Shiba Inu (SHIB), the popular meme coin, is facing a balancing act. Despite a recent price dip, the community has rallied around a massive token burn initiative, incinerating a staggering 175 million SHIB tokens in the past week. This aggressive burn strategy, up 281% compared to the previous week, aims to curb the token’s supply and potentially prevent further price declines.

Shiba Inu (SHIB) Burn Data: A Closer Look

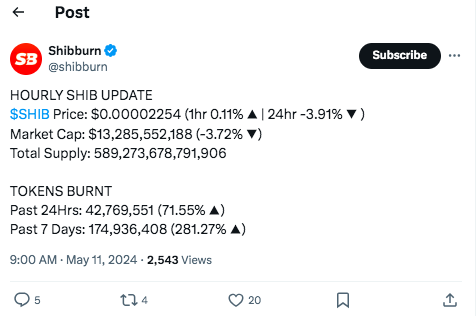

Diving deeper, Shibburn, the dedicated SHIB burn tracker, reveals a 71.55% increase in burns today alone. Over 42 million tokens vanished into the digital furnace within the last 24 hours. This relentless pursuit of supply reduction underscores the community’s commitment to boosting SHIB’s value.

As of now, SHIB’s circulating supply sits at 582.94 trillion, with the total supply mirroring that figure. Interestingly, a significant portion, roughly 410.72 trillion tokens, have already been burned. While this represents the destruction of nearly half the supply, a much-anticipated price surge hasn’t materialized yet.

SHIB started the year on a promising note, skyrocketing from a low of $0.000008 to a peak of $0.00003 in March. This impressive rally mirrored the broader meme coin market surge documented by the VanEck meme coin index. Additionally, positive developments within the Shiba Inu ecosystem further fueled the token’s rise.

The Main Question: Will It Reach $0.00003 Again?

It’s important to remember that while the community’s burn efforts have been relentless, proposed tokenomic upgrades intended to further enhance SHIB’s economic model were ultimately rejected. Following its March peak, SHIB entered a sideways trend, leaving investors questioning its future trajectory.

Currently, SHIB is experiencing a slight pullback, dipping 3.59% to $0.0000226. Market volatility is evident, with the token’s price hovering between $0.00002222 and $0.00002358 over the past 24 hours. Market capitalization also reflects this dip, falling 3.46% to $13.29 billion. However, the trading volume echoes a similar pattern, decreasing 2.18% to $374.93 million.

Open Interest and Derivatives

Interestingly, Coinglass data reveals a different story when it comes to investor sentiment. Open interest for SHIB actually rose 0.36%, reaching $59.74 million. Likewise, the derivatives volume climbed 3.33% to $114.26 million. This suggests that despite the short-term price dip, some investors remain cautiously optimistic about SHIB’s future.

A recent analysis by the VR Soldier suggests that a sustained market recovery could potentially propel SHIB back to the $0.00003 level. However, the token’s Relative Strength Index (RSI) currently sits near 42, indicating that it’s neither overbought nor oversold. While this doesn’t necessarily predict a downward trend, it suggests the market remains somewhat indecisive.