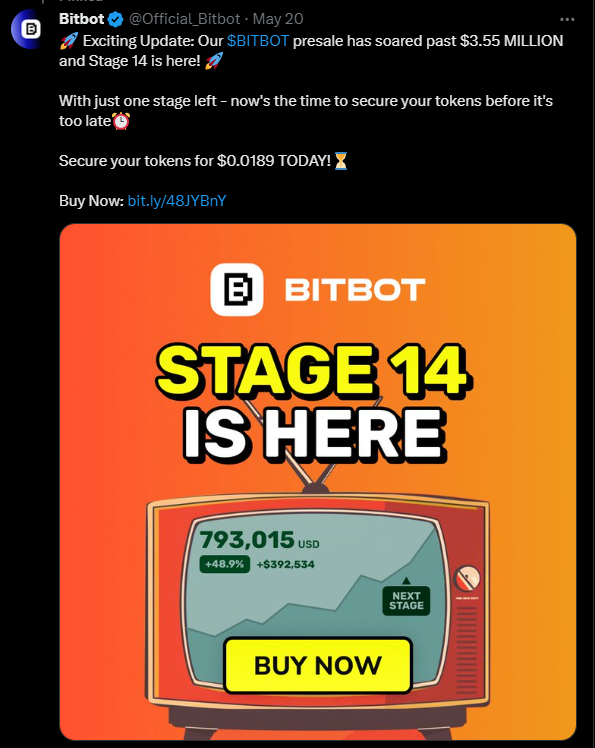

Litecoin (LTC), one of the oldest assets in the crypto market, has not impressed with its dynamics: unlike many altcoins that have updated all-time highs, it still cannot break above the important psychological level of $100. On the other hand, Bitbot, amid its rapid-selling presale, is garnering tremendous attention. It has already amassed $3.7m and is presently in stage 14, with a presale price tag of $0.0189.

Litecoin Bullish Signal: Ichimoku Daily Cloud Test

LTC recently tested the lower boundary of the Ichimoku daytime cloud. This development suggests potential upside, especially if Bitcoin continues its move towards $73,000. A successful cloud breakout could push the altcoin towards the important $93 resistance level.

The Ichimoku Cloud provides additional support at $85.70. To maintain the bullish trend, Litecoin must remain above it. On the other hand, the amount of $85.09 (38.2% Fibonacci Retracement ): This level serves as the first line of defense for LTC. Loss of support could signal a weakening bullish trend and lead to further correction.

$83.74 (50% Fibonacci level): The 50% retracement level is a critical support zone. A fall below it will indicate a potential trend reversal.

Litecoin (LTC) Forecast

If LTC breaks through the Ichimoku Cloud, the next significant resistance level to watch is $93. There could be significant selling pressure at this level. On the contrary, a fall below $81 could signal a potential trend reversal, which requires caution.

The Spent Output Profit Ratio (SOPR) and its adjusted version (aSOPR) for Litecoin are greater than 1, indicating that more LTC transactions are being made at a profit. This is a strong bullish indicator as it reflects positive market sentiment and fundamental strength. Meanwhile, although the altcoin is showing encouraging signals, testing the Ichimoku cloud and maintaining positive SOPR and aSOPR values, traders should watch for a breakout of the $81 level, which could indicate a change in trend.

Why is Bitbot perceived as a top crypto investment opportunity?

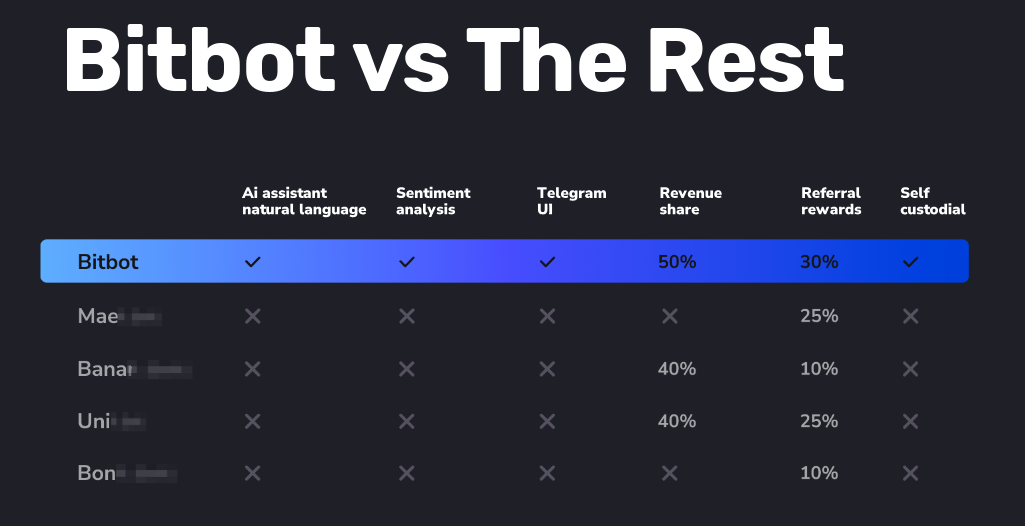

The Telegram bot market is hovering around the $1 billion mark as of writing. For example, Banana Gun, Unibot, and various AI-powered tokens dominate it. Bitbot has entered this swiftly expanding market with over 106 million lifetime trades. In addition, It currently averages over 400k transactions per day.

At the core of Bitbot’s value proposition are its advanced AI tools. For example, the Jewel Scanner tool utilizes cutting-edge proprietary AI technology to reveal bargain-priced crypto jewels and high-potential presale opportunities. Additionally, the mimic trading feature enables novices to imitate successful trades from seasoned users, gaining knowledge while generating profits.

Bitbot is the sector’s inaugural non-custodial security solution in collaboration with acclaimed cybersecurity firm Knightsafe. Bitbot’s commitment to user security is illustrated by its “not your keys, not your crypto” philosophy. It eliminates the necessity for third-party involvement in transactions when trades are executed.

Can Bitbot outshine BNB’s price performance this year?

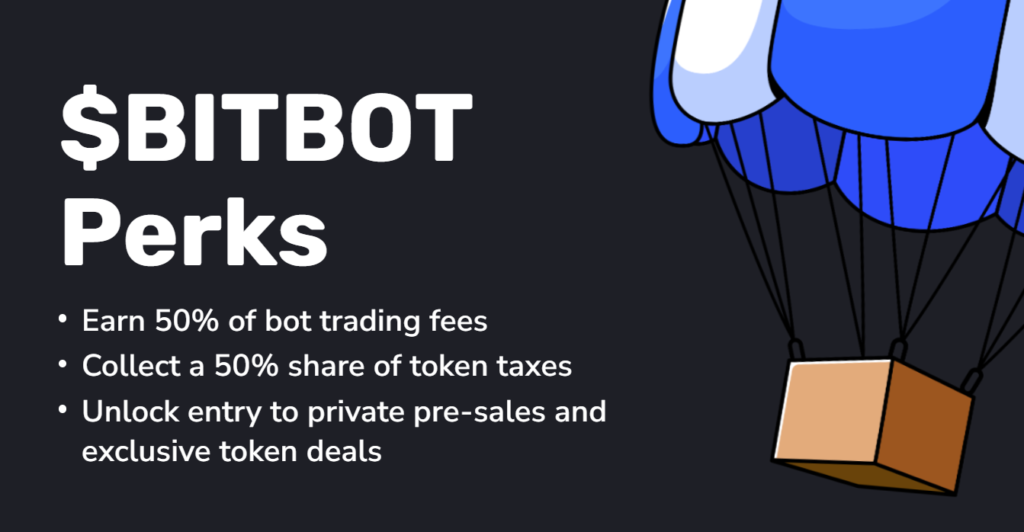

While the BNB price fluctuates, following remarkable early growth in the first quarter of 2024, pundits are awaiting the result of the Bitcoin halving event to observe if BNB will soar. Meanwhile, Bitbot investors harbor fewer worries as the presale swiftly sells out. Bitbot holders will possess a share of up to 50% of transaction fees. Now, there’s no doubt that Bitbot stands as one of this year’s premier crypto investment opportunities.

So, if you’re seeking an exhilarating, groundbreaking crypto investment this year, look no further than Bitbot. Don’t let FOMO triumph; acquire your Bitbot coins today. This dedication to security without compromising the trading experience positions Bitbot as one of the foremost crypto investment opportunities in 2024. This abundant growth potential has led to analysts projecting 50x-100x returns by the conclusion of 2024.