’re new to this or already know a lot about trading, 1Inch is designed to be simple and easy for everyone to use.

Getting Started with 1Inch DeFi Trading:

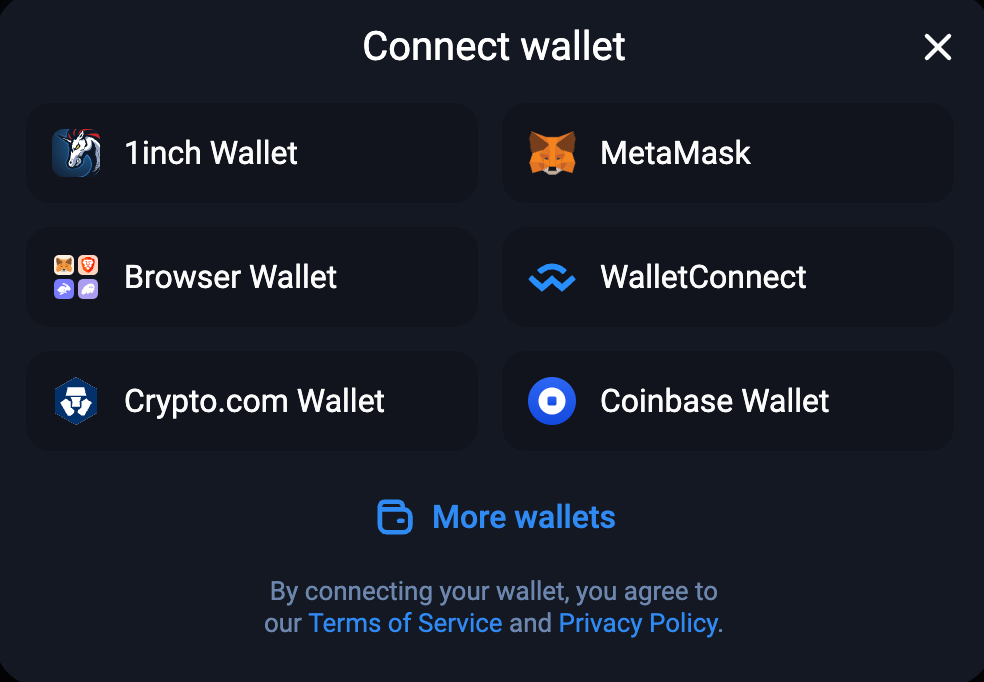

Pick a Wallet: First, you need a cryptocurrency wallet that works with 1Inch. Think of this like a digital money bag where you keep your cryptocurrencies. Some popular choices are MetaMask, WalletConnect, or Coinbase Wallet. Make sure your wallet works with Ethereum or other blockchains that 1Inch DeFi Trading supports.

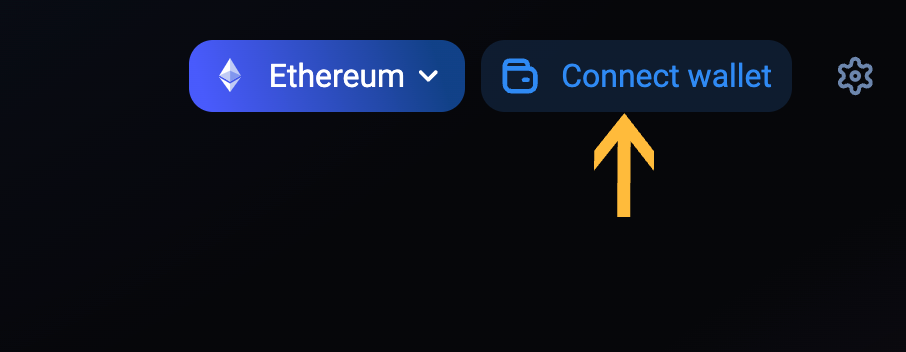

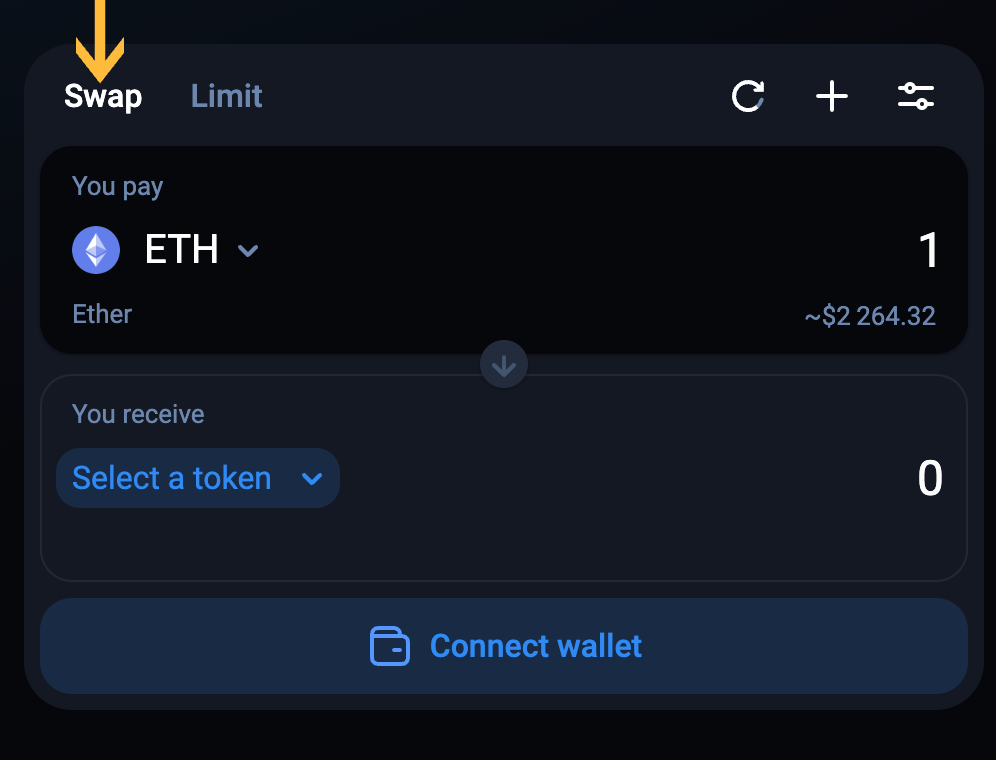

Connect Your Wallet to 1Inch: Next, go to the 1Inch website and click on the “Connect Wallet” button. There will be some easy steps to follow to link your wallet to 1Inch. Furthermore, This is a really important step because it lets you start trading and using cool DeFi stuff.

Make Sure You Have Enough Cryptocurrency: Before you start trading, check your wallet to see if you have enough cryptocurrency for what you want to trade, plus a little extra for fees. Fees can change depending on how busy the network is and how complex your trades are. It’s like making sure you have enough money to buy something and pay for the delivery too!

Making Your First Trade:

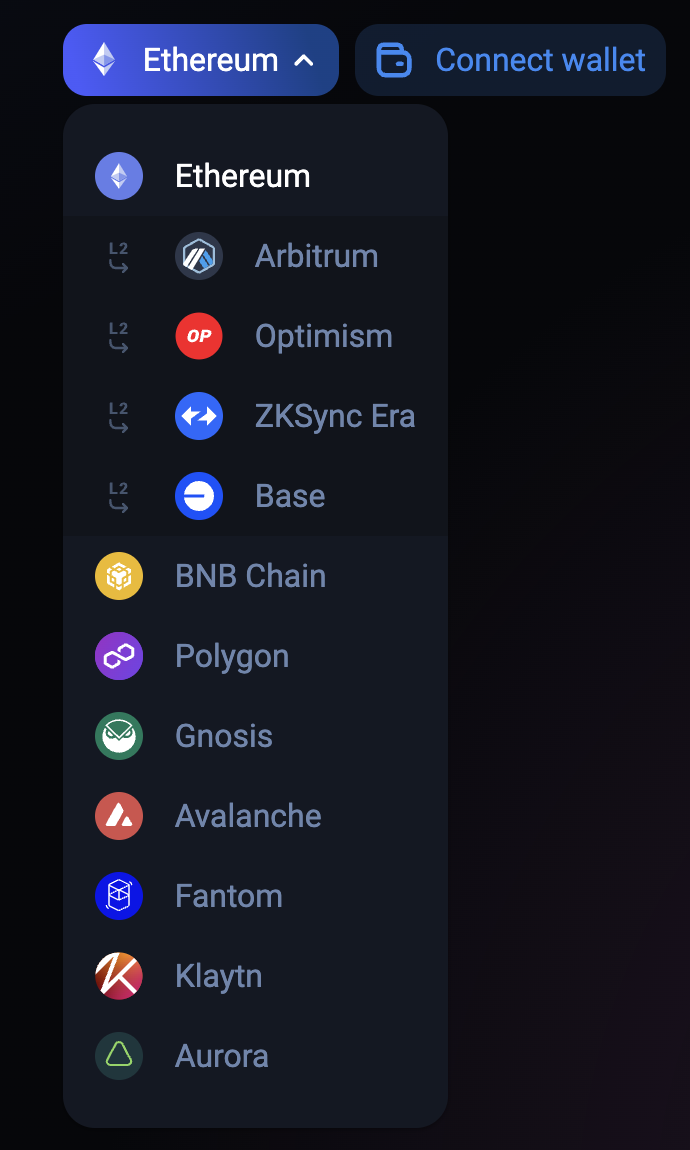

When you’re ready to trade on 1Inch, pick the best network for you. 1Inch DeFi Trading supports many networks, each with benefits, so you can choose one that fits your trading needs. Here’s a quick look at your options:

Ethereum (ETH): This is the main network where you’ll find a huge variety of tokens to trade.

Layer 2 Networks on Ethereum: These special networks work on top of Ethereum to make your transactions faster and cheaper. Some of these include:

- Arbitrum: Great for handling lots of transactions and lower fees.

- Optimism: Speeds up transactions and cuts down costs.

- ZKSync Era: Keeps your transactions private and efficient.

- Base: Helps Ethereum handle more transactions.

BNB Smart Chain: Known for being fast and having lower fees, it’s a popular choice.

Polygon (MATIC): A network that makes trading on Ethereum faster and less expensive.

Gnosis: Good for stable and efficient trading.

Avalanche: Perfect for using decentralized apps and fast transactions.

Fantom: Known for speedy transactions and a variety of DeFi services.

Klaytn: Focuses on making blockchain easy for everyone.

Aurora: Works with Ethereum and is known for handling lots of transactions.

Choose a network that matches the types of tokens you want to trade and fits your trading style. This is important because it affects what you can trade, how fast your trades happen, and how much they cost.

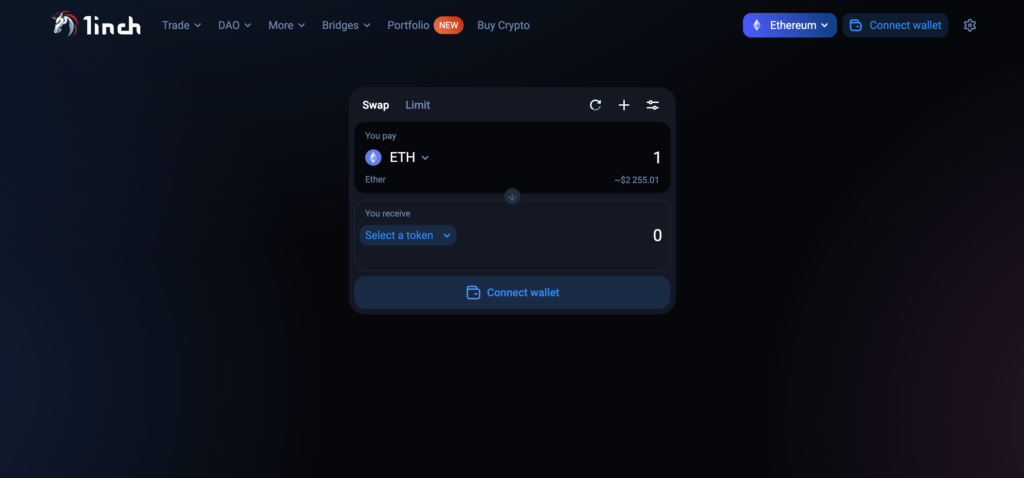

1Inch offers two main trading options for flexibility and control: Swap and Limit.

Swap: This option allows you to exchange one type of cryptocurrency for another immediately at the current market price and, It’s quick and straightforward, perfect for when you want to execute a trade right away.

Limit: With the limit option, you can set a specific price at which you want to buy or sell a cryptocurrency. Your trade will automatically execute when the market hits your target price. This is great for trading with more precision and planning.

Swap Option on 1Inch

Step 1: Select Swap

Choose the ‘Swap’ option on the 1Inch platform. This is for immediate trades at the current market prices.

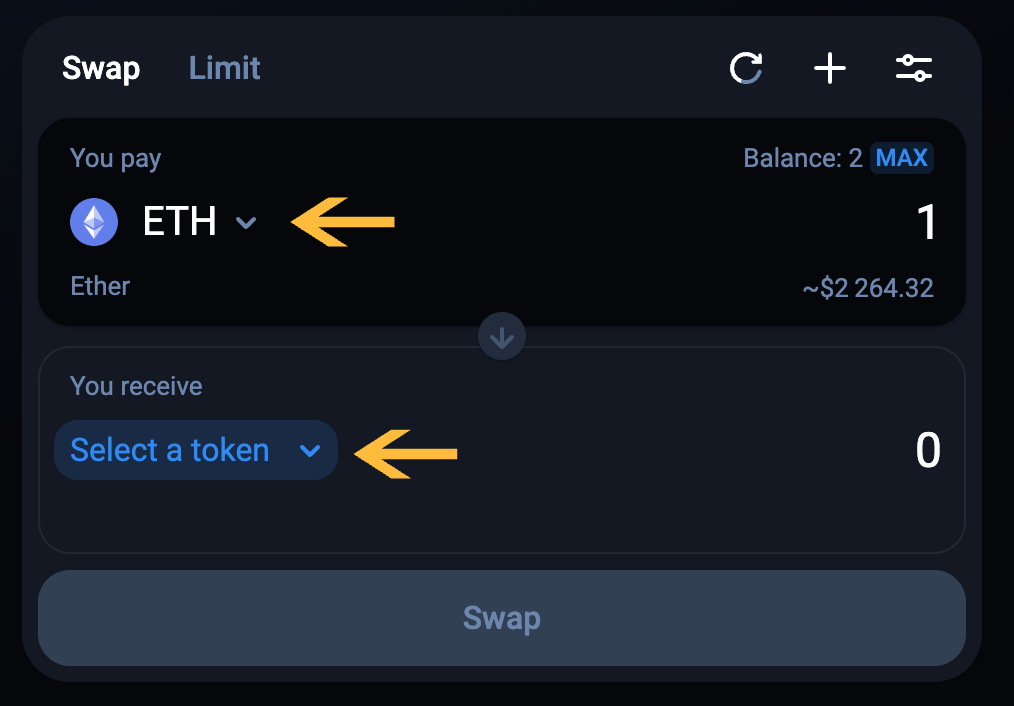

Step 2: Choose Your Tokens

Select the cryptocurrency you want to swap and the one you wish to receive.

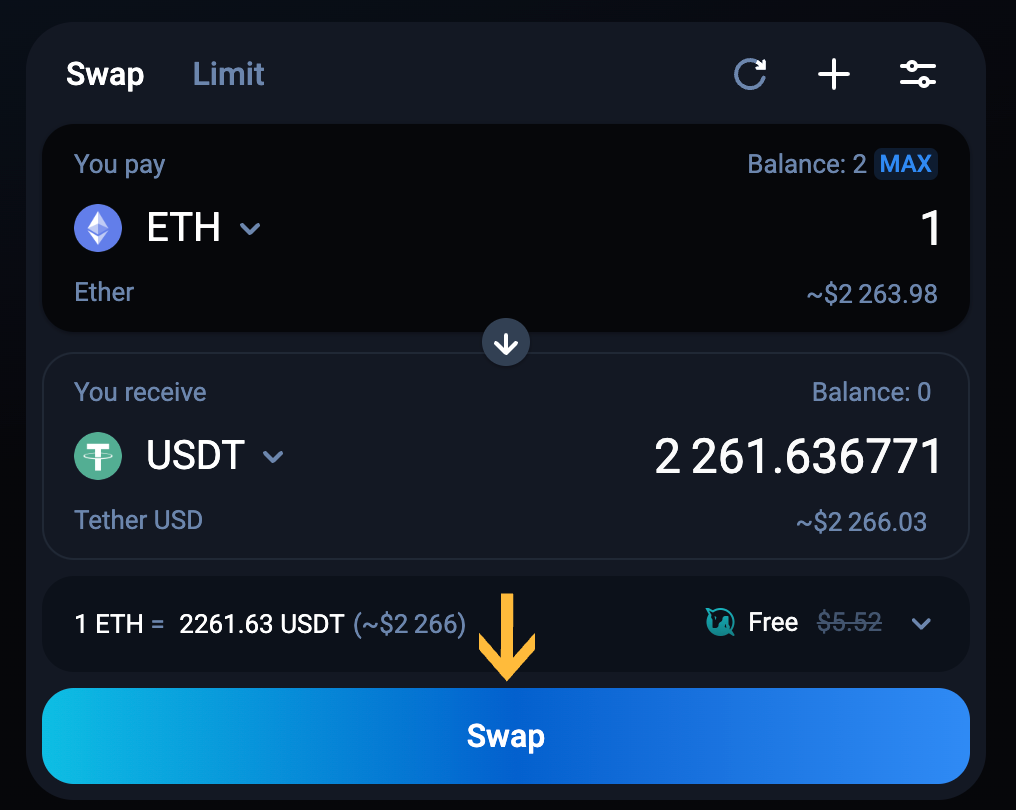

Step 3: Review and Adjust Settings

Check the offered exchange rate and adjust settings like slippage tolerance to suit your preferences.

Step 4: Confirm the Trade

Review all details, including network fees and estimated arrival time of the new tokens.

Confirm and execute the trade by approving it in your connected wallet.

Limit Option on 1Inch:

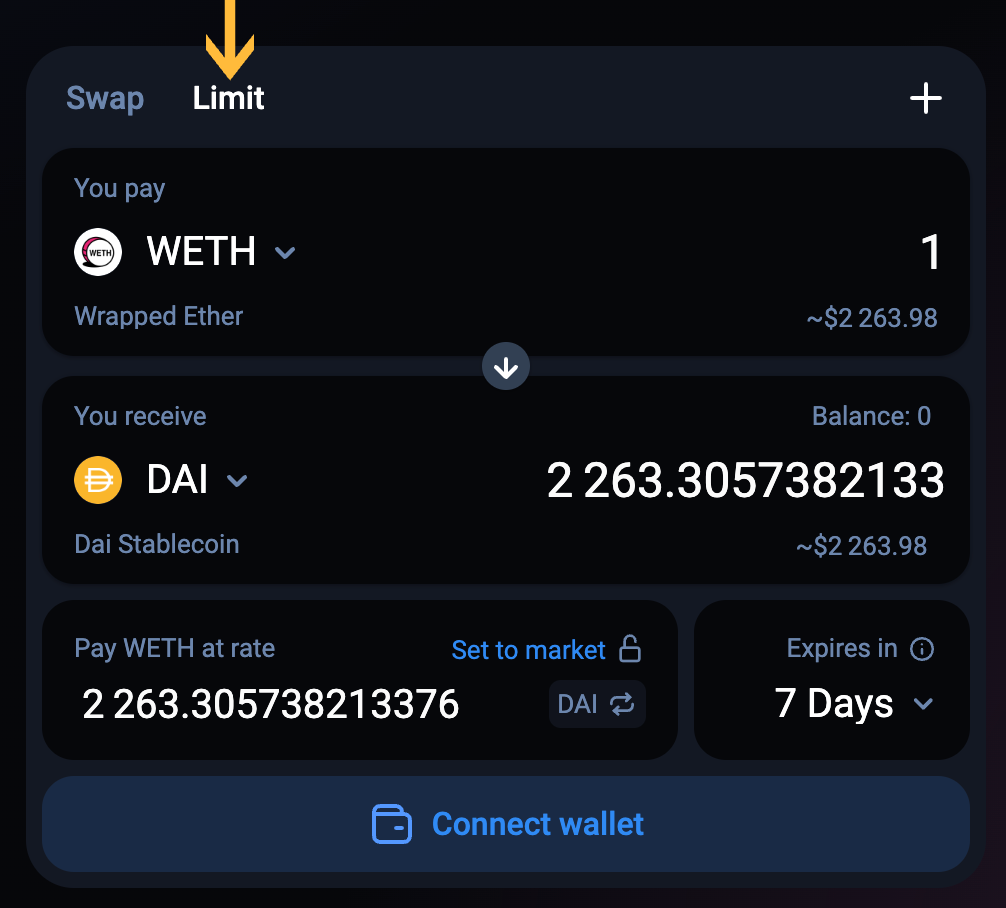

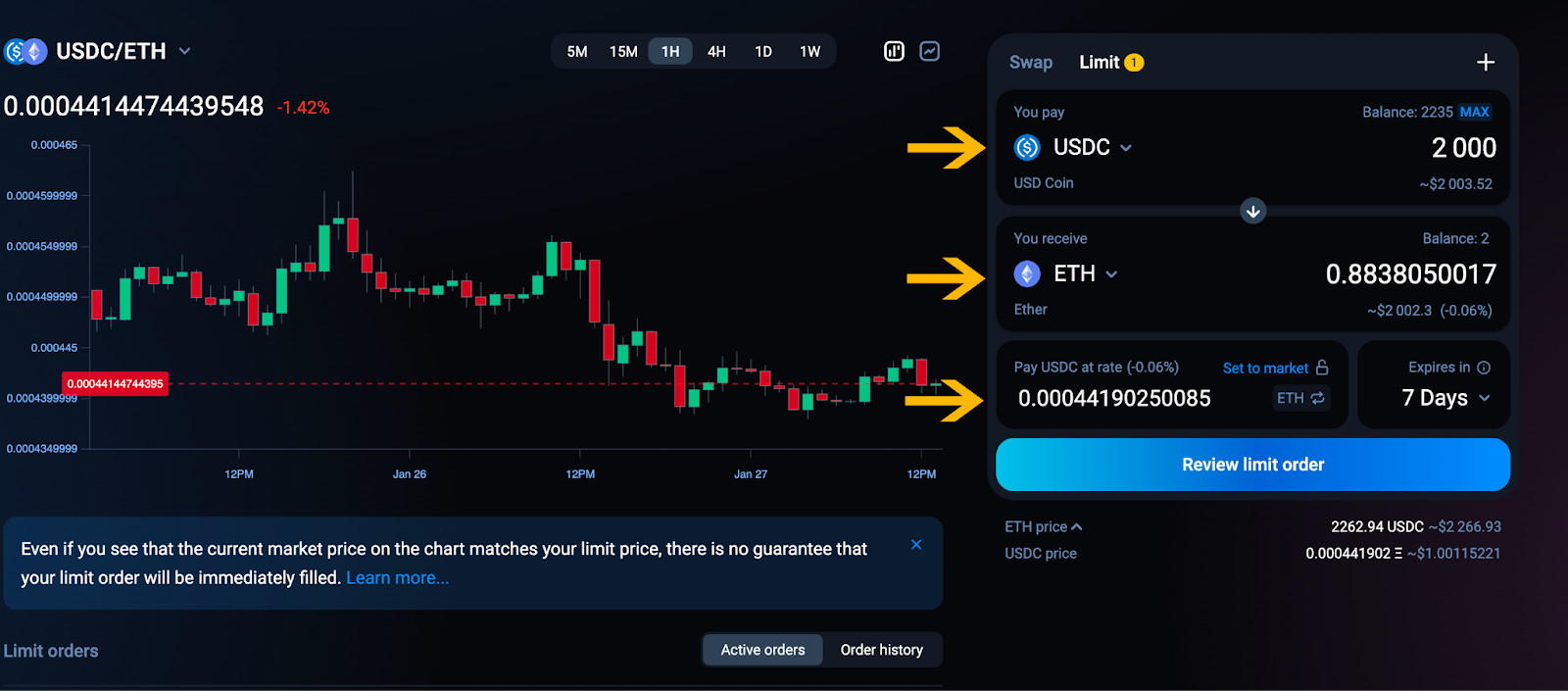

Step 1: Select Limit

On the 1Inch DeFi Trading interface, select the ‘Limit’ option. This is used to set trades that execute when the price reaches a level you’ve set.

Step 2: Set Your Price

Choose the cryptocurrencies you want to trade.

Set the price at which you want the trade to execute.

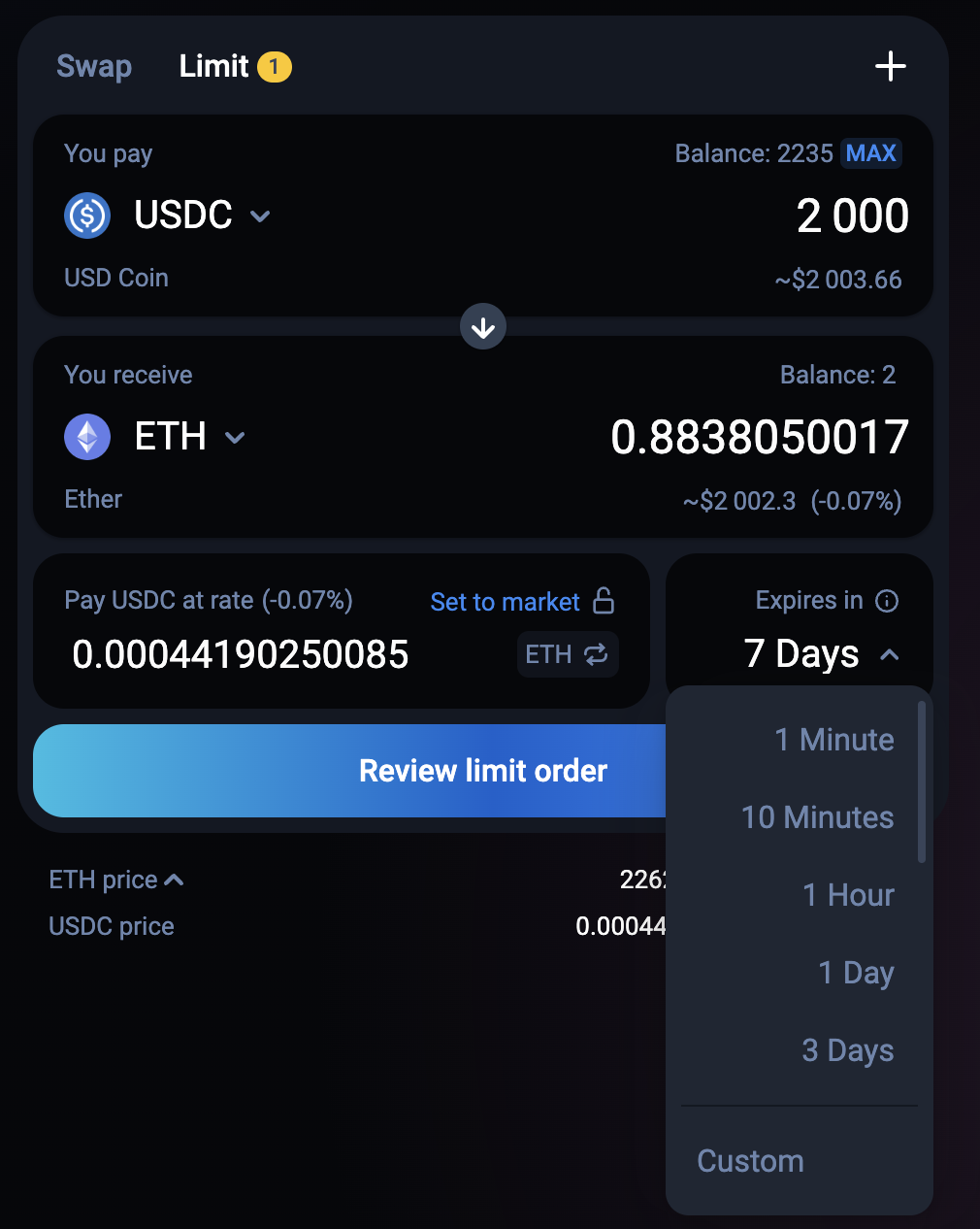

Step 3: Define Order Details

Specify the amount of the cryptocurrency you want to buy or sell.

Set the duration for how long the order should stay active.

Step 4: Place Your Limit Order

Review all the details of your limit order to ensure they match your trading strategy.

Confirm and place your order. The trade will execute automatically once the market reaches your specified price.

Both the Swap and Limit options on 1Inch provide different approaches to trading, offering flexibility to cater to your immediate trading needs or more strategic, price-targeted trades.

Advanced Features for 1Inch DeFi Trading Success

Once you’re comfortable with the basics of 1Inch DeFi Trading, exploring its advanced features can elevate your trading experience, offering ways to earn more and have a say in the platform’s future. Here’s a rundown of these sophisticated options:

Liquidity Pools

What They Are: Liquidity pools are like shared pots of different cryptocurrencies, making trading possible on decentralized exchanges. When you add your crypto to these pools, you’re helping others trade more smoothly.

Your Benefit: By contributing to a liquidity pool, you earn some fees traders pay. This is an excellent way to make some passive income from the crypto you already have.

Staking

What It Means: Staking is like putting some of your 1INCH tokens into a digital safe. While locked up, they help keep the network secure and running well.

Rewards for You: In exchange for staking your tokens, you get rewarded with more tokens. The more you stake and the longer you leave them, the more rewards you can earn. This not only helps you but also strengthens the whole 1Inch DeFi Trading platform.

Governance

Your Role: If you own 1INCH tokens, you can be part of the decision-making process. This can be about changing how 1Inch DeFi Trading works or adding new features.

The Big Picture: By participating in governance, you’re helping shape the future of 1Inch. It’s like having a voice in a community where everyone’s opinions and ideas can make the platform better for everyone.

Each of these advanced features offers you a chance to increase your earnings and enhances the overall functionality and user experience of 1Inch. They’re a step up from basic trading and are perfect for those looking to get more involved in the DeFi space.

Aggregation Protocol

What It Does: Splits your trade across multiple exchanges to find the best price, lowest slippage, and fees.

The Benefit: You get better deals, especially for large trades or rare tokens.

Pathfinder Algorithm

Its Role: Acts like a navigator, finding the best trade paths across various exchanges.

Your Gain: Ensures you get top trading rates by considering factors like transaction costs and price changes.

Best Practices and Safety Tips:

Start Small: If you’re new to 1Inch DeFi Trading, beginning with smaller trades is wise. This helps you get used to the process without too much risk.

Stay Informed: The DeFi world changes fast. Keep up with the latest news, trends, and security tips to stay ahead.

Choose Secure Wallets: Use well-known, reliable wallets for your transactions on 1Inch. Ensure they’re compatible with the platform and have robust security features.

Double-Check Transactions: Before confirming any trade, review all the details, like the tokens you’re swapping, the amounts, and the slippage tolerance.

Manage Slippage Tolerance: Set your slippage tolerance according to current market conditions and your trading strategy. Remember, higher tolerance can mean higher chances of transaction success and more price variability.

Conclusion

As we wrap up our journey through the features and functionalities of 1Inch, it’s clear that this platform stands as a powerful gateway into the world of decentralized finance (DeFi). Whether you’re a seasoned trader or just starting, obviously 1Inch offers a blend of user-friendly interfaces, advanced trading options, and robust security measures, making it an ideal choice for navigating the DeFi space.

Remember to start small, stay informed, and approach each transaction cautiously. By adhering to best practices and leveraging the innovative tools offered by 1Inch, you can enhance your trading strategy and enjoy a secure, efficient DeFi experience. The world of DeFi is vast and constantly evolving, and platforms like 1Inch are at the forefront, paving the way for accessible, decentralized trading for everyone. Happy trading, and here’s to your success in the dynamic and exciting world of DeFi!