Key Takeaways

PROVE tumbled after its Binance debut, with early holders cashing in. Despite the sharp 38% drop, signs of accumulation and bullish volume suggest the sell-off might be temporary. A potential rebound may be brewing if support holds.

Binance Hype Turns Into Dump City

August 5th was supposed to be PROVE big moment, the day Succinct’s native token hit Binance Spot. The zero-knowledge proof project launched with major fanfare, including an airdrop of 2 million tokens to eligible traders.

But just hours later, reality struck. Airdrop recipients rushed to sell, dragging PROVE down by a brutal 38% to $1.18. That massive sell-off had many yelling “rug pull,” but not so fast, deeper data suggests this might not be the full story.

Bears Took the Wheel… But Bulls Are Lurking

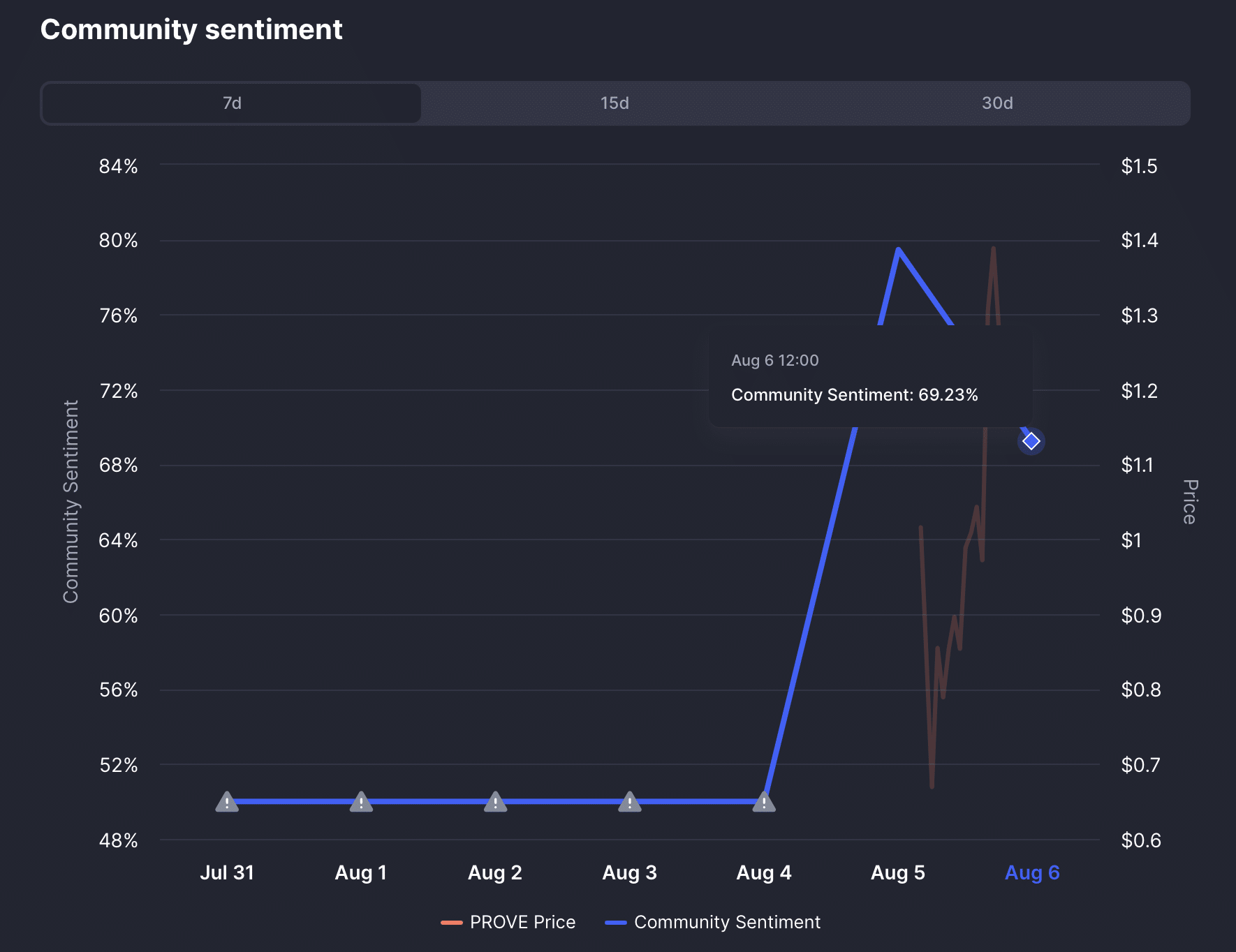

Community sentiment took a nosedive as over 10% of CoinMarketCap-tracked wallets joined the sellers. Within a day, bullish sentiment dropped from nearly 80% to just under 70%.

Still, chart watchers saw two possibilities. One? A bounce from the $1.27–$1.01 demand zone. Two? A deeper dip toward $1.13 before a fresh climb.

Historically, this kind of dip, especially after a major listing , signals the setup for a healthy rally. Why? Because that demand zone acts like a trampoline for serious accumulation.

The PROVE Volume Behind the Chaos

Despite the dramatic dip, volume tells a different story. PROVE’s 24-hour trading volume exploded to $1.09 billion, a jaw-dropping 26,000% surge. Prices stabilized around a 40% range, showing signs that the panic might be overdone.

Even more interesting? MEXC exchange showed the highest trading premium and volume for PROVE. That means traders there are hungry for the token, and they’re willing to pay extra.

So… PROVE Dip or Moon Mission?

If PROVE manages to hold above $1.13 and bulls continue stepping in, we might see a rebound that reclaims the all-time high of $1.925. If not, and the bears double down, deeper cuts could be coming.

Still, with this kind of volume, exchange interest, and strong support zones, the token isn’t down for the count. Whether this turns into a textbook rebound or a trapdoor, one thing is certain, PROVE has the market’s full attention.