Bitcoin and the crypto market has been riding a bullish wave, with Bitcoin regaining ground and Ethereum inching toward the $4K mark. But if you’re hoping for an unstoppable altcoin surge, the charts might be hinting at a slowdown before the next big push.

Ethereum Tests $4K But Sellers Are Lurking

Ethereum [ETH] has been flirting with the psychological $4,000 barrier, coming within a few dollars of the mark after shaking off July’s rejection at $3,941. The excitement is building, especially with on-chain activity heating up and institutional interest steadily growing.

Even well-known analyst Tom Lee’s $6,000 Ethereum prediction doesn’t sound too far-fetched in this climate. Still, the reality is that every step closer to $4K has been met with noticeable selling pressure, which could make an immediate breakout more challenging than traders expect.

Altcoin Market Cap Hits a Ceiling, Again

Zooming out, the altcoin market capitalization has been stuck in a range since July, bouncing between $1.34 trillion and $1.54 trillion. At the time of writing, it’s sitting at around $1.5 trillion, still shy of the upper boundary.

Here’s the catch: ranges don’t break just because traders want them to. Every time the market pushes into the extremes, betting on a breakout too early can backfire. Unless TOTAL2 convincingly pushes above $1.54 trillion, there’s a good chance this sideways pattern continues.

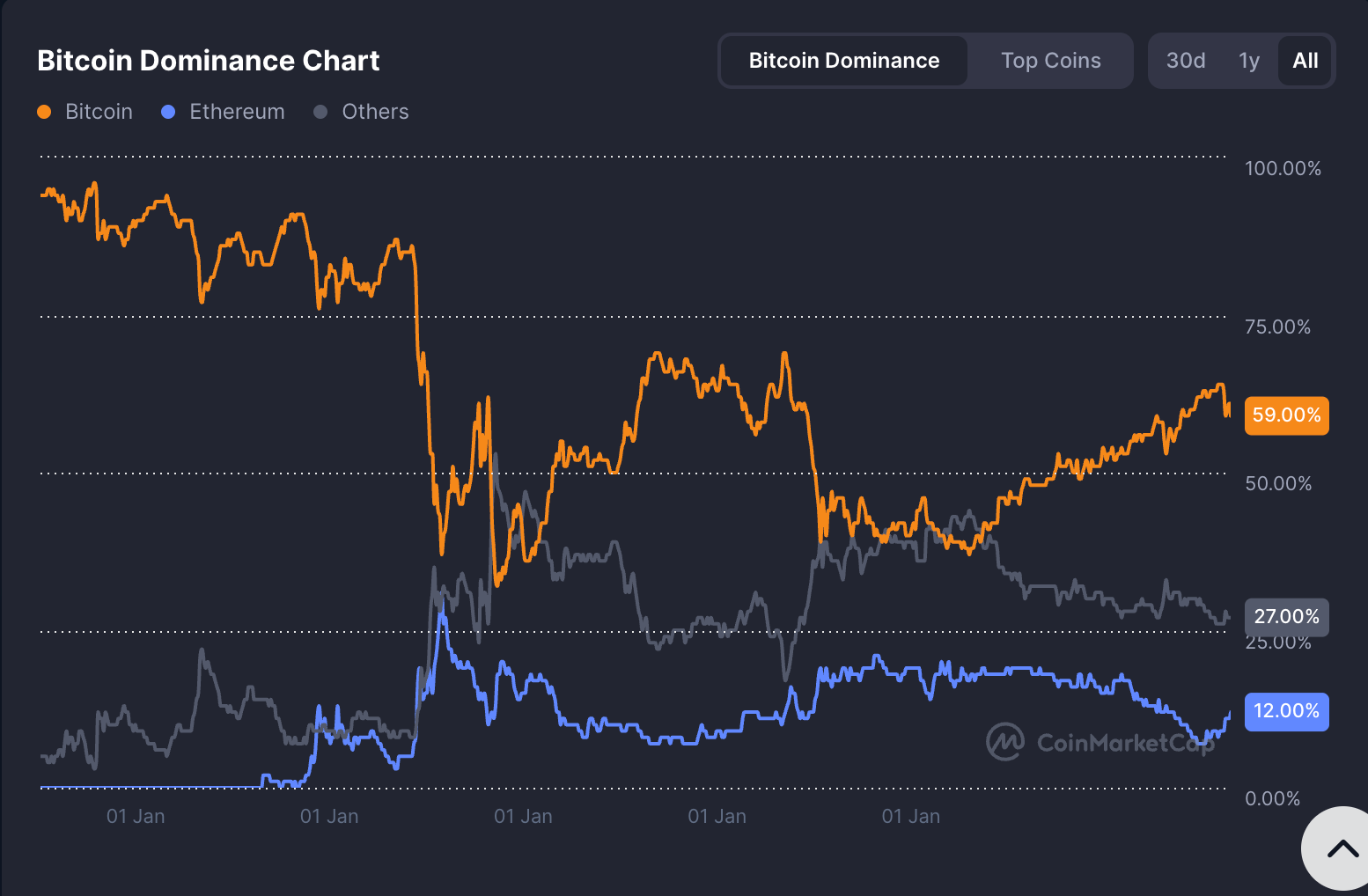

Bitcoin Dominance Suggests the King Isn’t Done Yet

Bitcoin’s dominance (BTC.D) chart has also been locked in its own range for the past three weeks, currently resting at a support level that’s been holding firm. A bounce from here could mean Bitcoin is about to outperform altcoins in the short term.

That scenario wouldn’t necessarily spell doom for altcoins, but it could stall the pace of their rallies. Traders holding long altcoin positions may want to consider banking some profits now rather than betting on a sudden, sustained breakout.

Is Bitcoin The Safer Play for Risk-Averse Traders

Bitcoin’s bounce from $113.1K earlier this week already fueled a mini altcoin rally led by Ethereum. But with both the altcoin market cap and BTC dominance charts hinting at potential shifts, the safer move for conservative traders might be to step aside and wait for a clearer breakout signal.

Long-term, Ethereum’s corporate demand story still looks strong, and a move to fresh all-time highs is very much in play. The question is whether that move happens now, or after another round of consolidation.