Altcoin Season is still here, and Bitcoin may have been reclaiming resistance levels around $112K, but its dominance (BTC.D) isn’t following the same script. Instead of flexing strength, BTC.D slipped into another weekly red candle, recovering less than 60% of inflows. The money flow is telling the story: TOTAL2, which tracks the crypto market minus Bitcoin, climbed 3.58%, highlighting how capital is chasing high-volatility altcoins instead of the king coin.

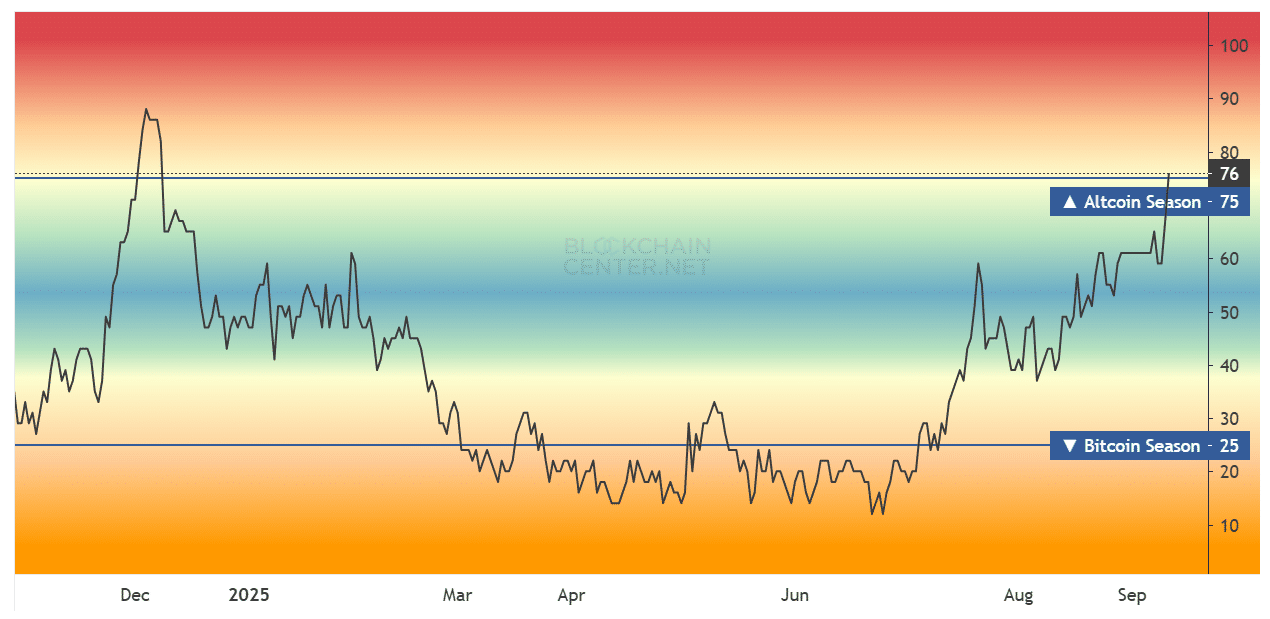

The result? The Altcoin Season Index spiked 13% in just one day, shooting up to 76—its first true “altseason” signal since the last election frenzy. In plain terms, traders are looking for bigger wins outside Bitcoin, even if it means taking on bigger risks.

DOGE steals the spotlight

Ethereum’s attempt to push higher stalled as the ETH/BTC ratio couldn’t break above 0.04. But while ETH struggles, Dogecoin is barking loud. The DOGE/BTC pair has surged nearly 10% in less than two weeks and is now eyeing resistance at 0.0000024. The pattern feels familiar: memecoins catch fire, BTC.D slips, and Ethereum sits in neutral. If that déjà vu feeling is right, we could be watching a 2024-style repeat play out in real time.

Why the caution flag is still up

History reminds us that altcoin euphoria doesn’t last forever. During the previous election cycle, the Altcoin Season Index ripped to 88 by early December, while BTC.D tumbled 10% to 54%. But when Bitcoin’s dominance snapped back to 65% by mid-June, the Index collapsed all the way down to 12. The fallout? Altcoins got crushed as overleveraged positions unwound.

Fast forward to today, and the setup feels just as fragile. Data from Coinalyze shows Bitcoin’s Open Interest (OI) dominance at 38%, meaning altcoin leverage is running nearly 50% hotter than Bitcoin. That kind of imbalance rarely ends with calm waters.

A new twist in the cycle

Here’s the interesting part: unlike the last cycle, Bitcoin dominance isn’t bouncing back. Instead, BTC.D has printed two lower lows since peaking at 65%. That suggests capital isn’t rotating back into Bitcoin—it’s staying glued to altcoins. According to AMBCrypto, this persistent flow away from BTC has left it chopping sideways, unable to reclaim market leadership.

As long as this divergence holds, the Altcoin Season Index could keep climbing and maybe even test its previous 88 peak. But traders should remember: the higher the index runs, the more brutal the eventual reset tends to be.

Looking ahead: thrill or trap?

Right now, the altcoin crowd is dancing at 76 on the Index, with Bitcoin dominance struggling to catch its breath. That’s exciting, but also dangerous. If the cycle repeats, we could see explosive gains in the short term—followed by a sharp correction when the music stops. The question isn’t whether altseason ends, but how messy the exit will be this time around.