Amid the dynamic cryptocurrency market, Chainlink has demonstrated its resilience, maintaining a market value of $7.31, outperforming many other cryptocurrencies in the last 12 hours. This strength raises questions about where smart money is flowing, particularly among wallets holding between 100,000 and 10,000,000 LINK tokens. What insights can we glean from the increasing number of addresses in this range since September 18th?

Chainlink’s Performance

Chainlink, a decentralized oracle network, has been a key player in the blockchain ecosystem. Its technology facilitates the integration of real-world data into smart contracts, unlocking various use cases across DeFi, NFTs, and more. The project’s robust fundamentals have contributed to its consistent presence in the market.

Smart Money in Action

Smart money refers to experienced and strategic investors who often influence market trends. When we observe an uptick in the number of wallets holding substantial quantities of a cryptocurrency like LINK, it suggests an intriguing trend.

Growth in Smart Money Addresses

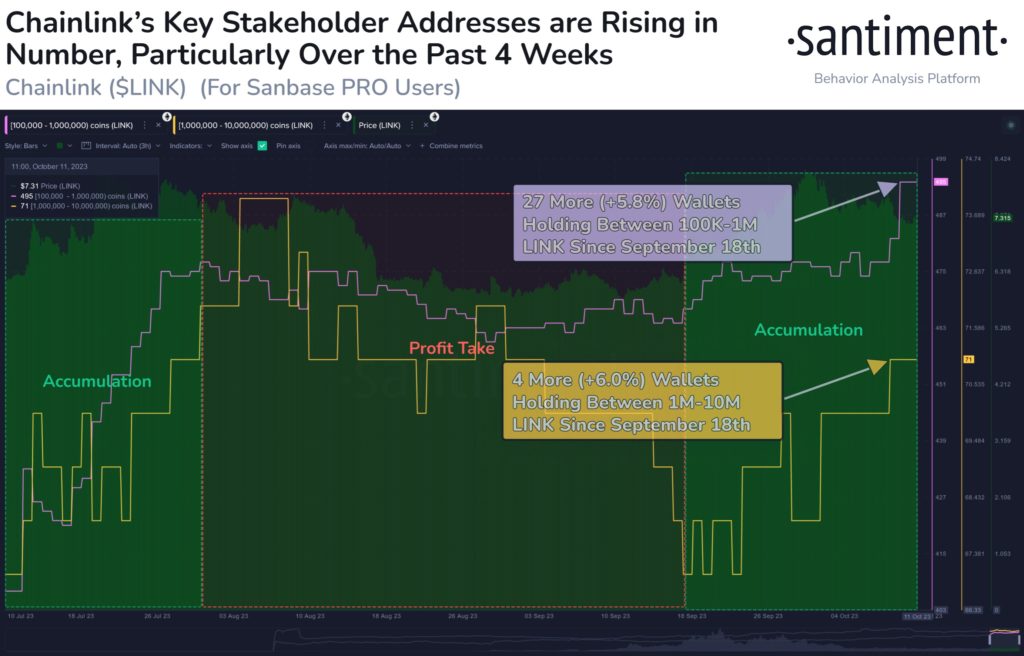

Since September 18th, Chainlink has witnessed an increase in the number of addresses holding significant LINK holdings. Notably, there are 27 more wallets (a 5.8% growth) with holdings between 100,000 and 1,000,000 LINK. In the 1,000,000 to 10,000,000 LINK range, there are four more wallets (a 6.0% increase) since the same date.

Implications for Chainlink

This surge in the number of smart money addresses could imply that experienced investors recognize the potential of Chainlink and see value in accumulating LINK tokens at current price levels. The utility and demand for Chainlink’s decentralized oracles continue to expand, further underscoring its significance in the blockchain space.

Conclusion

Chainlink’s ability to maintain its market value amid market fluctuations showcases its resilience. The increasing number of wallets with substantial LINK holdings since September 18th reflects growing interest from strategic investors. While this could indicate optimism regarding Chainlink’s future, it’s crucial to remember that the cryptocurrency market remains speculative and subject to various factors. As such, investors should conduct comprehensive research and consider their own strategies when interpreting these smart money trends and market dynamics. Watching where the smart money is going provides valuable insights into the evolving landscape of the cryptocurrency market.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Image Source: djvstock//23RF// Image Effects by Colorcinch