Stablecoins Overtake CBDCs

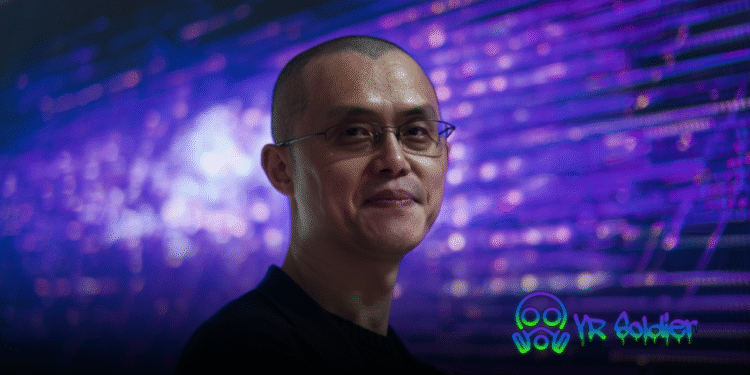

Former Binance CEO Changpeng “CZ” Zhao believes central bank digital currencies (CBDCs) are already outdated. Speaking at the WebX conference in Tokyo on August 25, CZ argued that stablecoins have taken the lead, becoming the preferred choice for governments, regulators, and users worldwide.

He pointed to the fact that at least 10 countries have paused or abandoned their CBDC pilot projects, citing low demand, high costs, and weak use cases. In contrast, stablecoins—backed by real assets and widely integrated into the crypto ecosystem—continue to gain traction.

“CBDCs are already outdated. In contrast, stablecoins are gaining more attention,” Zhao said during his keynote.

Why Stablecoins Are Winning

Stablecoins benefit from real collateral and market adoption, making them more practical than experimental CBDCs.

-

Global Regulation: Nations are passing laws around stablecoins, such as Hong Kong’s Stablecoin Ordinance and the GENIUS Act in the U.S.

-

Market Growth: Standard Chartered projects stablecoins could grow to $2 trillion, up from the current ~$260 billion.

-

Wider Acceptance: Even countries resistant to crypto, such as China, are exploring a yuan-backed stablecoin to counter USD-pegged competitors.

CBDCs, meanwhile, have struggled to progress beyond pilots. Projects in Japan, Denmark, Finland, Singapore, South Korea, and the U.S. have either paused or been dissolved due to lack of adoption.

CBDC Projects Still Standing

Only a handful of CBDCs have moved into actual adoption. Examples include:

-

Bahamas’ Sand Dollar

-

Nigeria’s eNaira

-

Ghana’s e-Cedi

In Europe, Christine Lagarde of the European Central Bank has confirmed that the digital euro is on track for a 2025 launch.

Still, momentum appears to be shifting. The Bank of England is considering halting its digital pound project, urging banks to instead focus on tokenized deposits and other private-sector payment innovations.

The Shift From CBDCs to Stablecoins

According to CZ, the rise of stablecoins reflects a global shift in priorities:

-

Countries want faster, cheaper payment tools without the challenges of building CBDCs.

-

Regulators are more willing to embrace fiat-backed stablecoins than roll out unproven CBDC infrastructure.

-

Users already trust and use stablecoins across exchanges, wallets, and DeFi platforms.

What began as a wave of central bank experiments in the 2010s has now been overtaken by a market-driven, stablecoin-first reality.