Introduction

Bitcoin is becoming harder to find on exchanges because big investors, including the U.S. government, are buying more of it. With less BTC available for trading, some believe this could cause prices to go up in the future. But will this shortage of Bitcoin really lead to a big price jump, or is the market still too uncertain?

BTC’s Supply is Shrinking as More Investors Buy

The amount of Bitcoin available on exchanges has dropped to around 2.5 million BTC, a big decrease over the past year. As more investors buy and hold BTC, the supply on the market gets smaller. This is one reason why Bitcoin’s price has been rising over time.

Right now, BTC is worth $87,656, which is 2.64% lower than yesterday. Even though the price has dropped, reports say the U.S. government is buying BTC and keeping it as a financial asset. If other countries start doing the same, Bitcoin’s supply could shrink even more, making it rarer and possibly more valuable.

Bitcoin’s Price May Be Getting Ready to Jump

Bitcoin’s price chart is forming a descending symmetrical triangle, a pattern that usually means a big price move is coming soon.

At the moment, BTC is struggling to rise above $94,267 and $99,407. If buyers step in and push the price past these levels, BTC could go up to $106,766. But if the price can’t break through, Bitcoin may drop back down to $83,728, where it has strong support. BTC’s RSI (Relative Strength Index) is at 43.28, which means the coin is getting close to being oversold. When this happens, prices often bounce back as more people buy in.

Are Bitcoin Holders Still Making Money?

Even with the price drop, most people who own Bitcoin are still making a profit. Right now, about 75.24% of BTC holders bought BTC at a lower price, meaning they’re still in the green. Only 21.25% of investors are losing money, while 3.51% are at break-even. This shows that most BTC owners aren’t panicking or selling their BTC, which is a good sign for the market. When people hold onto their BTC instead of selling, it helps keep the price stable or even push it higher.

Are Big Investors Still Interested in Bitcoin?

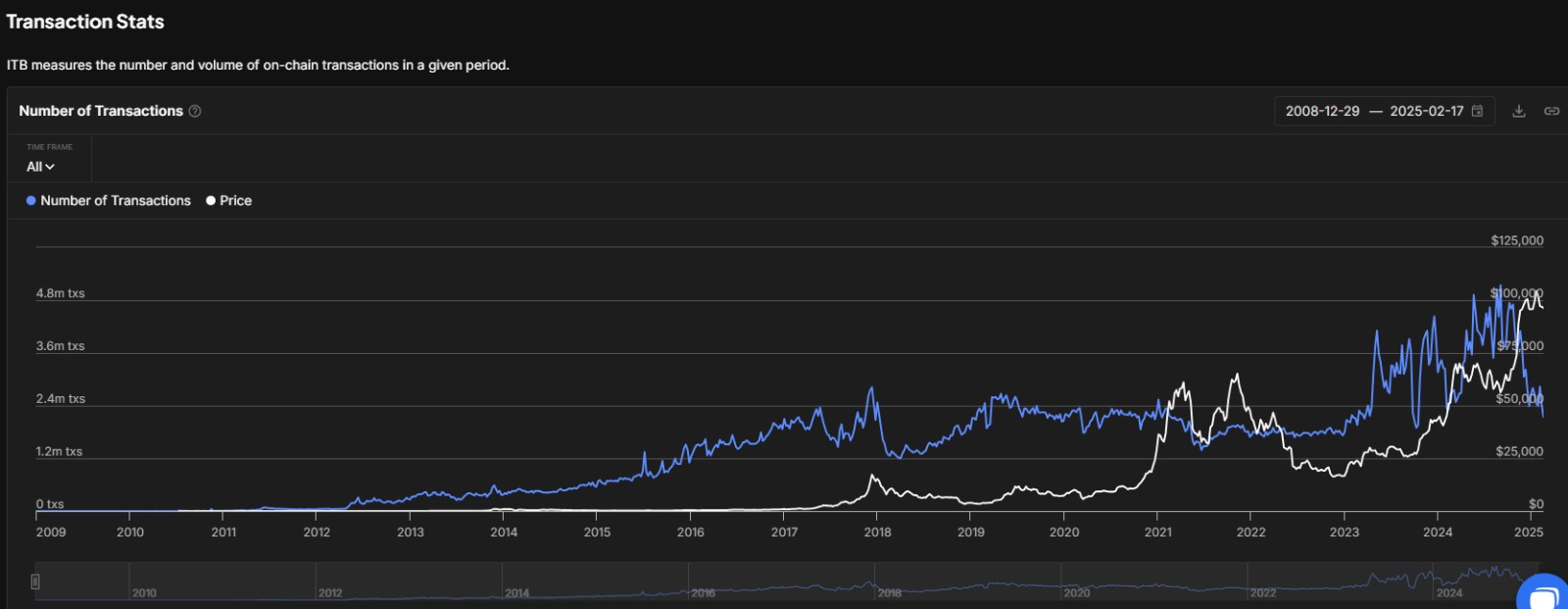

Even though daily BTC transactions have dropped by 6.70%, new investors are still entering the market. The number of new BTC addresses has increased by 2.14%, showing that fresh buyers are interested.

Meanwhile, large BTC transactions (over $10 million) have increased by 36%, meaning that big investors (whales) are still active in the market. If these large buyers continue accumulating BTC , it could help support future price increases.

Bitcoin Recent Liquidations – Who is Losing More?

Bitcoin’s price drop has caused some traders to lose money. In the past day, $116.93 million in long trades were liquidated, compared to only $43.96 million in short trades. This means that many traders who were betting on BTC going up lost their investments when the price dropped. However, if BTC finds support and stabilizes, future liquidations could help push prices higher instead of lower.

Conclusion

Bitcoin is becoming harder to find on exchanges, and both institutions and the U.S. government are adding BTC to their holdings. At the same time, BTC’s price charts suggest a big move is coming soon. If demand continues to grow, BTC’s next rally could be just around the corner. However, if BTC fails to break through key resistance levels, it might see another price drop before bouncing back. Investors will be watching closely to see what happens next.