Based on Solana, the ecosystem constructed around the Raydium project provides a decentralized, liquid, and inexpensive trading experience. Raydium achieves this dynamic perfectly by merging Serum’s order books with their AMM protocol. But let’s first comprehend what Raydium is and how it functions. Raydium offers fast, cheap trading and yield farming opportunities through liquidity pools.

What Is Raydium?

Raydium is a decentralized AMM (automated market maker) on the Solana blockchain. It draws directly from the order book of Serum, Solana’s largest DEX (decentralized exchange), to operate its swap system. The primary advantages of an AMM built on Solana are speed and affordability. Additionally, Raydium interacts directly with the Solana ecosystem and with Serum for greater liquidity. The enthusiasm around DeFi is indicative of the escalating interest in DEXs employing the AMM model. DEXs such as Maker, Compound, Uniswap, Aave, and SushiSwap are attracting an increasing number of investors. Despite having only been launched in February 2021, Raydium has garnered significant popularity — and for valid reasons.

Note: RAY is the native utility token of the Raydium ecosystem.

Automated Market Makers (AMMs)

In financial markets, liquidity isn’t solely provided by traders. Market makers are also responsible for compensating for the lack of organic liquidity. They help to ensure smoother exchanges by providing liquidity in a dynamic manner. An automated market maker (or AMM) is a protocol that ensures the liquidity of a digital market, particularly in crypto exchanges. An AMM is a decentralized exchange that automatically establishes an asset’s purchase and sale price. AMMs are widely used within predictive markets (e.g., Augur and Gnosis), and in decentralized finance protocols, such as Uniswap.

How AMMs Work?

Different algorithms are employed, depending on the types of markets. In the decentralized finance (DeFi) world, AMMs ensure access to liquidity via liquidity pools. Unlike in traditional trading, there are no order books. Instead, assets are traded with a liquidity pool, an aggregate of liquidity provided by users of the protocol. Three agents are involved in these protocols: Traders who wish to trade assets with each other, Liquidity providers who bring assets to traders in exchange for fees, and Arbitrageurs who are responsible for keeping the price of assets consistent on the AMM in relation to external markets while generating profit.

The Crypto Swap

One classic feature of any AMM is the ability to exchange assets with others on the fly. With Raydium, this process is quick and fuss-free. Like any AMM, Raydium features Swap, an essential tool in DeFi, and it couldn’t be easier to use. With Swap, you can exchange two tokens by first selecting the token you already possess, followed by the token that you desire. This is the first milestone in the utilization of DeFi and yield farming. Depending on your requirements, you can swap all the tokens you possess or only a portion of them.

Yield Farming on The Raydium Ecosystem

Raydium rewards liquidity providers with 0.03% of all transaction fees. It issues a token that allows the percentage of the pool that each user owns to be traced. Yield farming allows anyone to invest their tokens by taking advantage of the best returns of DeFi. You can, of course, deposit your newly acquired LP tokens in pools before maximizing your yield.

However, this process is called yield farming or liquidity mining. When a liquidity provider (LP) provides liquidity on the platform, and it issues an LP token representing that particular LP’s share in a pool. Some pools decided by the community can farm these tokens to return RAY tokens as a reward. Projects can also incentivize users by adding RAY tokens to a pool to be distributed in exchange for holding their native tokens.

How to Start Yield Farming on the Ecosystem?

To bring liquidity to Raydium, you’ll need a functional Solana wallet for the tokens you want to place in the liquidity pools. There’s now a native version of USDT on Solana. So, if you want to transfer USDT to a Solana wallet, you can withdraw your USDT from your wallet at no cost. Once your wallet has enough USDT, you need to connect it to Raydium to proceed with the next step. If you want to farm the RAY/USDT pair, you’ll need an equal amount of RAY and USDT tokens.

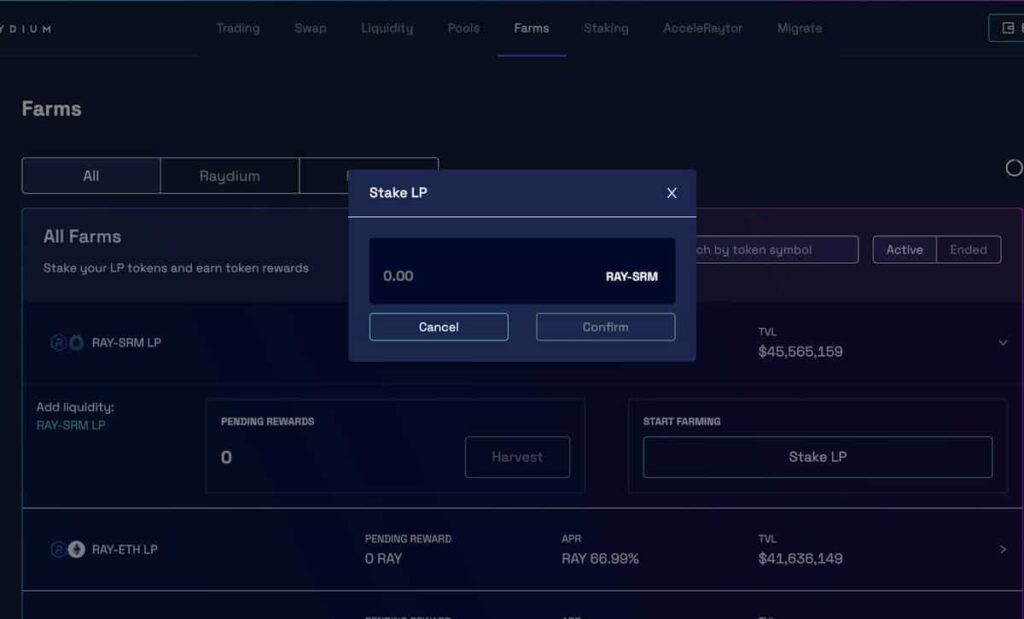

To participate in yield farming, you’ll need LP tokens acquired in the previous step to deposit in the farm pool, corresponding to the tokens you’ve already deposited. You can then start farming tokens. Note that these tokens aren’t blocked and can be withdrawn at any time.

Note: Before you start the yield farming process, it’s crucial to read and fully understand the mechanics of impermanent loss, lest you be taken by surprise upon your exit from any pool.

Conclusion

Although Raydium has been around for a brief period, it’s managed to diminish the gap between centralized and decentralized exchanges. Thanks to the speed of the Solana blockchain and the liquidity of Serum, the Raydium platform can process 65,000 transactions per second, with blocks created in a mere 400 milliseconds. By offering a plethora of DeFi services such as yield farming, Raydium is enabling users to earn constant passive income through staking and participating in liquidity pools.