Bitcoin, the dominant cryptocurrency, is presently witnessing a resurgence in its short-term price trajectory after accumulating over $2.8 billion worth of Bitcoin (BTC) within a mere 24-hour period. This surge in accumulation comes on the heels of a recent downturn in Bitcoin price, which dropped to $56,555 earlier in the week, sparking concerns across the cryptocurrency landscape.

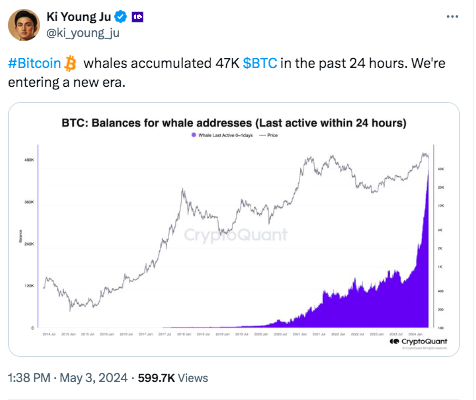

Bitcoin Whales Accumulated 47K $BTC in the Past 24 Hours

Market observers, bolstered by fresh on-chain metrics, are finding reasons to be hopeful about Bitcoin’s near-term prospects despite the recent price volatility. One noteworthy development is the renewed accumulation patterns observed among Bitcoin whales.

According to Ki Young Ju, the founder of CryptoQuant, whale wallets engaging in transactions over the past 24 hours have collectively amassed a staggering 47,500 BTC during this period. Notably, these whales acquired Bitcoin at an average price of $59,000, indicating a concerted effort to “buy the dip” with a total investment of $2.8 billion. This significant acquisition has led Young Ju to assert that the market is “entering a new era” characterized by renewed confidence among large investors.

As a result of this recent accumulation, the cumulative BTC balance held by these active whales has surged to 498.1K tokens, up from approximately 450K BTC just a day earlier. This accumulation underscores the substantial influence wielded by these prominent investors, who now command a staggering $29.38 billion worth of Bitcoin.

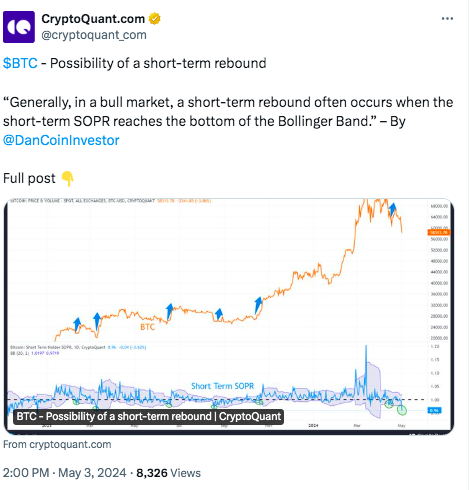

On-Chain Metrics Signal Bitcoin Price Recovery

In a separate analysis, CryptoQuant analyst Dan delved into on-chain metrics to bolster the case for a potential rebound in Bitcoin’s price. Dan focused on the behavior of short-term investors, whose activities often influence the cryptocurrency’s price movements.

Dan examined the Bollinger Band technical indicator alongside Bitcoin’s Spent Output Profit Ratio (SOPR) data, which helps identify potential buying and selling points based on transaction profitability. He noted that when the SOPR reaches the bottom of the band during bull markets, it indicates oversold conditions and typically precedes a price rebound – a scenario currently unfolding. Moreover, Dan highlighted a decrease in positive sentiment among general investors amidst the ongoing market correction. According to him, this cooling of market enthusiasm suggests that a rebound may be on the horizon following this adjustment period, further bolstering the case for short-term relief in Bitcoin’s price.

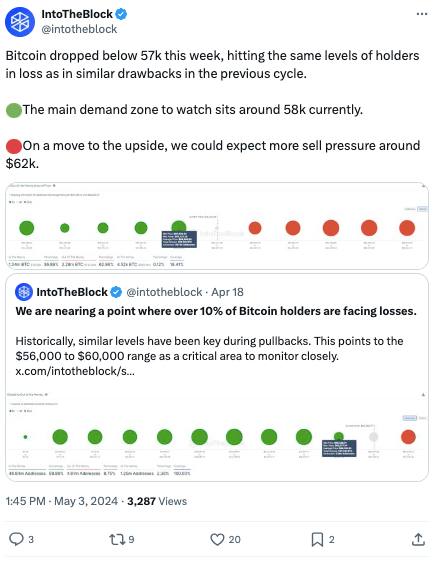

BTC Demand Zone Identified at $58K

Additionally, insights from the market intelligence platform IntoTheBlock shed light on Bitcoin’s recent price sentiment. IntoTheBlock observed parallels between Bitcoin’s recent drop to the $56K range and previous cycles in terms of the rate of holders experiencing losses.

Identifying the $58K range as a critical demand zone to monitor, ITB suggested that if the market trends upward, increased selling pressure may emerge around the $62K mark, reaffirming the notion of impending short-term relief for Bitcoin.

Interestingly, BTC has swiftly validated the assessments made by these prominent entities. At present, Bitcoin is trading at $63,030, reflecting a notable 7.2% gain from its previous day’s price point of $58,000.