Staking platform Lido shared data that 25% of the entire Ethereum token supply is locked in staking The staking narrative on the Ethereum blockchain continues to gain momentum, even despite the relatively weak performance of the ETH price. As a result, the number of ETH currently staked represents a quarter of the project’s total circulating supply of tokens.

Another Major Milestone for Ethereum

While the numbers vary slightly depending on the analytics platform, most confirm that staking on the Ethereum network has indeed reached this milestone.

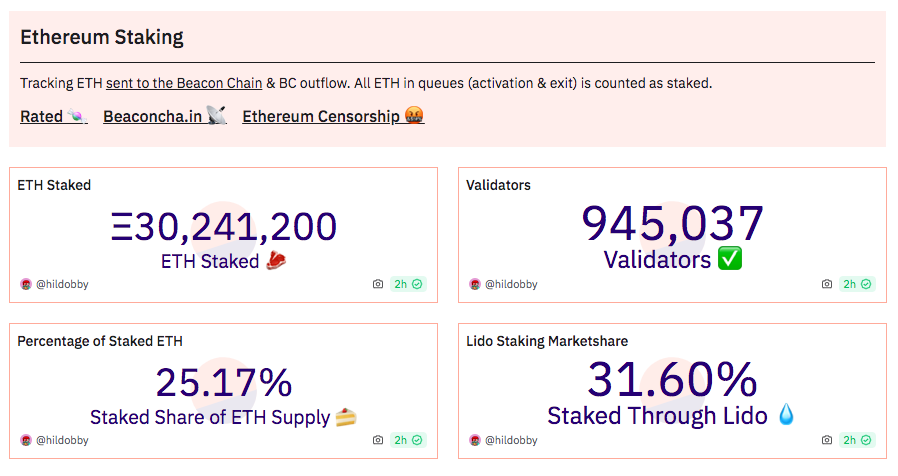

Staking platform Lido cited a screenshot from Dune Analytics claiming that 25% of the total ETH supply is currently locked in staking. This is equivalent to more than thirty million ETH. Meanwhile, Lido is now the market leader with a share of 31.5%. The total amount of coins locked in staking is estimated at approximately $73 billion at current prices. Also, according to published statistics, there are 940,563 validators in the Ethereum network.

Analytics company Nansen published similar data. They showed that 30 million ETH were staked, representing 25% of the total ETH supply (120 million). In addition, the company reports that the queue for unlocking funds has decreased. This indicates that there are no large volumes of ETH waiting to be withdrawn from the protocol. It was reported that there are 176,686 ETH in the withdrawal queue, which is less than 0.6% of the total supply.

The platform also reports that since the Merge in September 2022, the Ethereum supply has decreased by 344,960 tokens. At current prices, this would deflate supply by nearly $840 million. The current intraday inflation rate on the Ethereum network is -0.57% per year.

ETH Price is Rising

At the time of writing, ETH is up 2.2% in the last 24 hours and 6.5% in the last seven days to trade around $2,460, according to CoinMarketCap. The token is quickly approaching immediate resistance levels and is still below its 2024 high reached on January 12 at $2,700. At current levels, Ethereum has dropped by exactly 50% from its historical high, noted in November 2021. However, this gap may soon narrow thanks to the concept of Ethereum re-staking, which allows users to stake the same ETH across multiple protocols, increasing the security of the network.