The daily trading volume on decentralized exchanges (DEX) on the Solana blockchain has experienced a notable decline. On May 26, data from Artemis dashboard indicated that the volume had plummeted to $984 million. This is a significant drop from the volume three days prior, which exceeded $1.5 billion. This decrease contrasts sharply with Solana’s performance in April, when the DEX volume reached a monthly record high of $60 billion. However, the recent decline in trading volume can be attributed to reduced interaction with memecoin launched on the Solana network. Previously, a surge in memecoin trading had driven the volume to unprecedented levels. However, as the memecoin craze subsides, so does the trading volume on SOL decentralized exchanges.

Solana: Weakening Open Interest Signals Potential Downtrend

Another critical indicator pointing to Solana’s potential downturn is the Open Interest (OI) on the network. According to Santiment data, Solana’s OI has plunged to $1.90 billion from nearly $2.20 billion on May 20. Open Interest measures the total value of all open positions in a contract. An increase in OI typically signals a bullish trend as more capital flows into the market. Conversely, a decrease suggests that liquidity is being withdrawn, indicating a bearish trend.

The drop in Solana’s OI suggests a weakening market sentiment. As liquidity exits SOL contracts, the potential for an uptrend diminishes. This reduction in OI has correlated with a decline in SOL’s price, which previously surged to $188.45 when OI was higher. If the current trend continues, SOL could face further declines, potentially reaching $145.90.

Bullish Solana Predictions

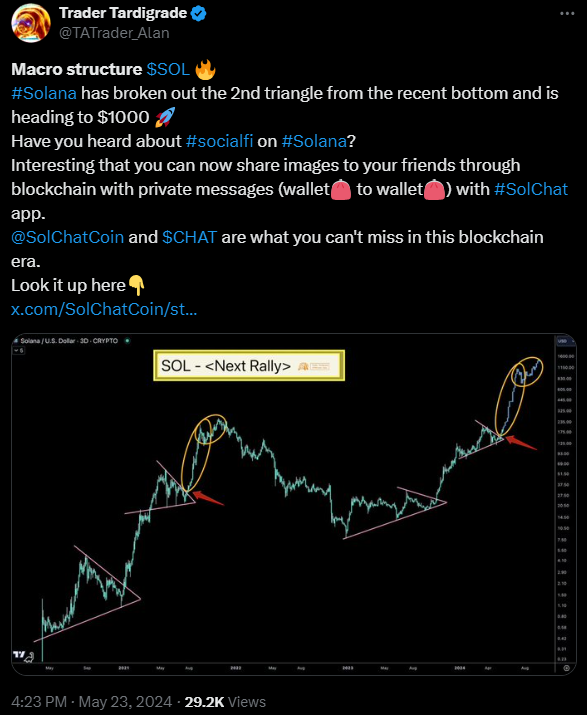

Crypto analyst Trader Tardigrade has made bold predictions regarding Solana’s future price trajectory. Tardigrade’s analysis highlights Solana’s recent breakout from a consolidation pattern, suggesting a potential rise towards the $1,000 mark. This optimistic outlook comes as SOL trades at $170, indicating significant growth potential.

Tardigrade’s prediction is supported by Solana’s strong market performance. Despite short-term fluctuations, including a 4.50% decrease in the last 24 hours and a 1.30% decline over the past week, the overall outlook for SOL remains positive. The cryptocurrency’s ability to maintain support levels amidst market volatility underscores its strength and investor confidence.

Memecoin Frenzy Fades: Impact on Solana’s Market Trends

This decrease in volume has also affected Solana’s native token, SOL. At the time of reporting, SOL’s price stood at $165, with a 24-hour increase of 2%, down from a peak close to $190 just a few days earlier. The demand for SOL is closely linked to memecoin trading, as many memecoins require SOL for transactions. In addition, its market capitalization has increased by 5% to $74,467,605,568. The recent approval of the highly anticipated Ethereum ETF is expected to have a positive impact on the entire altcoin market, including Solana.

This market-wide bullish sentiment could propel SOL prices higher. The Ethereum ETF’s approval not only signifies increased institutional trust in the cryptocurrency market but also paves the way for other blockchain projects to gain mainstream attention.