Introduction

Bitcoin is currently experiencing a critical juncture, hovering around $85,000 but facing potential downward pressures that might pull it towards $82,000. This analysis seeks to uncover the factors that could influence Bitcoin’s short-term price movements, especially focusing on the behavior of recent buyers and market signals that suggest possible trends.

Understanding UTXO Realized Price Bands and Market Sentiments

The UTXO Realized Price bands, particularly for short-term holders, are showing signs that these investors could be preparing to sell off their holdings, potentially leading to a price decline. The transition of the 1-week to 1-month and 1-month to 3-month cohorts falling below the longer-term 3-month to 6-month cohort around the $85K mark suggests a bearish sentiment building up among newer investors. Historically, such crossovers have often led to further bearish market behavior as these newer investors are likely to sell at losses, impacting the broader market sentiment.

Key Technical Resistances and Bitcoin Struggle

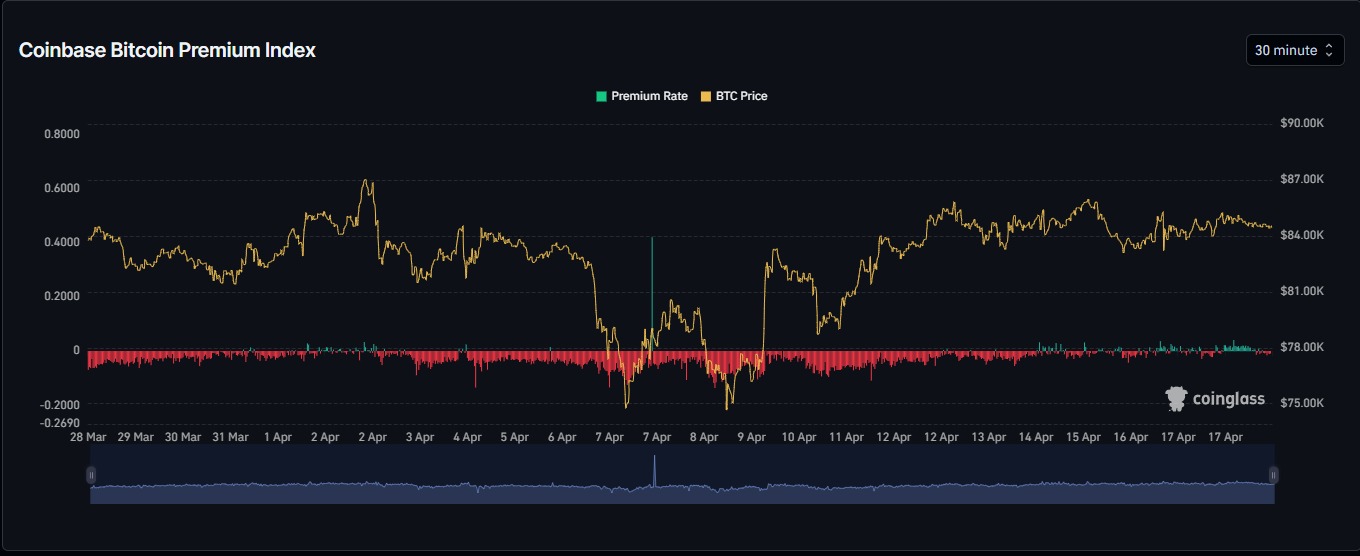

Bitcoin has been testing crucial resistance levels, including the diagonal and the significant 200-day Moving Average (MA), which are essential barriers to its upward movement. Despite positive indices from platforms like Coinbase, where a premium suggests buying interest, Bitcoin has struggled to make significant upward progress beyond these resistance points.

Detailed Bitcoin Market Indicators and Their Implications

The Coinbase Premium index, which remained positive at 0.01%, suggests some buying interest at higher levels, although the impact on price has been limited. On the trading front, despite high buying volumes observed on exchanges like Binance and Bybit, the overall market response has been tepid, as indicated by the Cumulative Volume Delta (CVD) readings.

Additionally, a slight decrease in Open Interest from $6.64 billion to $6.55 billion hints at potential long-term position liquidations and a hesitancy to initiate new positions, further suggesting a cooling market sentiment.

Bitfinex’s Position and Overall Market Cautiousness

Bitfinex’s bearish stance, holding a significant position of 71,036 BTC, also plays into the broader market cautiousness, with traders wary of pushing past the $85K resistance despite otherwise bullish spot metrics. This resistance level is crucial; failing to surpass it could see Bitcoin’s price drop below $84,000.

Predictive Analysis of Bitcoin Price Movement

Looking ahead, the immediate resistance formed by the Daily 200EMA at $87,740.23 has been a consistent point of rejection. This level is pivotal; a break above could pave the way towards $90,608.53, potentially reinvigorating bullish momentum. Conversely, failure to overcome these barriers could lead to a decline towards $82,000, driven by sustained bearish pressure and a lack of positive market triggers.

Conclusion: A Critical Phase for Bitcoin

In conclusion, Bitcoin stands at a decisive point. The market’s next moves will be critical in determining whether Bitcoin can overcome current resistances and head towards higher valuations or if it succumbs to bearish pressures leading to further declines. Market participants remain on alert, with the next few days likely to be crucial in setting the tone for Bitcoin’s near-term market trajectory.