An In-depth Look at the Crypto “Retail Exhaustion” Market Theory

Over the past eight years, my journey through the world of cryptocurrency has been filled with many experiences, encompassing everything from exhilarating highs to profound lows, and the inevitable cycles of booms and busts. Among these, the current cycle marks my third voyage into the tumultuous seas of crypto, yet it distinguishes itself significantly, capturing my attention more emphatically than its predecessors.

The Unlearned Lessons: Why Retail Investors Remain Wary of Cryptocurrency

Reflecting on the 2017-2018 market cycle, it strikes me how it served as an introduction to the realm of cryptocurrency for many, myself included. Brimming with optimism and the allure of a new frontier, this period also drew in a wave of inexperienced investors. Unfamiliar with the terrain, many were ill-prepared for the hurdles ahead. While a fortunate few celebrated their initial successes, akin to striking gold, the majority struggled to navigate the market’s volatility. Compounded by errors in transactions, misplaced seed phrases, and encounters with scams, the fallout from this cycle was a maelstrom of chaos and disillusionment for many.

Advancing to the 2021-2022 crypto market cycle, we observe a sense of déjà vu, with history seemingly on a loop. Nonetheless, lessons have been learned. A segment of the community, having absorbed the teachings of the past cycles, dedicated themselves to gaining a deeper understanding of the crypto world. Through years of research and engagement, they have emerged more informed and ready to face the challenges that lie ahead.

Yet, despite these strides, a considerable portion of the community remains unenlightened from their past misadventures, whether due to a deliberate disregard for learning or the absence of trustworthy guidance. This scenario has regrettably left those who were previously scorched by the market’s volatility no better off in their investment endeavors than they were initially.

We are going so much higher.

Retail interest in crypto is still at the depths of the bear market 😅 pic.twitter.com/LvCUyMKQ2g

— ted (@tedtalksmacro) February 14, 2024

The sting of capital loss, compounded by one or two unfavorable experiences, alongside the perception of having missed out on a significant rally, constitutes, in my view, a deterrent for retail investor participation in the current cycle. While numerous analysts interpret this decreased engagement as a positive indicator, suggesting that it underscores our collective advantage of being “early,” I perceive this trend with a hint of concern.

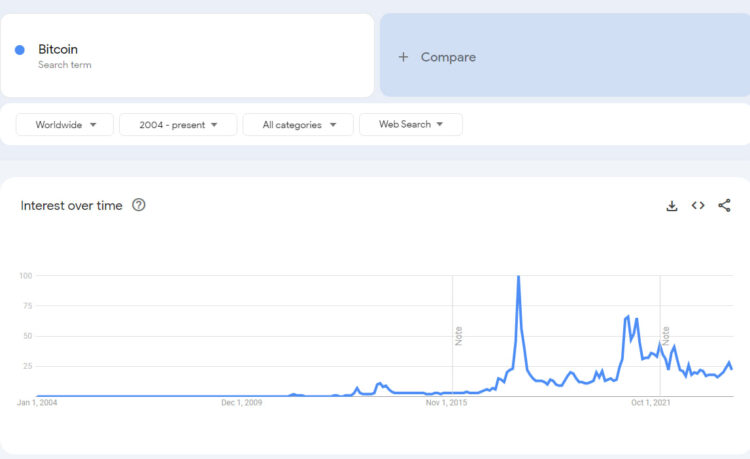

Decoupling Trends: The Unusual Divergence of Crypto Prices and Search Interest

Delving into Google search trends unveils a fascinating piece of data. When we juxtapose the price of Bitcoin against search inquiries, an intriguing divergence for the years 2023/2024 emerges. Historically, search volumes tend to swell in tandem with rising BTC prices. However, it’s noteworthy that the current search volume mirrors that observed during the 2020 bear market, despite Bitcoin inching closer to all-time highs. This anomaly indicates that, contrary to expectations for this phase in the market cycle, the search interest for Bitcoin and related crypto topics is significantly subdued.

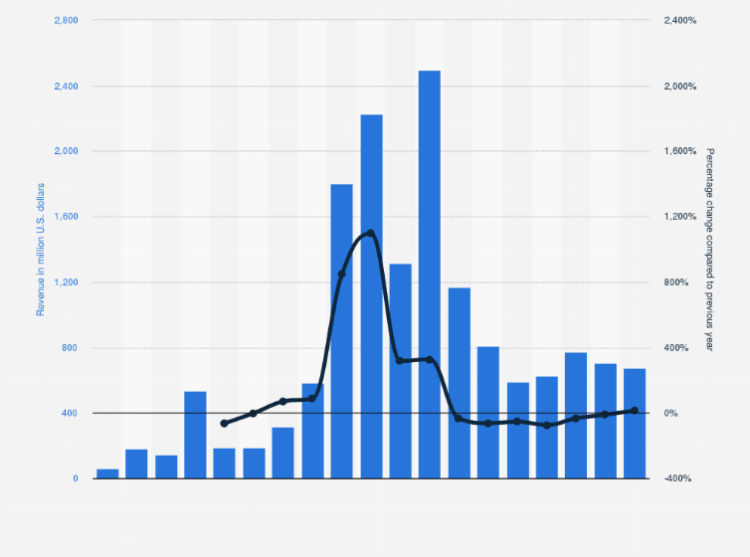

Exploring the financial landscape of Coinbase reveals yet another compelling narrative. As a prominent centralized exchange catering largely to retail investors, a parallel can be drawn between its revenue streams and the trajectory of Bitcoin prices. This comparative analysis uncovers a discernibly tepid reaction from the broader market. Such a stark decline in trading fee income has propelled Coinbase towards adopting a subscription-based revenue model for its diverse array of products and services. While some interpret this strategic shift as a beneficial move for retail investors, I perceive it more as a critical maneuver aimed at sustaining revenue streams from a seemingly depleted user base.

In the interest of brevity, I will refrain from delving into further instances that highlight the mismatch between retail interest and price fluctuations. However, I strongly encourage you to embark on your own investigation into this phenomenon. By aligning the performance metrics of any retail-dominated cryptocurrency platform with your Bitcoin chart, the insights you unearth are bound to provoke thought, perhaps even surprise. This discourse leads me to a succinct conclusion, encapsulated in a single assertion: Retail investors may never make their way back to the cryptocurrency market.

Beyond Price: The Real Drivers of Cryptocurrency Adoption and Their Impact on the Market

Yet, it’s important to acknowledge the existence of alternative perspectives, as I never claim to possess all-encompassing knowledge or to invariably hold the correct viewpoint. In my estimation, the driving force behind retail investment in this specific market cycle may not solely be attributed to price appreciation. I have consistently believed that the true impetus propelling the industry is mass adoption.

It’s conceivable that an unforeseen catalyst or phenomenon will play a pivotal role, not only in influencing price movements but also in facilitating the widespread integration of cryptocurrency into the fabric of everyday life. My speculation leans towards the realms of social media, video gaming, or other crypto-integrated products and services, which could subtly, yet positively, nudge users towards embracing cryptocurrency.

Ultimately, the outlook for Bitcoin and the broader cryptocurrency market remains optimistic, notwithstanding any temporary challenges that may arise. It’s entirely plausible that retail investors might yet make a timely entrance, possibly exhibiting a lagged reaction for reasons yet to be discerned.

You can follow me if you want. I write stuff about #Bitcoin and other #crypto because I can. Apparently, I know some things about this topic, which is why @thevrsoldier gibs me blank papers to scribble on. Tanks!#Bitcoin #BTC #NEAR #Fantom #Solana pic.twitter.com/OosPfCdNtn

— Kelpie Manes (@IamKelpieManes) February 21, 2024

My intention is not to cast aspersions on cryptocurrency; rather, I aim to offer stimulating discussions that could assist you in formulating investment strategies that align with your best interests. Remember, the primacy of price movement cannot be overstated, and a robust grasp of chart analysis, market cycles, and the underlying technology will invariably be more beneficial than any content consumed online. I wish you all the best in your cryptocurrency journey and hope for your prosperous endeavors!