The new AI startup InQubeta (QUBE) has reached a significant milestone as its presale phase comes to an end, amassing an impressive $13.6 million in funds. Meanwhile, the issuer of the most popular stablecoin on the USDT market, Tether, announced the launch of a platform for tokenizing real world assets Real World Assets, or RWA.

InQubeta (QUBE) successfully wrapped up its presale

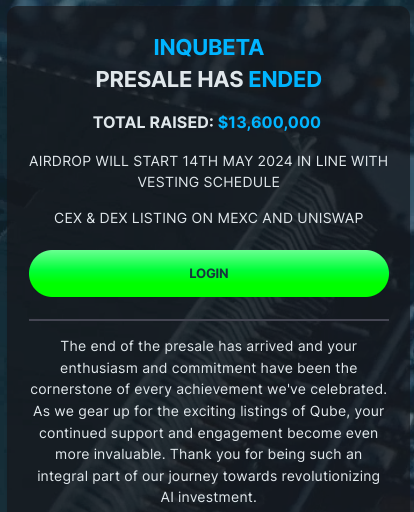

The new AI project InQubeta has reached a significant milestone as its presale phase comes to an end, amassing an impressive $13.6 million in funds. This achievement sets the stage for the next phases of development and engagement within the crypto community.

Furthermore, exciting developments await as InQubeta prepares for listings on both centralized and decentralized exchanges. The project is set to debut on MEXC, a prominent centralized exchange (CEX), providing enhanced accessibility to traders and investors. Simultaneously, InQubeta will also be listed on Uniswap, a leading decentralized exchange (DEX), catering to the decentralized finance (DeFi) community and offering decentralized trading options.

InQubeta (QUBE) Aligns Airdrop with Vesting Schedule

The upcoming airdrop, scheduled to commence on May 14, 2024, aligns with the project’s vesting schedule, ensuring fair distribution and incentivizing long-term participation from token holders. This strategic approach aims to foster a strong and committed community around the InQubeta ecosystem.

The combination of a successful presale, airdrop distribution aligned with vesting, and forthcoming exchange listings highlights InQubeta’s commitment to transparency, community engagement, and ecosystem growth. As the project continues to unfold, stakeholders and enthusiasts can anticipate further updates and opportunities within the rapidly evolving crypto landscape. Stay tuned for more exciting developments from InQubeta as it navigates the path toward its vision of innovation and inclusivity in the blockchain space.

Tether RWA tokenization platform

Tether CEO Paolo Ardoino wrote on X (formerly Twitter) that the new product will work across multiple networks and support a range of cryptocurrency assets. According to Ardoino, the new product from Tether is a masterpiece that “will soon be available to everyone.” He did not give exact dates. The issuer’s CEO also did not share any details, but highlighted several key features of the RWA platform, including:

-complete non-custodiality

-support for several blockchains and types of assets (stocks, bonds, loyalty program points, etc.)

-high level of customization.

Tokenization is the latest trend in the crypto market, which is being joined by more and more giants of the crypto industry. “Tokenize anything from bonds, stocks or funds to bonus points at a coffee shop,” added the Tether CEO. Thus, in March of this year, the world’s largest asset manager BlackRock introduced its first fund of tokenized assets based on Ethereum ( ETH ). In its first week of existence, BUIDL raised more than $240 million.

Earlier it also became known that the Bitfinex Securities platform will issue debt instruments in the amount of $6.25 million. They will be spent on the construction of a hotel near the international airport of El Salvador. Paolo Ardoino is the CTO of Bitfinex, who commented on the initiative as “an important step forward in the development of the nascent market.”

Tether recent activity

Recently, Tether has been actively expanding the boundaries of its activities. The issuer recently announced that it will delve into artificial intelligence (AI). In particular, the company is interested in developing open-source multimodal AI models.

At the end of last year, the firm invested about $500 million in Bitcoin (BTC) mining. Tether is now building cryptocurrency mining farms in several South American countries, including Uruguay and El Salvador. The issuer wants to increase its share in the global hashrate of the network of the main asset on the crypto market to 1%.

Tether’s interests do not end there. The company is also open to international cooperation. Thus, the issuer recently teamed up with the authorities of Uzbekistan to develop a digital sum and a legislative framework for crypto assets.