Trump Points Fingers at Biden Over Economic Decline. U.S. stock markets closed mixed on Wednesday, ending a tough April. This month was filled with ups and downs, as the economy shrank and trade policies created uncertainty. The S&P 500 went up by 0.15%, but the Nasdaq Composite dropped by 0.086%. Meanwhile, the Dow Jones Industrial Average gained 141 points after new information showed that the U.S. economy shrank for the first time since 2022.

The Commerce Department reported that the first-quarter GDP (Gross Domestic Product) fell by 0.3% annually. This was a big change from the 2.4% increase seen in the previous quarter. This drop in economic growth was partly caused by a 41% increase in imports. Businesses had been stocking up ahead of new tariffs introduced by President Trump. At the same time, consumer spending slowed down to its weakest point in over a year. Government spending also dropped, which made the economy shrink even more.

Tariff Turmoil and Uncertainty

Earlier in the month, markets had been doing better. They rose after Trump paused some tariffs and hinted that he might make trade deals with countries like India. But after the weak economic data came out, the markets turned volatile again. Investors were also worried about inflation and unclear trade talks.

The losses in April came after a sharp drop in the stock market following Trump’s announcement on April 2. He had talked about “reciprocal” tariffs, which caused the S&P 500 to fall more than 11% at one point.

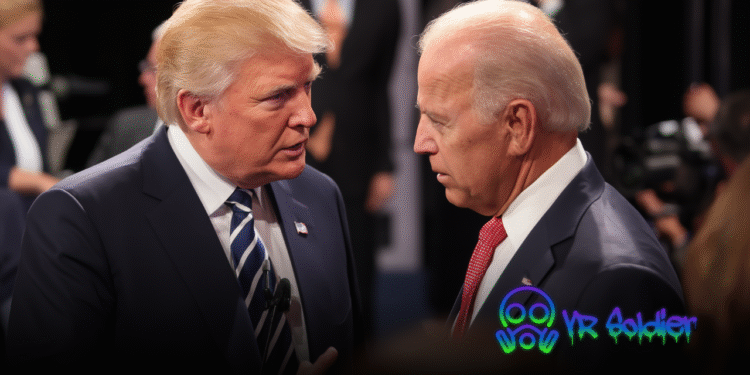

Trump Blames Biden for Market Struggles

On his social media platform, Truth Social, Trump tried to shift the blame for the market struggles onto President Biden. He wrote,

“This is Biden’s Stock Market, not Trump’s.”

He argued that a “Biden Overhang” was causing the poor market numbers. Trump also called for patience, explaining that his policies would take time to show results.

Weak Performance for Trump’s Second Term

Trump’s second term as president has seen one of the weakest performances in terms of the stock market during the first 100 days. Many experts believe that the ongoing uncertainty around tariffs is one of the main reasons for this. Kelly Bouchillon, from Sound View Wealth Advisors, said, “This is very clearly brought on by the uncertainty surrounding the tariffs, period.”

Companies Struggling with Tariff Issues

At the same time, some major companies have also been struggling due to the uncertainty surrounding tariffs. For example, First Solar and GE HealthCare have lowered their future expectations because of the effects of the tariffs. Nvidia’s shares also went down after Super Micro Computer reported poor results. These challenges show just how much tariff issues are affecting both the stock market and major businesses.