Solana (SOL) exited the ascending channel on May 20th. Since then, the price of the altcoin has fallen by 13%. Moreover, as selling pressure intensifies, SOL risks moving below the 20-day exponential moving average (EMA) and continuing its correction. These events unfold as FTX reportedly completes the sale of all its SOL holdings.

Solana Bears enjoy success

The double-digit decline in SOL price in recent days has pushed it towards the 20-day EMA. A fall below this line is generally considered a bearish signal and is seen as a move from accumulation to distribution.

The fall in the SOL Cash Flow Index (MFI) confirms the increasing influence of sellers. At the moment, the indicator is below the neutral level of 50, indicating the readiness of market participants to get rid of the altcoin.

Futures market participants believe in SOL growth

The drop in the price of SOL over the past few days has led to a surge in liquidations of long positions in the futures market. However, between May 20 and May 23, traders using leverage lost $19 million.

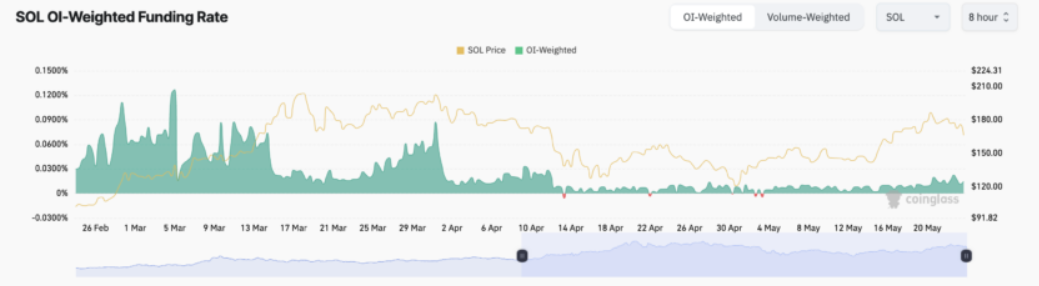

However, despite this, the funding rate remains positive, amounting to 0.014% at the time of writing. This suggests that derivatives market participants continue to believe that Solana’s price will rise and are opening more longs.

If the trend continues and the bulls regain control of the spot market, the price of the altcoin could rise to $169.94. However, increasing selling pressure could cause SOL to fall to $151.95.

FTX sold out Solana

According to sources familiar with the matter, Pantera Capital and Figure Markets purchased a block of 800,000 SOL for approximately $80 million—thus, the price of one token was $102. This significant discount reflects the urgency of FTX’s efforts to liquidate its remaining assets. Kyle Chasse, founder of Master Ventures, noted the importance of these deals. “This event closes a significant chapter in the liquidation of FTX’s assets,” he said .

Pantera Capital also participated in the auction, although details of their purchase were not disclosed. The company’s ongoing interest in Solana underscores its strategic approach to investing: Pantera previously attempted to raise $250 million to purchase tokens from FTX.

In the past, selling Solana at a significant discount has resulted in a noticeable drop in the asset’s price. However, this time the news did not have any impact on the asset price. According to data from the VR Soldier, SOL is trading at $168.5, having lost 1.73% in the last 24 hours.

Occurring in November 2022, the FTX collapse became one of the most notorious cases in the crypto industry. The exchange owes customers and creditors more than $11 billion. Despite these obligations, FTX disclosed the availability of free cash in the amount of $16.3 billion, which allowed it to fully repay its debts, including interest.

The exchange’s ability to find available cash and its aggressive asset liquidation efforts provide a positive outlook for the recovery plan. FTX’s amended Chapter 11 plan, pending court approval, aims to ensure a fair distribution of assets among clients.