In nine months, there will most likely be no bitcoin left on cryptocurrency exchanges. The reasons are the upcoming halving, as well as spot ETFs on BTC. The day before, reserves of the first cryptocurrency on centralized platforms (CEX) fell to a three-year low. According to Bybit analysts, in less than a year there may be no BTC left at all.

BTC Unpleasant Forecasts

The main reasons that provoke the outflow of bitcoins from centralized exchanges, analysts include:

-The upcoming halving, which will take place in two days.

-The emergence of BTC spot ETFs.

As a result of the halving, the supply of Bitcoin will be halved. The supply of the first cryptocurrency will no longer meet demand – there will be less BTC on the market than investors want. And with the launch of asset-based exchange-traded funds, investor demand has become too high.

Bitcoin whales add up to 200 thousand BTC per month to their balances. After the halving, the number of coins entering circulation will decrease to 14 thousand BTC. “Bitcoin reserves on all centralized exchanges are depleting faster and faster. If we assume that the daily inflow of funds into spot BTC ETFs is $500 million, then about 7,142 bitcoins will leave exchange reserves daily. This means that it will take only nine months to use up all remaining reserves,” Bybit said in the study.

According to CryptoQuant, on April 17, Bitcoin reserves on the CEX fell to a three-year low. The figure currently stands at 1.94 million BTC, or about $127 billion.

Bitcoin Miners Position

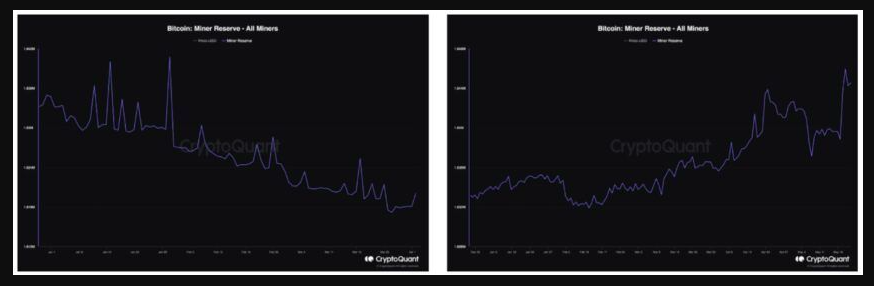

According to Bybit, a feature of this cycle was that miners began to sell off their reserves much earlier than in previous years. This can be seen in the chart showing the holdings of cryptocurrency miners ahead of two halvings: 2024 and 2020. Experts believe that this indicates a change in sentiment among miners.

These dynamics may indicate that Bitcoin miners believe the BTC price rally ahead of the 2024 halving is weaker than in past cycles. Therefore, they wanted to make a profit earlier – in their opinion, the value of the first cryptocurrency will no longer grow at the same speed as before, the study says.

However, this year has become special for Bitcoin. For the first time in history, the asset set a new all-time high even before the mining speed was halved in March 2024 at $73,737. Some analysts are of the opinion that BTC will rise after the halving. However, it may take time to reach a new high. Markus Thielen from 10x Research expects the Bitcoin price rally to begin in at least six months – not until the fall of 2024.