Introduction

XRP, one of the most well-known cryptocurrencies, is getting more attention from big investment companies that manage billions of dollars. These firms are starting to add XRP to their portfolios alongside popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Why Are Investment Firms Buying XRP?

Investment firms handle huge amounts of money for wealthy individuals, companies, and governments. Recently, many of these firms have started buying XRP because they believe it has a strong future. One expert, Ryan Rasmussen, Head of Research at Bitwise, explained why institutions are now paying attention to XRP. He said,

“XRP has strong brand recognition. It has been around for a decade and survived multiple boom/bust cycles. It has also done a good job marketing to institutions.”

In simple terms, XRP has been around for a long time and has proven itself in both good and bad market conditions. This has made it a trusted name in the crypto world, especially for big investors. Another reason investment firms are interested in XRP is its real-world use.

For example, SBI Shinsei Bank, a major financial institution, partnered with Ripple, the company behind XRP, to help people send money across countries faster and cheaper.

This kind of adoption by banks and financial companies is one of the reasons why XRP is catching the attention of investors.

Could it Become as Big as Bitcoin and Ethereum?

Right now, Bitcoin and Ethereum are the most popular cryptocurrencies among big investors. One of the main reasons for their success is the launch of spot exchange-traded funds (ETFs) in the United States. ETFs allow large institutions to invest in cryptocurrencies easily and legally.

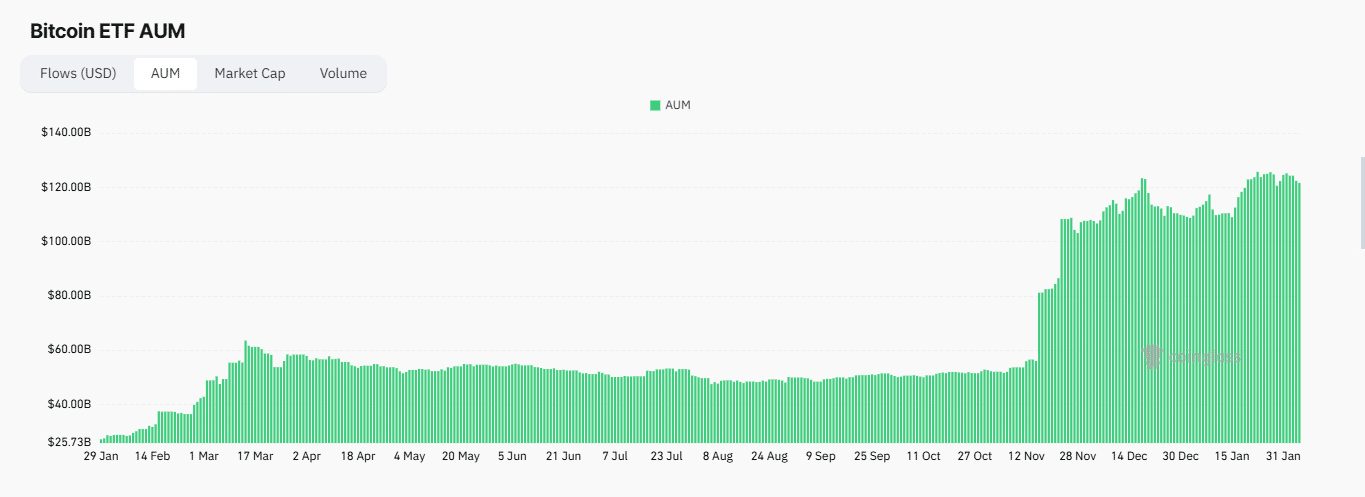

Since they launched, Bitcoin ETFs have attracted over $122 billion in investments, while Ethereum ETFs have brought in over $10.21 billion.

If XRP also gets its own ETF, it could follow the same path and attract billions of dollars from big investors. This would increase its price and popularity even more.

Is an XRP ETF Coming Soon?

There are already signs that an XRP ETF could be on the way!

- Grayscale, one of the biggest crypto investment firms, has filed to convert its XRP Trust into an ETF and list it on the New York Stock Exchange (NYSE).

- CoinShares and Bitwise, two other major investment firms, have also shown interest in launching XRP ETFs.

If these ETFs get approved, XRP’s price could go much higher, just like Bitcoin and Ethereum did after their ETFs launched. Some experts believe that if XRP ETFs are approved, they could attract over a billion dollars in investments within a few months!

XRP’s Recent Growth and Future Potential

XRP has been performing well in the market, catching the attention of both small and large investors.

- In January 2025, XRP reached a price of $3.40, coming close to its all-time high of $3.84, which was set in 2018.

- XRP’s network has been running for over 110,000 hours since 2012, with only two hours of downtime! This shows that it is a very reliable and well-maintained blockchain.

- XRP gained more than 20% in a single day recently, showing that it still has strong momentum in the market.

While the price of XRP is not guaranteed to go up, the growing interest from big investors, financial institutions, and ETF providers makes its future look promising.

Conclusion

If XRP ETFs get approved, they could bring in billions of dollars in new investments. At the same time, more banks and businesses are starting to use XRP for fast and cheap payments, increasing its real-world adoption. Additionally, big investors are already buying XRP, which shows their confidence in its future growth.