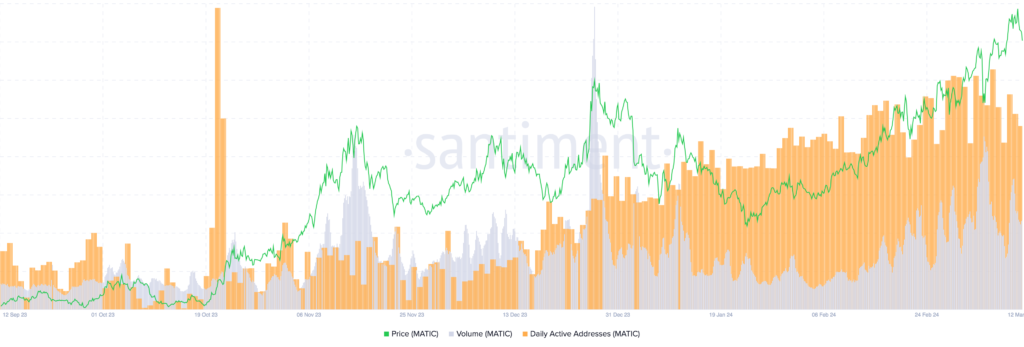

The price of Polygon (MATIC) has been on a steady rise over the past month, rising over 50%. The number of active addresses on the network has increased sharply. The price growth of Polygon (MATIC) has slowed down a bit on the approaches to an important barrier, but breaking it could strengthen the bullish momentum. Let’s figure out whether an 88% increase in the number of active addresses in the network can influence such a breakthrough.

Polygon gains support as active addresses grow

If many altcoins were able to develop a rally based on other cryptocurrencies, then MATIC achieved the same thanks to the support of its hodlers who are active on the network.

The average number of active addresses—that is, those making transactions on the network—increased by 88%, from 1,719 to 3,232. The high level of participation indicates the growing popularity of the altcoin and investor confidence in it.

Secondly, investors began to actively buy the native Polygon token. The supply of the coin on all exchanges has decreased over the past week. Investors purchased almost 59 million MATIC worth $70.2 million, which means bullish sentiment is likely to continue for some time. This could also help Polygon’s price survive the threat posed by the $1.18 resistance level.

MATIC Price Forecast

Polygon price on the 3-day chart has made a slight correction over the past 48 hours, slowing its growth. The altcoin faced resistance at $1.18, which it last tested in April 2023.

If you look at the state of the market and investor interest, the price is ready to break through the $1.18 level and continue the rally. Turning this resistance into support will allow MATIC to reach $1.30 and mark a yearly high.

However, it cannot be ruled out that this time MATIC will not be able to break through the $1.18 mark, since it failed to do so in April last year. In this case, the price will likely fall to $1.05, making a 10% correction. If this support level is lost, the bullish scenario will fail and MATIC may fall below the $1 support.