The industry experienced the largest and longest outflow of assets from spot Bitcoin ETFs on record. At the beginning of the new working week, the market began to show positive signals. We’ll tell you what’s happening with spot BTC – ETFs and why one of the most respected members of the crypto community, Adam Back, believes that the real effect of launching trading in the instrument is yet to come.

The #bitcoin ETFs are still not priced in.

— Adam Back (@adam3us) March 21, 2024

What’s happening in the Bitcoin spot ETF market

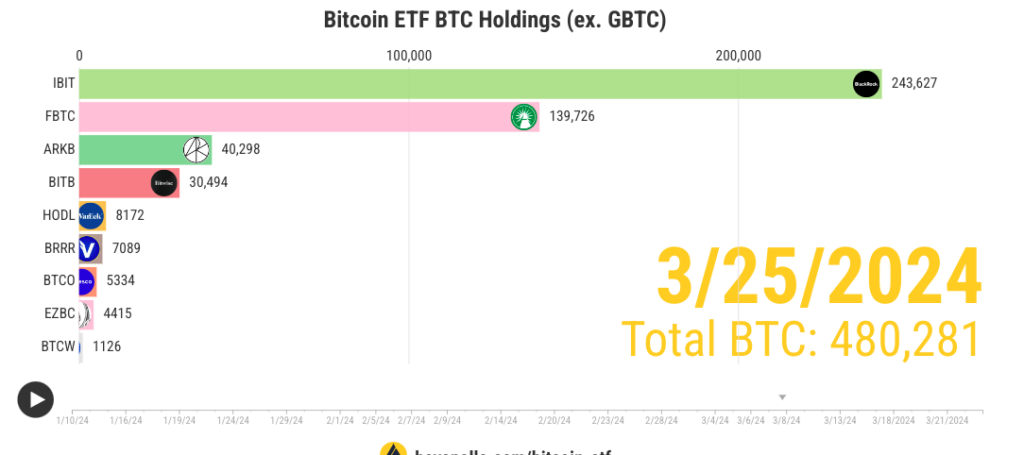

Trading volume in the spot Bitcoin ETF market continues to decline. The maximum – $9.93 billion – was recorded on March 5, 2024 – 9 days before the update of the absolute maximum value of BTC at $73,750. At the end of the last working week, trading volume in the spot Bitcoin ETF market decreased to $3.1 billion, which is $1.4 billion less than on the first day of trading. BlackRock’s iShares Bitcoin Trust (IBIT) continues to take a share of the Grayscale Bitcoin Trust ETF (GBTC). At the time of writing, IBIT accounts for 46%, and GBTC 21%. On the first day of trading, the Grayscale Bitcoin Trust ETF held 50% of the market, while the iShares Bitcoin Trust held only 22%.

Spot Instruments Up While GBTC Influence Down

The share of spot instruments in the Bitcoin ETF market continues to grow. As of the time of writing this review, it is 87%. The maximum – 90% was recorded on March 13, 2024.

The market remains under pressure from the outflow of assets from GBTC. At the same time, the growth of BTC last week and at the beginning of the new working five-day period suggests that the influence of the Grayscale tool on the position of the cryptocurrency is weakening.

Let us recall that earlier Arkham Intelligence analysts estimated that Grayscale will exhaust its reserves in approximately three months – by the end of June 2024. Meanwhile, the volume of BTC purchased under the ETF is declining. If on March 19 the figure was 4.8% of the total cryptocurrency issue, then by the time of writing this article it had decreased to 4.7%. Grayscale remains the holder of the largest share (1.6% of the issue). In second place is BlackRock (1.1% of the issue).

The massacre is over

The spot BTC – ETF market started its new business with an influx of $15.4 million in assets. Prior to this, market participants recorded an outflow of assets within five days. Last week was the worst week for the spot BTC ETF market. The maximum amount of outflow of funds (-326.2 million) was recorded on March 19, 2024. According to Bloomberg analyst James Seyfarth, the largest sales of the past week were associated with Gemini and Genesis. He predicts a slowdown in the rate of asset outflows from spot ETFs. The leaders in the influx of funds into the spot Bitcoin ETF market, according to Bloomberg, were IBIT and FBTC. Both instruments showed positive dynamics within 50 days.

Bitcoin ETFs: The best is yet to come

Many members of the crypto community continue to believe in the positive impact of spot ETFs on the cryptocurrency rate. For example, crypto industry veteran and Blockstream CEO Adam Back believes that the launch of the tool is still not reflected in the price of the coin.

In his opinion, the market will see the real effect of the launch of spot Bitcoin ETFs when the GBTC sell-off ends. The problem is that a lot of bankrupt people have the Grayscale BTC Trust ETF. When they run out of GBTC, Beck is sure, the market will face a wave of influx of assets into spot BTC – ETFs, which will force issuers of the instrument to purchase cryptocurrency, thereby pushing its rate up.