Many members of the crypto community expect massive growth from Bitcoin (BTC), the most capitalized cryptocurrency, in 2024. The main event that can bring the coin to new highs is halving. We decided to find out whether investors have a chance to catch BTC at an attractive rate before the mining speed is halved. We tell you how not to miss the opportunity to profitably buy Bitcoin before the bull run.

Why is everyone waiting for the halving?

First, let’s figure out why all members of the crypto community are waiting for halving and how the event affects the cryptocurrency rate.

Bitcoin emissions are limited. A total of 21 million BTC will be mined, and approximately once every four years (every 210 thousand mined blocks in the Bitcoin network), the rate of release of cryptocurrency from the network is halved. The event is called halving. With his arrival, the level of payments to miners – members of the crypto community who mine Bitcoin – is reduced by half.

How to know when it will happen?

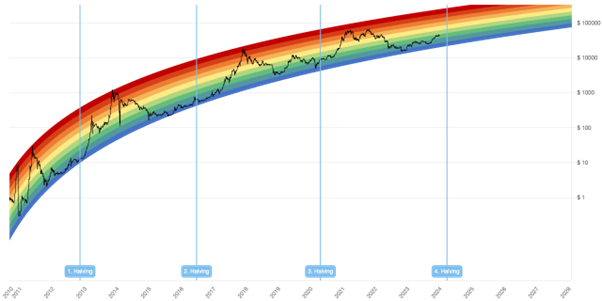

In order to know when it will happen, you need to know how to read a rainbow chart. Rainbow graphics have nine color zones. Each has its own meaning:

- Dark Red: Extreme levels of FoMO. The level is typical for peak Bitcoin values. BTC moving into the dark red zone could be a harbinger of a cryptocurrency correction. At this level, there is a high probability of the coin being overbought. Therefore, investors should not purchase Bitcoin in the dark red zone.

- Light Red: Cryptocurrency overbought zone. Profit-taking level. The zone should also not be considered for purchasing Bitcoin since there is a high probability that the coin will enter a correction.

- Dark Orange: Increased buyer interest in cryptocurrency, which contributes to the approach of FoMO.

- Light orange: Level of uncertainty. In the market, you can see the equality of power between buyers and sellers.

- Yellow: The territory of Bitcoin holders – members of the crypto community who prefer to hold cryptocurrency for an extended period of time, no matter what. At this level, you should not make sudden movements. It’s better to lie low and analyze the prospects.

- Light green: Not a bad level for purchasing cryptocurrency.

- Dark Green: Cryptocurrency sell-off continues.

- Light Blue: Great time to buy Bitcoin.

| Tip: The easiest way to demonstrate the impact of halvings on BTC is using a Bitcoin rainbow chart. It shows halvings with vertical blue lines. |

The rainbow itself allows you to understand whether the cryptocurrency was cheap (blue area) or expensive (red area) in each period of time. Here are the details you should pay attention to:

- After each halving, BTC updated its absolute maximum value.

- BTC starts to grow approximately 5-7 months after the halving.

- Bitcoin reaches its absolute maximum value approximately a year and a half after each halving.

- BTC met all three halvings in the blue area. That is, its rate was low compared to the levels it occupied after the event.

Bitcoin has already experienced three halvings: in 2012, 2016, and 2020. After each halving of payments to miners, BTC behaved approximately the same. The reason is that the conditions of halvings do not change. Each time, the event reduces the BTC mining speed by exactly half. It can be assumed that subsequent halvings will lead to the same result. That is, they will bring Bitcoin to new absolute maximums. Therefore, many participants in the digital asset market are waiting for the next reduction in the speed of cryptocurrency mining in the hope of making money.

Effect of Spot ETFs

Many members of the crypto community believe that the launch of spot Bitcoin ETFs in the US could enhance the halving effect. Market participants have been waiting for the instrument to appear since 2013. The long-awaited approval of spot Bitcoin ETFs in America took place on January 10, 2024, and trading started the next day.

Spot Bitcoin ETFs make it easier to invest in cryptocurrency. With their help, investors can make money on BTC price movements without buying coins directly. To work, it is enough to invest in a fund under which the issuer of a spot ETF purchases cryptocurrency.

Participants in the crypto industry believe that the tool will attract institutional investors to the digital asset market, whose money will support the growth of BTC.

The greater the demand for spot Bitcoin ETFs, the more cryptocurrency issuers will purchase for their funds, thereby increasing the demand for the coin. Changes may support the growth of the BTC rate.