Introduction

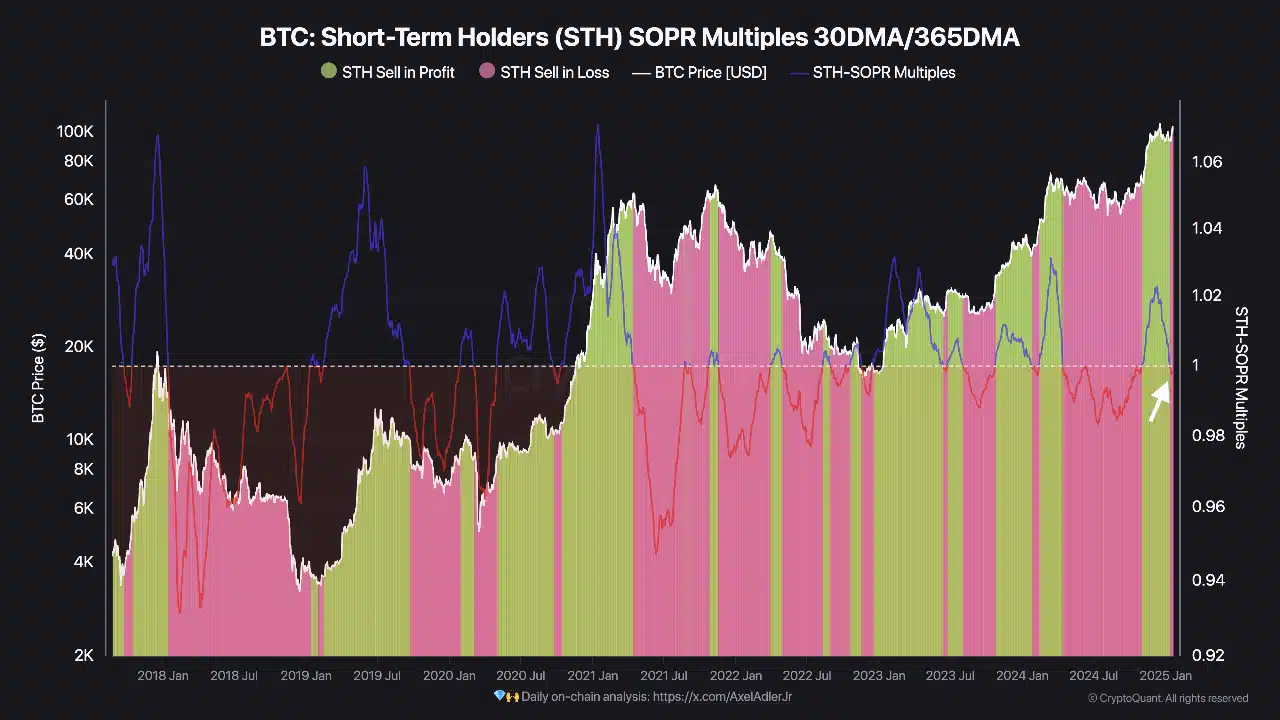

Bitcoin [BTC] short-term holders (STHs) are selling their coins at a loss, according to a key metric called the Short-Term Holder Spent Output Profit Ratio (STH SOPR). This metric shows whether these holders are selling for more or less than they originally paid. Right now, it’s negative, meaning they’re selling at a loss. This has raised concerns in the market. But what does this mean for Bitcoin? Let’s break it down.

What Is Bitcoin STH SOPR?

STH SOPR compares the price short-term holders sell Bitcoin for to the price they bought it. A number below 1.0 means they’re selling at a loss.

Recently, this ratio dropped below 1.0, showing a clear trend of people selling their BTC for less than they paid. This usually happens when the market is under stress. People may sell because they’re worried prices will drop even more. However, these situations can also lead to new opportunities for long-term investors who see lower prices as a chance to buy more BTC.

What Happens When Bitcoin Short-Term Holders Sell at a Loss?

When short-term holders sell at a loss, two main things can happen:

- Prices Stabilize: Sometimes, people stop selling because they don’t want to lose more money. This can help the price of BTC stabilize. If this happens, it might provide a foundation for the price to go up again.

- More Selling Pressure: Other times, the selling continues. This can create a domino effect, where more people sell, causing the price to drop even further. While this can hurt in the short term, it can also attract long-term investors who see lower prices as a bargain.

Right now, it’s unclear which way the market will go. It depends on how other investors react and overall market confidence.

Lessons from Bitcoin’s History

History shows us that when the STH SOPR goes negative, it often marks an important turning point for Bitcoin.

- March 2020 Crash: During the COVID-19 crash, short-term holders sold at big losses. While this caused BTC’s price to drop to $4,000, it also created a massive buying opportunity. Within a year, BTC’s price skyrocketed to over $60,000.

- Mid-2018 Bear Market: In 2018, BTC’s price fell after hitting $20,000. Short-term holders were selling at losses back then too. This period turned out to be a time when long-term investors started buying. Later, BTC hit new highs in 2020.

These examples show that selling at a loss doesn’t always mean bad news for the market. Sometimes, it signals the start of a recovery.

What Does This Mean for Bitcoin’s Long-Term Investors?

If history repeats itself, this could be a good time for long-term investors to enter the market. When short-term selling slows down, Bitcoin often begins to recover. However, there are no guarantees. The market’s direction depends on many factors, including global events and investor confidence. For now, the current selling trend highlights market uncertainty, but it also offers potential opportunities for those who believe in Bitcoin’s long-term value.