Introduction

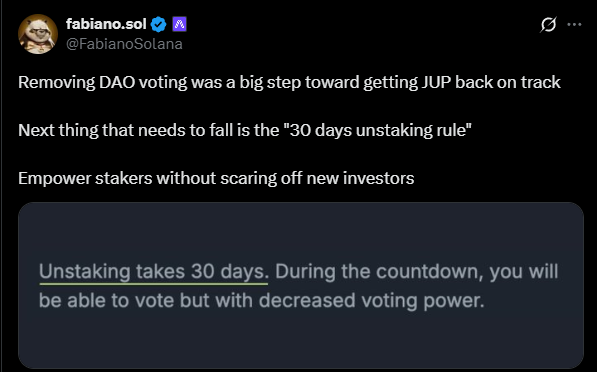

If you blinked, you might’ve missed Jupiter’s brief moment in the spotlight. The DAO behind the once-buzzy token has hit the brakes, literally. Governance? Suspended. Why? To avoid what developers call “gridlock,” but the community heard “emergency brake.” While some investors see this as a desperate but necessary reset, others are raising eyebrows over what decentralization even means anymore. Is this a clever pivot or the first note in a slow death spiral?

Utility? What Utility? Speculators Demand a Plot Twist

For a token that soared past $2 after launch, JUP has now plummeted to earth, trading at around $0.41. That’s an 80% nosedive worthy of a crypto cautionary tale. And while Jupiter’s ecosystem flexes a trillion dollars in trading volume, token holders are asking the tough question: what does JUP actually do?

So far, answers are murky. With staking options still limited and no clear roadmap for real-world use, JUP’s biggest value might still be its potential. But investors are no longer willing to wait on just vibes. They’re looking for utility, and fast.

Price Panic: When Selling Jupiter Becomes the Only Strategy

Let’s talk numbers, and they’re not pretty. JUP has lost over 82% from its peak. More than a third of that happened in the past month alone. That’s not just a dip; it’s an extended trust fall with no one catching.

Technical indicators show the RSI clinging to 46 (not encouraging), and the MACD still buried below zero. Even the faint signs of flattening in the momentum chart haven’t sparked serious buyer interest. Volume’s ticking up, but so is the sense of dread.

And then there’s the elephant in the room: token unlocks. A flood of JUP has hit the market like a crypto tsunami, and buyers simply aren’t lining up to mop it up.

Jupiter Fork in the Road, Crisis or Comeback?

Here’s the million-dollar question: is this just the dark night before a new dawn for Jupiter, or is the rocket out of fuel entirely? The project still has one thing going for it: visibility. Everyone in DeFi is watching, either to scoop up discounted tokens or take notes on what not to do.

The Foundation’s bet on centralized decision-making might provide the strategic reset JUP desperately needs, but it comes at the cost of community trust. If developers can roll out meaningful utility and create genuine token demand, there’s hope yet.

Otherwise, JUP might go down as another crypto darling that burned too bright, too fast, and left its holders holding the cosmic bag.