The cryptocurrency Chainlink (LINK) is currently trading below $18 but is showing potential for a bullish breakout and rally that could bring investors significant profits. Moreover, Chainlink (LINK)’s current bullish potential is clouded by a number of headwinds that could limit the token’s growth.

Chainlink Investors Became Optimistic

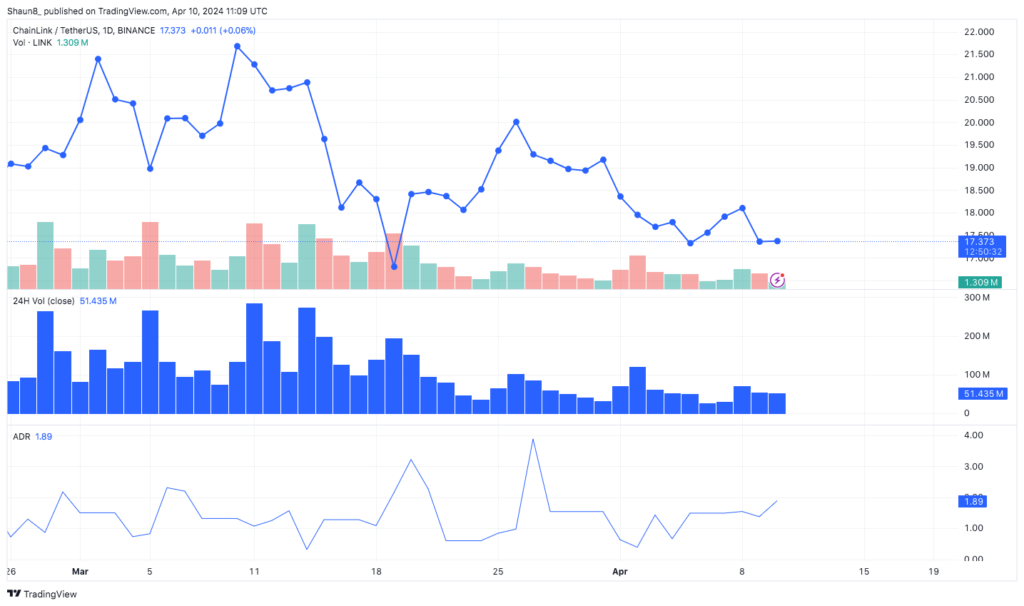

The token price, after falling over the past two weeks, is trying to start recovering again. Although it has been experiencing difficulties over the past few days, it appears that the situation will soon change.

LINK holders have shown a sudden surge in interest in the asset, as evidenced by the increase in the number of participants on the network. Active addresses surged nearly 104% on the daily timeframe, hitting a two-month high. This suggests that investors expect prices to rise.

This is confirmed by the fact that almost 38.55 million LINK tokens are approaching the border of the profitability zone. These coins, worth $684 million, were purchased between $17.49 and $18.73. Accordingly, investors may prefer to hold their coins until they make a profit.

LINK Needs to Break Through: Bulls Eyeing Higher Prices

The price is now testing local support at $17.85, a rebound from which could push the altcoin above the resistance level at $18.73. As the aforementioned supply volume enters profitability territory, LINK may continue to rise.

However, the loss of the $17.85 support level could trigger a decline towards the $16.95 base. This support has been tested many times in the past and its break will lead to the abandonment of the bullish scenario. In this case, the price could drop to $16.00.

About Chainlink (LINK)

Chainlink was proposed as the first decentralized oracle system that provides information to smart contract external context via the emplacement of data from nodes which assures the data authenticity. This mechanism is of primary importance in that it allows contracts to request for off-chain data as it involves payment and events external API. It is thus realized that contract is the foundation of executing payments and they can be performed through all possible payment systems or banking networks.

The LINK token however is based on the ERC 677 Standard which operates on top of ERC20 and inherits all of its functions. To put it simply, its main mission is to pay node operators for the data of smart contracts, thus ensuring there are value flows on the edge of the network. Tokens are structured according to the principles that can be implemented efficiently by blockchains. In what outside networks smart contracts are supposed to link to ChainLink, an amount must be deposited on the node operator as well. Additionally, the LINK token is tapped for facilitating the transfer of assets within the Chainlink’s network.