Real Vision crypto analyst Jamie Coutts suggests that key indicators for NEAR Protocol, which he considers as Ethereum (ETH) competitor, are signaling strong bullish sentiment.

Jamie Coutts Sees 47% Upside for NEAR Protocol

The former Bloomberg analyst informs his 14,100 followers on the social media platform X that NEAR Protocol (NEAR) has the potential to surge by more than 47% from its current valuation.

“Absolute price momentum: has been consolidating since March. The technical pattern appears exceedingly bullish if it breaches this resistance around $7.60, where a cluster of volume has traded consistently these past months. This represents a high conviction setup if it breaks the pattern neckline, resulting in a target above $10.50 (+30%).”

Analyzing his chart, the analyst indicates that NEAR is forming an inverse head and shoulders pattern (I-HNS), which is considered a bullish technical formation. The right shoulder implies that bulls are willing to accumulate the asset without waiting for the price to drop to its previous low.

Active user momentum

The analyst also forecasts that NEAR’s positive trend against Bitcoin (NEAR/BTC) and Solana (NEAR/SOL) will persist. “Relative price momentum: NEAR versus SOL and BTC are optimistic and poised for an upward breakout.” According to the analyst, NEAR is also witnessing significant daily active user (DAU) growth on the network compared to other smart contract platforms, which is another bullish signal.

“Absolute active user momentum: NEAR’s Daily active users have surged from 50,000 to 1.76 million in the past year. Ex-NEAR, that figure has risen from 5.4 million to 8.75 million.” He notes that the rate of user growth significantly surpasses the combined growth rate of other layer-1 and layer-2 projects. “Relative active user momentum: that’s growth of 33x vs 0.6x for the rest of the L1/L2 ecosystem.”

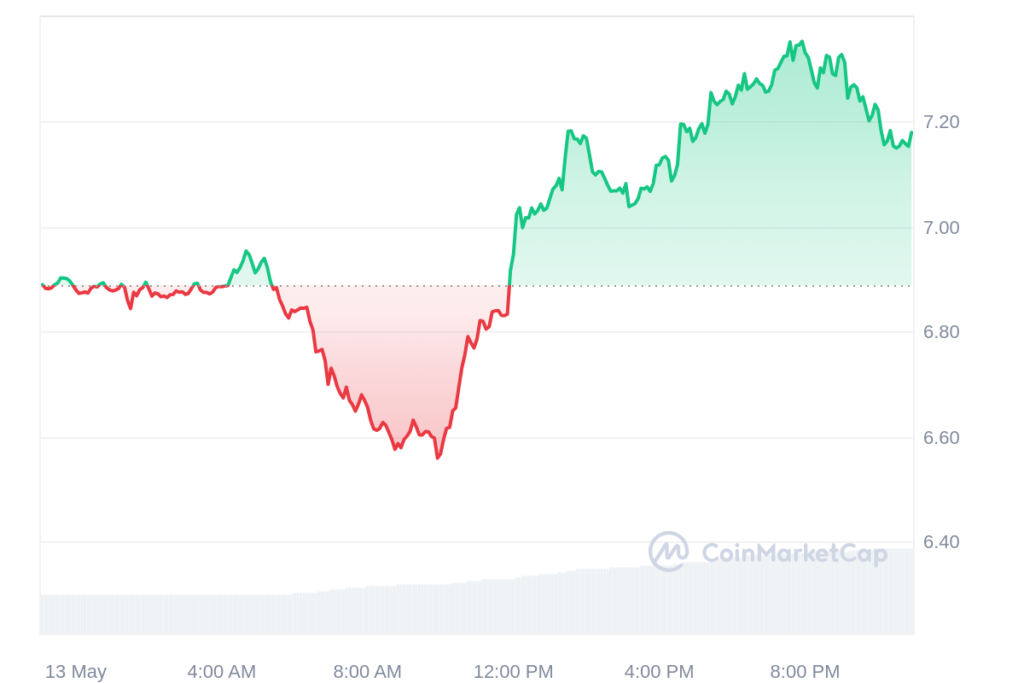

NEAR Protocol: Current Price Movement

At the time of writing, the current price of NEAR is at $7.17, showing an uptrend of 4.17% over the last 24 hours. However, NEAR’s price chart reveals a death cross within the Exponential Moving Average (EMA) lines, a bearish signal typically indicating a shift from bullish to bearish sentiment. This pattern, characterized by a short-term EMA crossing below a longer-term line, suggests recent price declines may overshadow previous gains, hinting at the beginning of a downtrend.

Yet, the close proximity of NEAR’s EMA lines, alongside the contrasting increase in transaction volumes and a dipping RSI, suggests a complex market sentiment leaning towards consolidation, supported by strong nearby support and resistance levels. However, should NEAR’s price initiate an upward trajectory, overcoming immediate pressures, it could aim for the $8.0 mark.