The price of Fantom (FTM) has experienced a notable correction amid waning investor interest and rising selling pressure. The noticeable increase in the supply of FTM on exchanges since March 25 suggests that the fall may drag on for a long time.

Investors are losing interest in Fantom

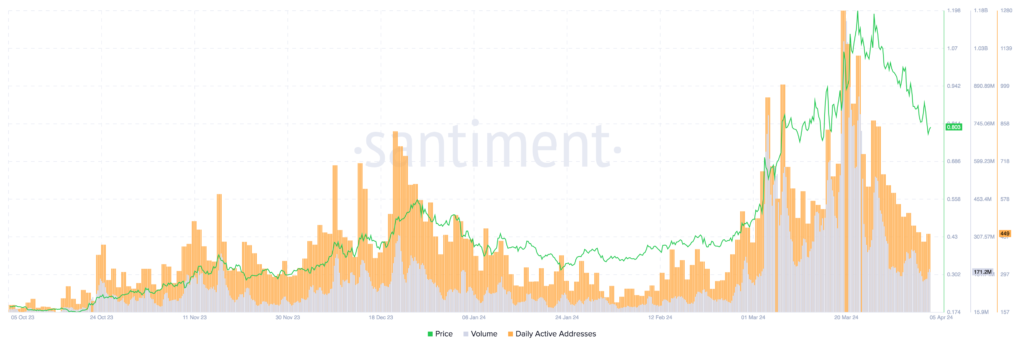

Between March 17 and March 28, the number of Fantom holders increased from 109,930 to 111,280. At the same time, the price of the asset soared from $0.78 to a local peak of $1.25. However, after March 28, the momentum began to decline, leading to a sharp correction to $0.84.

A rapid decline in the number of holders is considered a bearish sign. It reflects weakening investor interest and a possible change in their sentiment to bearish. In addition, the supply of FTM on exchanges increased from 654.83 million to 670.73 million tokens. This suggests that more and more traders are losing confidence in the future dynamics of the altcoin and are ready to sell coins at the current price.

FTM Price Prediction: New Lows

The exponential moving averages (EMA) on the 4-hour Fantom chart have formed a death cross. This technical pattern indicates the possibility of a major sell-off. If the downtrend continues, FTM price may approach the $0.71 support zone. Failure to hold this level could trigger a further fall to $0.65.

On the other hand, a break above the $0.98 resistance level will open the way to a retest of the $1.22 zone, which could signal a bullish reversal.

Fantom (FTM) Key Levels to Watch for Potential Buying Opportunities

Fantom (FTM) price was not an anomaly during the past week, plummeting alongside the rest of the market trend. With altcoins taking their cues from Bitcoin (BTC) price, the sole distinction is that even if the pioneer crypto initiated a correction, and with it FTM price would only be appealing if it completed its downswing.

FTM could decline 15% to offer another buying opportunity around $0.6467 as broader markets decline. Multiple technical indicators bolster the chances for further downside momentum, commencing with the plummeting Relative Strength Index (RSI) that displayed decreasing buyer momentum. The volume indicator is also in the red, indicating a growing bearish sentiment.