Bitcoin has been stuck in a sideways shuffle, and the reason is surprisingly simple: the whales are on break. After unloading and repositioning between April and May, the big players stepped aside, leaving retail traders in charge of the market’s tempo. The result? A messy mix of chop, fakeouts, and squeezes that feel more like a casino than a chart.

But history suggests whales don’t stay quiet for long. They usually resurface at strong support levels or just before a new trend erupts. When that happens, Bitcoin rarely moves politely, it tends to sprint. Until then, retail’s back-and-forth will keep prices circling in neutral.

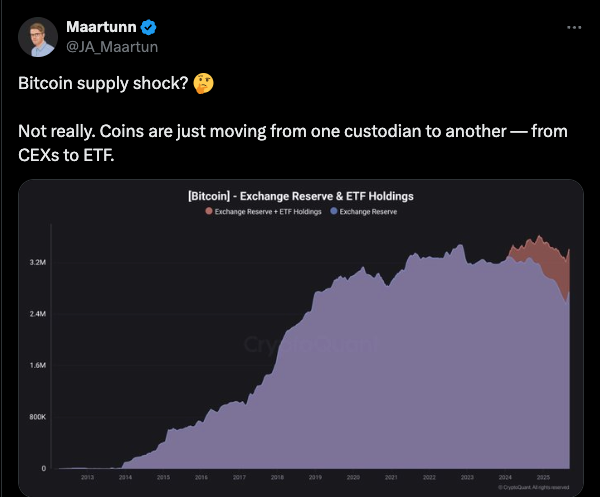

The Bitcoin supply shock illusion

Talk of a looming Bitcoin shortage has also been making the rounds. Exchange reserves are dropping, which might sound like a bullish squeeze waiting to happen. But scratch beneath the surface and you see a less dramatic picture. Most of those coins aren’t vanishing; they’re simply relocating from centralized exchanges into ETF custodians.

When ETF balances are factored back in, the “missing” supply isn’t missing at all, it’s just changing storage addresses. The real impact comes only when ETFs attract meaningful new inflows, and so far, that hasn’t hit critical mass. Until then, the supposed supply crunch is more illusion than reality.

Bitcoin short-term holders blink first

If whales are snoozing, short-term holders (STHs) are starting to fidget. Data shows they’ve slipped back into selling at a loss, with SOPR falling below 1 for the first time in months. At face value, that sounds bearish, but perspective is key.

Unlike the frenzy of past cycles where retail greed drove unsustainable surges, this year’s climb from $60K to $125K has been a slow burn fueled largely by institutions. The absence of overheated retail speculation makes this dip look more like a breather than a full-on reversal.

Why the cycle still favors bulls

Put the puzzle together, and the signals don’t point to the end of the party, just an intermission. With institutions still holding the reins, ETF flows acting as the quiet giant in the background, and whales likely waiting for the right moment to rejoin, the larger bull trend remains intact.

Yes, Bitcoin feels stuck in neutral for now. But if key supports hold and SOPR bounces back above 1, the rally has plenty of fuel left. In other words, this pause may be the market’s way of catching its breath before the next sprint.