Gold evangelist Peter Schiff is criticizing Bitcoin and the crypto market, drawing a comparison to the madness of the 17th-century Dutch tulip bubble. Schiff believes President Donald Trump’s promotion of cryptocurrencies is accelerating the collapse of the U.S. dollar while giving legitimacy to digital assets. According to Schiff, Trump is promoting what he calls a “decentralized Ponzi scheme,” which could lead to a financial disaster.

Schiff’s Concerns About Trump’s Crypto Advocacy

Schiff claims that Trump’s advocacy for Bitcoin and other cryptocurrencies is dangerous for the U.S. economy. He believes that by supporting digital currencies, Trump is helping undermine the dollar, which could lead to its collapse. Schiff argues that the cryptocurrency hype is misleading the public into thinking digital assets are safe investments, which in his view is far from the truth.

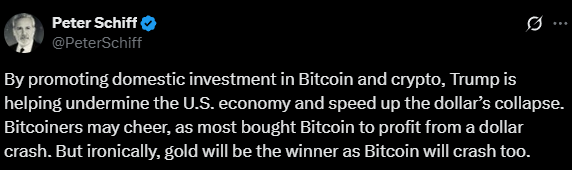

“By promoting domestic investment in Bitcoin and crypto, Trump is helping accelerate the collapse of the U.S. dollar,”

Schiff wrote on X. He added that while some Bitcoin supporters may initially celebrate the weakening of the dollar, gold would ultimately benefit in the end because Bitcoin will eventually crash too.

Decentralized Ponzi Scheme

Schiff does not hold back when describing Bitcoin. He refers to it as a “decentralized Ponzi scheme,” arguing that it offers no real value. Schiff criticized recent cryptocurrency bills, claiming they are attempts to make Bitcoin appear legitimate. He believes these efforts are simply a way for industry insiders to profit by getting people to buy Bitcoin at inflated prices before cashing out.

“The industry is using these bills to hype Bitcoin and other cryptos so insiders can cash out at higher prices,” Schiff said. According to Schiff, this is a legislative low point and a dangerous trend. He is also skeptical of stablecoins, which he sees as ineffective tools for maintaining the dominance of the U.S. dollar.

Stablecoins Are Not the Answer

Schiff doesn’t think stablecoins will help secure the U.S. dollar’s global position either. Stablecoins are digital currencies backed by traditional currencies like the U.S. dollar. However, Schiff believes they provide no true stability advantage.

“The hype around stablecoins helping secure the U.S. dollar’s dominance is nonsense,” Schiff stated. He warned that stablecoins are only as stable as the underlying currency they are backed by. When the value of the dollar fluctuates, stablecoins will lose their supposed stability.

The Madness of Crowds

Schiff also draws a connection between the rise of Bitcoin and the Dutch tulip bubble. He refers to Charles Mackay’s book Extraordinary Popular Delusions and the Madness of Crowds to describe how people can become irrational when it comes to financial speculation.

“The tulip bubble is often cited as the first recorded financial bubble,” Schiff noted. In the 1630s, tulip bulb prices soared to ridiculous levels, only to collapse overnight, leaving many investors with nothing. Schiff sees Bitcoin as the modern equivalent of that irrational market mania.

“Just replace tulip with Bitcoin, and that sums it up perfectly,” he said. According to Schiff, Bitcoin, like the tulips of the past, is another example of people losing their senses and chasing a financial delusion. He believes society’s growing obsession with cryptocurrencies is a dangerous distraction from sound economic principles.

Schiff’s View on Gold and Cryptocurrency

Schiff has long been an advocate for gold as a stable and valuable asset. He believes that the economic system should be backed by gold rather than unregulated digital currencies. His warnings about Bitcoin reflect his broader skepticism toward any monetary system not tied to tangible assets like gold.

For Schiff, cryptocurrencies like Bitcoin represent a speculative distraction. He believes that while Bitcoin may have short-term gains, it’s a risky investment that could ultimately lead to financial losses for those who don’t understand its volatility.

Conclusion: A Cautionary Tale

Peter Schiff’s warnings highlight the dangers he sees in the rise of cryptocurrencies. He believes that Bitcoin’s popularity is based on hype and that it could eventually collapse, just like the Dutch tulip bubble. While some may see Bitcoin as an opportunity for wealth, Schiff sees it as a risky, speculative investment that could harm the economy in the long run.