Ethereum just pulled off one of its cleanest market squeezes in months. With over $1.3 billion in short positions lurking around $4,700, any strong institutional push could trigger a breakout powerful enough to leave bears scrambling.

From Breakneck Gains to a Critical Crossroads

In just six days between August 4th and August 10th, Ethereum rocketed by 21.45%, a vertical leap that usually screams “cool-off ahead.” History shows such rapid rallies often give way to a pullback as traders lock in profits and overleveraged positions get flushed out.

This time, however, things are playing out differently. After tapping $4,200, Ethereum saw over $1 billion in realized profits, yet Open Interest only dipped 3%. That means the majority of traders haven’t exactly run for the exits, a sign the market isn’t folding just yet.

Ethereum Momentum Without the Overheating

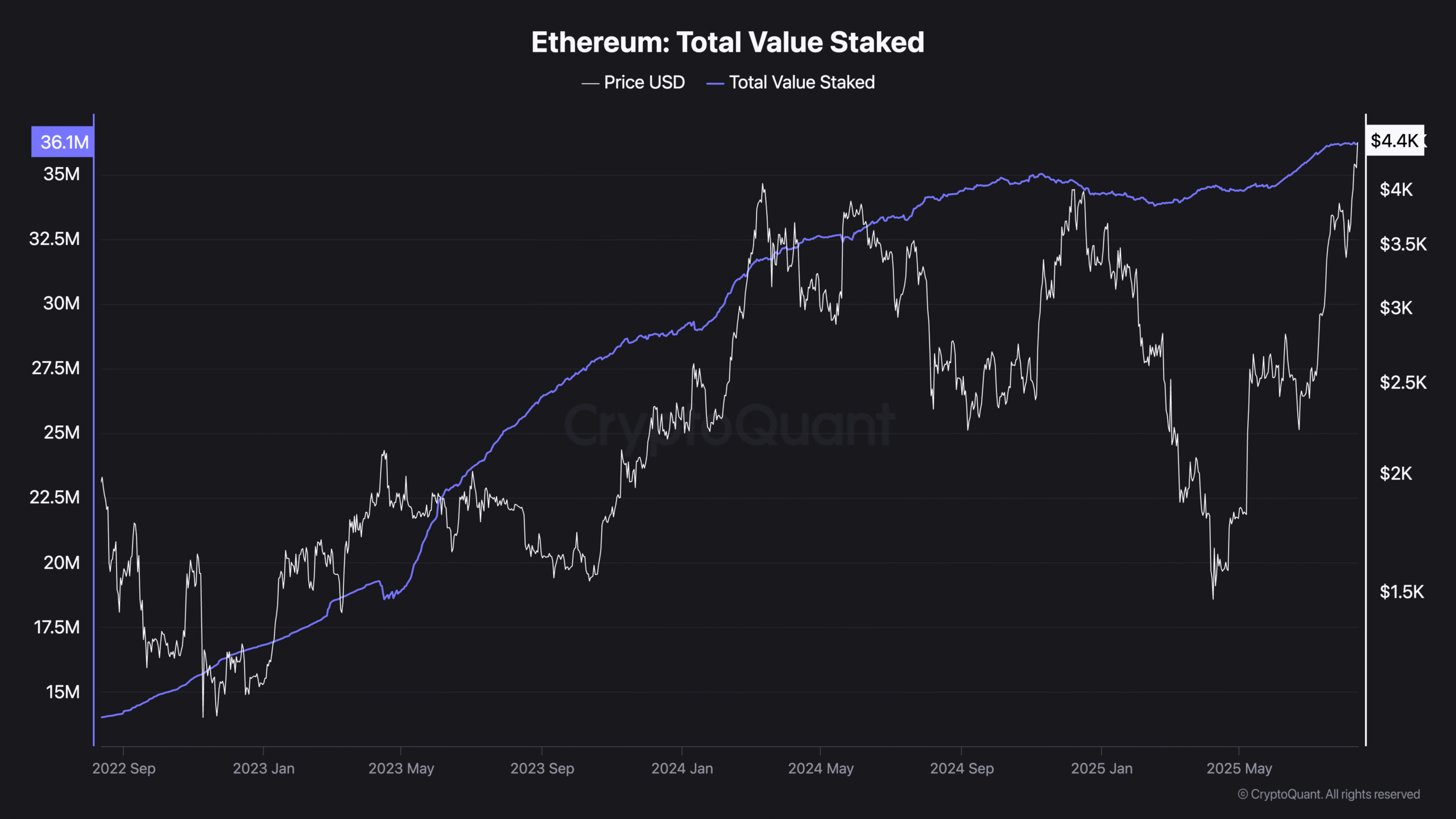

Ethereum’s charge past $4,100, a level unseen since 2021, was backed by notable resilience in its technicals. On-chain data revealed a subtle but important shift: after peaking at 36.23 million ETH staked on August 9th, balances eased to 36.17 million, marking about 60,000 ETH withdrawn in under a week.

Yet, unlike the overheated late-July rally when RSI burst above 80, the current RSI is sitting around 70. Translation? The trend is strong, but not exhausted. With this setup, ETH might just dodge the typical post-rally dip and keep climbing.

Institutional Money Is Speaking Loudly

The bullish case isn’t just technical, it’s also financial. Spot Ethereum ETFs hauled in $1.08 billion in net inflows, with BlackRock’s ETHA alone grabbing $640 million in a single day, marking its largest cash haul to date. When heavyweight institutions throw that kind of money into the mix, short-term pullbacks start to look more like buying opportunities.

A Tightening Market Meets Heavy Short Interest

Here’s where it gets interesting: the same week staking balances dipped by 60K ETH, exchange reserves plunged by 170K ETH. That’s classic liquidity tightening, fewer coins on exchanges means less supply for sellers to dump.

With Ethereum now testing $4.3K, the short side of the market is bracing for impact. At $4,344 sits a liquidity hotspot loaded with $36 million in leveraged shorts. Above that, a mountain of $1.32 billion in short positions teeters at $4,700, a potential detonation point if buyers push hard enough.

Why Ethereum at $5K Might Arrive Sooner Than You Think

Even with profit-taking in play, ETH has held its ground, fueled by strong institutional inflows and a market structure favoring the bulls. If current conditions hold, a break toward $5K before Q3’s close isn’t just possible, it’s starting to look probable.

For now, the question isn’t whether Ethereum will hit a new all-time high. It’s whether the shorts will get crushed before it gets there.