The CEO of the mining company Hut 8 said that large banks approached him with a request to sell Bitcoin (BTC). According to him, due to spot ETFs on BTC, a shortage of coins began on the market before the halving event.

Bitcoin (BTC) Supply Dries Up on Exchanges: Miners Like Hut 8 See More Bank Inquiries

According to Asher Genut, representatives of “the largest banks imaginable” have recently contacted him. DL News reported this after talking with the CEO of Hut 8. There is not enough Bitcoin on the market, and credit institutions are increasingly interested in purchasing coins from miners.

According to Genut, this is due to the fact that there is now a shortage in other places they are accustomed to. Hut 8 is one of the largest public companies focused on Bitcoin mining. According to the latest data, the miner owns digital assets totaling $600 million. This makes it the fourth-largest BTC holder among public firms. “We were approached by banks to try to buy our Bitcoin due to a lack of supply on various exchanges,” Genut said. The shortage of coins on centralized exchanges (CEX) is caused by the launch of spot Bitcoin ETFs in the United States.

Bitcoin Shortage Intensifies as Halving Nears

Since its launch in January of this year, the inflow into the new instrument has amounted to more than $12 billion. In addition, the upcoming halving is also contributing to the supply shortage. The event, scheduled for April 20, will cut the reward for a mined Bitcoin block in half, from 6.25 BTC to 3.125 BTC. All this will also reduce the number of tokens mined by miners daily.

“Reducing supply by 50% – from 900 to 450 BTC per day – also has a big impact because now demand is increasing and supply is decreasing. This is a double blow in terms of Bitcoin price growth,” Genut emphasized. The head of the mining company did not specify which specific banks contacted Hut 8. However, he noted that these organizations are very large.

What’s happening to the price of BTC?

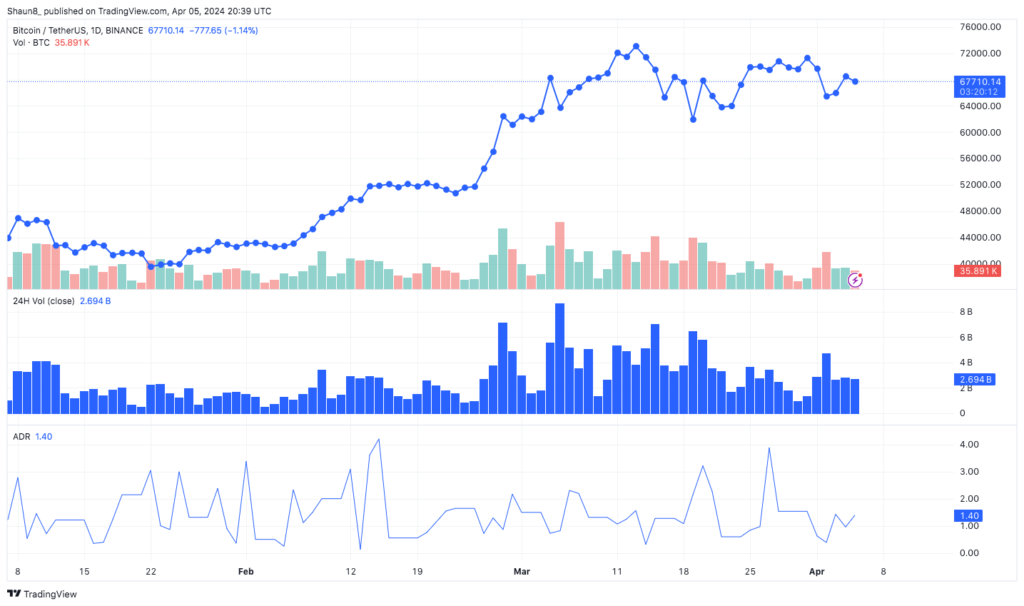

A few weeks before the halving, the mood for Bitcoin is volatile. The day before, the rate of the first cryptocurrency fell below $66 thousand, which led to large-scale liquidations in the market. Traders lost about $500 million. According to CoinGecko, over the past seven days, the rate of the first cryptocurrency has dropped by almost 5%.

At the time of writing, BTC is trading at $67,771. The peak value over the past day was $69,199. The decline in Bitcoin’s value is due to several factors, including negative dynamics in the BTC spot ETF market and declining optimism regarding the Fed’s monetary easing. In addition, this week, the US government also moved more than $2 billion in the main cryptocurrency, which naturally affected its price.