Ethereum has been playing a dangerous game of musical chairs around the $4.27K–$4.3K zone for the past two weeks. Neither bulls nor bears are in control, with the long/short ratio split almost evenly at 49-50%. The result? A price chart that feels like it’s holding its breath, waiting for someone to blink first. Any sudden burst of liquidity could tip the balance dramatically in either direction.

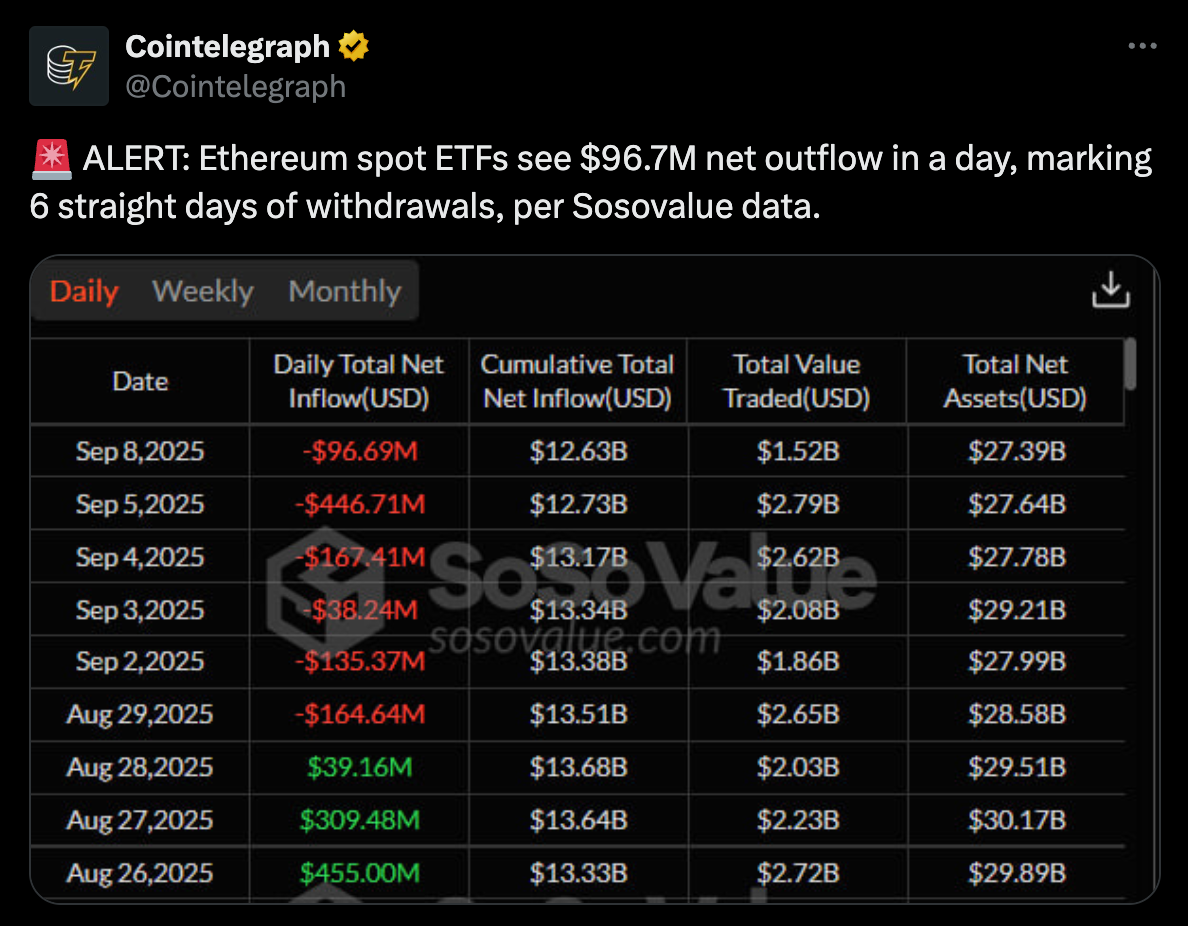

Spot flows turn sour while leverage piles up

If this were mid-June, bulls might feel confident. Back then, Ethereum clung to $2.5K for weeks before blasting 40% higher in just two weeks. But here’s the twist: today’s RSI is flatlined instead of quietly rising. That signals the “buy-the-dip” crowd isn’t buying much of anything right now. Even worse, Ethereum spot ETFs just saw $96.7 million in daily outflows, extending a six-day streak of redemptions. Back in June, they were raking in half a billion in inflows—a night and day difference.

The crowded long camp

Over on Binance, the long side looks like a packed bus during rush hour. Around 70% of traders are leaning bullish, which ironically makes the setup riskier. With open interest climbing, the stage looks set for bears to start fishing for liquidity. Beneath $4K, a juicy $266 million in leveraged longs is stacked at $3.97K. If price slices through that area, a brutal stop hunt could unfold before anyone has time to react.

Why Ethereum $4.3K feels like quicksand

At face value, holding above $4.3K might look like strength. But scratch the surface, and you see cracks forming. Spot demand is thin, ETF money is flowing out, and longs are dangerously overloaded. Combine those ingredients, and you get the recipe for a textbook bull trap—a setup that punishes overconfident traders before rewarding the patient ones.

What Ethereum traders should really expect

This doesn’t mean Ethereum is doomed. A shakeout below $4K could easily set the stage for a healthier bounce later. But the odds of a June-style, straight-line moonshot look slim unless conditions change fast. For now, $4.3K isn’t a fortress—it’s more like a wobbly stool. And sometimes, markets need a reset before they can climb again with conviction.