Introduction

Bitcoin kicked off May with a strong bullish move, closing at $97,406 and successfully breaking above a key resistance level it had struggled with since February. This breakout is significant—it signals renewed buying strength, especially now that the price sits comfortably above the short-term holder (STH) realized price of $93,342. That level now acts as a reliable support floor, representing the average on-chain cost basis for BTC held for up to 155 days.

With a new all-time high potentially within reach, investors are looking ahead. But as history often reminds us, Bitcoin rarely moves in straight lines. The next few weeks could unfold in one of three ways, depending on how momentum holds up.

Three Scenarios That Could Define Bitcoin Short-Term Future

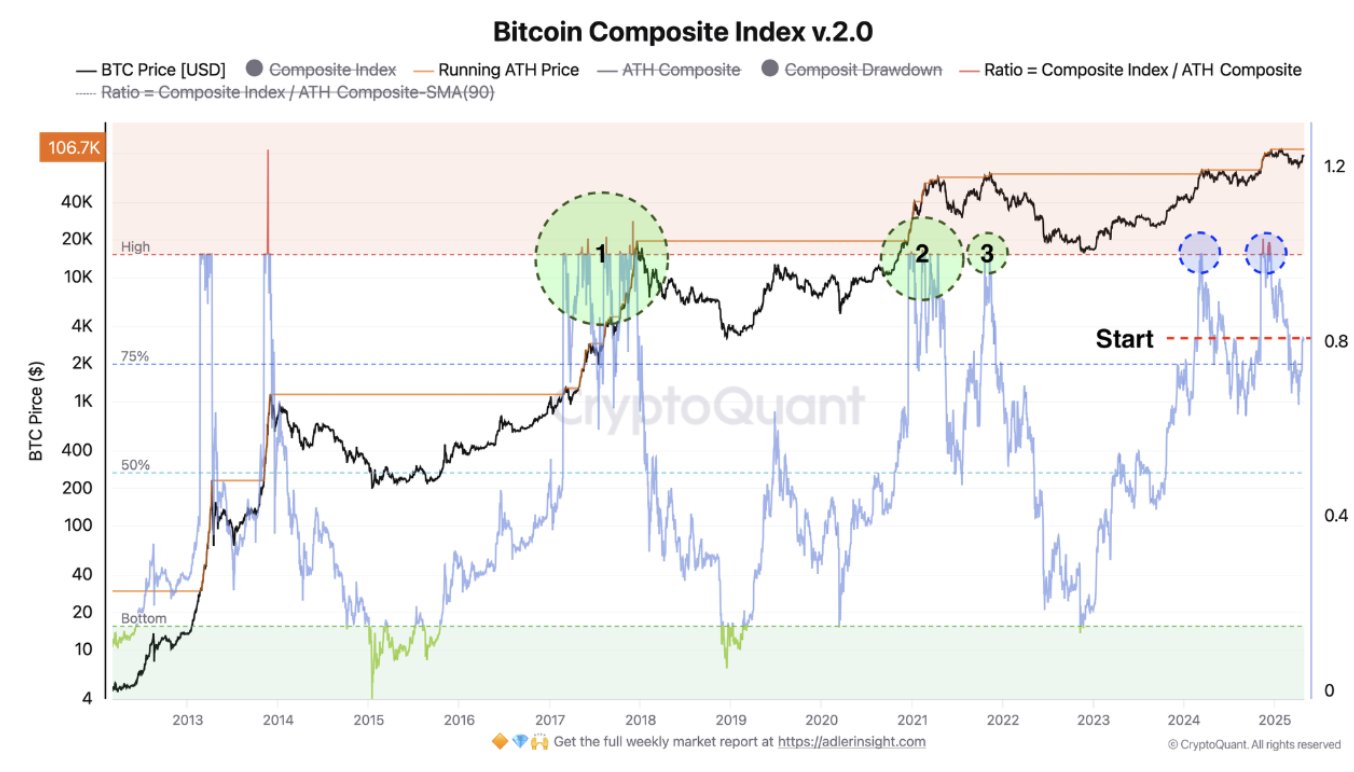

Crypto analyst Axel Adler outlines three likely paths for Bitcoin, each based on the market’s momentum ratio—a metric that currently sits around 0.8. This level places BTC in what Adler calls the “start” rally zone, meaning the market has room to run but hasn’t yet committed to a decisive breakout.

Scenario one is the most bullish. If the momentum ratio rises above 1.0 and stays there, on-chain metrics like MVRV and NUPL would likely shift into high gear. That kind of move could fuel a powerful rally, with prices potentially climbing toward the $150K–$175K range—levels consistent with past bull market blow-offs.

Scenario two is more neutral. Should the ratio hover between 0.8 and 1.0, Bitcoin could consolidate in a wide band between $90K and $110K. In this case, current holders might stay put, but new buyers wouldn’t flood in with enough volume to push prices sharply higher.

The third and least likely scenario is a bearish one. If momentum fades and the ratio drops to 0.75 or lower, short-term holders may begin selling, sparking a correction that pulls BTC back into the $70K–$85K zone.

MVRV and NUPL Support More Upside Potential

To understand how much higher BTC could go, it helps to look at historical metrics. The Market Value to Realized Value (MVRV) ratio, a key top signal, currently sits at 2.16—well below the 3.9 level typically seen at market peaks. That leaves plenty of room before conditions reach overheated levels.

Similarly, the Net Unrealized Profit/Loss (NUPL) indicator is holding at 0.54. In past cycles, NUPL has risen closer to 0.74 before signaling market tops. At today’s level, Bitcoin appears to be in the early stages of optimism—far from euphoria.

Consolidation or Breakout: Which Will Win Out For Bitcoin ?

Although the recent rally has reset key indicators, it’s worth noting that a correction already played out before the current move higher. That makes another deep pullback less likely in the near term. What’s more probable is a continued climb or a healthy consolidation.

Unless momentum unexpectedly vanishes, the chances of Bitcoin sliding back into the $70K range are slim. Consolidation between $90K and $110K may emerge if momentum slows, but should buyers regain control and push the ratio above 1.0, $150K–$175K could soon become more than just a projection.

Conclusion: All Eyes on Momentum as Bitcoin Enters a Key Phase

Bitcoin’s breakout above $97K has opened the door to multiple possibilities, but two paths stand out: a consolidation phase or a full-blown rally toward $150K and beyond. With metrics like MVRV and NUPL showing room for growth and the recent correction already absorbed, the odds lean in favor of continued strength.

Momentum will decide what happens next. Watch for the momentum ratio and key price levels—they could tell you whether BTC’s next move is sideways or straight into uncharted territory.