We present to you an analysis of eight upcoming events in March that could potentially significantly affect the dynamics of the crypto market. These events include Fed program ending date, inflation data, Ethereum update, FTX creditor meeting, Nvidia GPU conference.

The VR Soldier team has put together a variety of important events from March, from regulatory actions and economic indicators to technology news and litigation. All of them are capable of having a significant impact on the crypto market.

-

Emergency bank lending program by the US Federal Reserve

BTFP will expire on March 11

The US Federal Reserve’s Bank Term Funding Program (BTFP) will stop issuing new loans on March 11. Established under Section 13(3) of the Federal Reserve Act, the BTFP scheme was designed to provide a backup source of liquidity for eligible institutions during periods of financial stress.

The end of the program signals a shift towards normalcy following the economic turmoil, with institutions continuing to have access to liquidity through the discount window. This will affect the banking sector and have an indirect impact on the liquidity and stability of the crypto market.

-

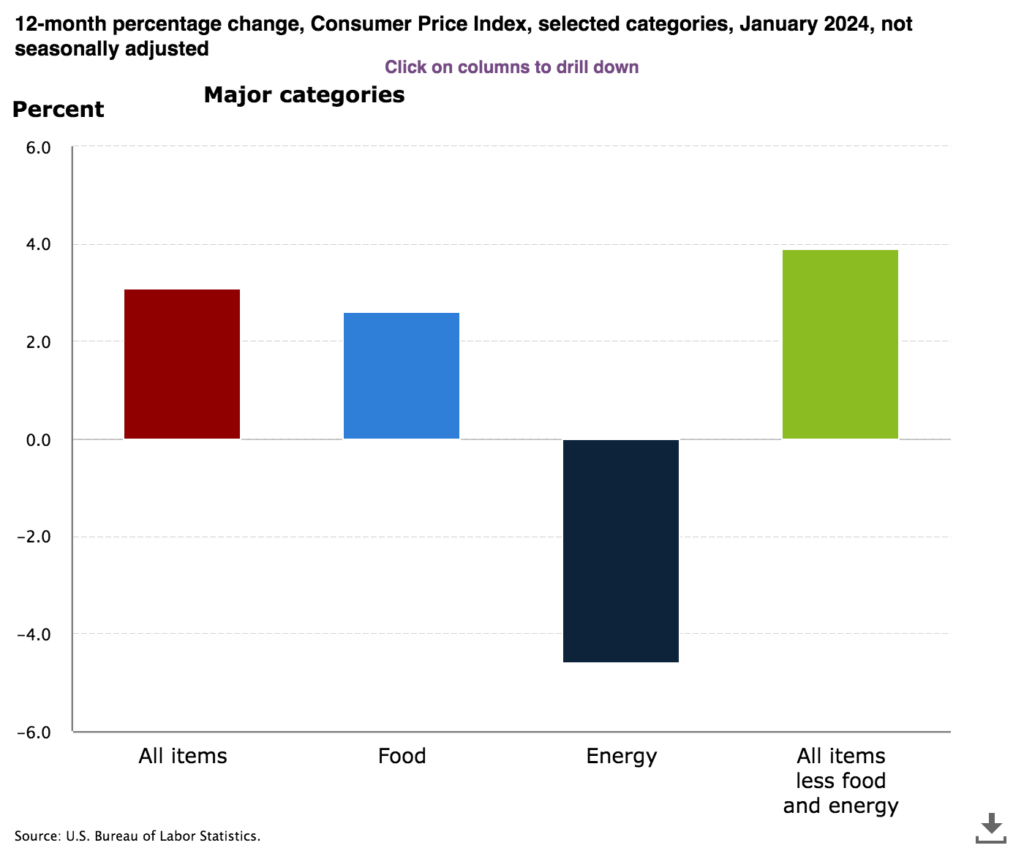

Publication of US Consumer Price Index data for February

Consumer Price Index (CPI) data for February, due March 12, is a key indicator of inflation. They are key to economic policy and investment strategies because they influence the Federal Reserve’s interest rate decisions.

Crypto market is often sensitive to inflation signals. These signals can influence the Federal Reserve’s monetary policy decisions by influencing investor sentiment toward risk assets, including cryptocurrencies.

For example, high inflation rates signal economic uncertainty, which could potentially lead to a shift in investment flows towards non-traditional assets such as cryptocurrencies.

-

Dencun update on Ethereum network

The Cancun-Deneb (Dencun) update will be launched on the Ethereum network on March 13th. It aims to improve scalability, efficiency, and security through various Ethereum Improvement Proposals (EIPs), including EIP-4844. In particular, it will allow introducing proto-dunksharding, increasing throughput and reducing the cost of transactions on the network.

This update is critical to Ethereum roadmap and marks a leap in blockchain technology, making Ethereum more accessible, increasing its usefulness in sectors like DeFi, and accelerating its mass adoption.

-

First meeting of FTX creditors

The first meeting of creditors of bankrupt crypto exchange FTX will take place on March 15 and will aim to create a liquidation committee as part of the formal liquidation process. This meeting is vital for stakeholders to understand the proceedings, the claims process and the potential impact of these developments on the cryptocurrency market.

The formation of the Committee and the information provided during the meeting may provide insight into the impact of FTX’s collapse and future regulatory oversight.

-

NVIDIA Conference on GPU Technologies

The upcoming Nvidia GTC 2024 conference on March 17 will announce the latest advances in GPU technologies, including the H200 and B100 models. These innovations have significant implications for computing tasks in the crypto industry, including mining, and the dynamics of cryptocurrencies based on the Proof-of-Work (PoW) consensus mechanism.

The company’s recent financial triumph, boasting triple-digit net profit growth, confirms Nvidia’s leading role in the AI ecosystem. With its GPUs at the forefront of development, robust demand bodes well for the entire industry. Increasing GPU efficiency and performance could impact mining economics by impacting the supply side and operating costs of the crypto market.

Together, all of the above events form potential factors that could change investor sentiment, the regulatory landscape and the technological evolution of the crypto market.