A Bitcoin denominated life insurer has raised $82 million from major Wall Street backers, signaling growing institutional involvement in crypto-linked financial products.

JUST IN: Bitcoin life insurer Meanwhile raises $82 million led by Pantera and Haun Ventures.

Meanwhile offers life insurance fully denominated in Bitcoin. 🟧 pic.twitter.com/96aP4sjXeR

— Bitcoin Archive (@BTC_Archive) October 7, 2025

Bitcoin institutional Interest Strengthens

Investors such as Apollo, Bain Capital, Pantera, Haun Ventures, Stillmark, and Northwestern Mutual participated in the round, bringing the company’s total funding to $120 million since its 2023 launch. Analysts view this as a further sign of Bitcoin’s steady movement into regulated finance.

The Bermuda-based firm offers life insurance policies fully denominated in Bitcoin, allowing policyholders to borrow up to 90% of their policy’s BTC value after two years. This structure provides liquidity without triggering capital gains and mirrors traditional insurer balance sheets.

Bitcoin Expanding Role in Finance

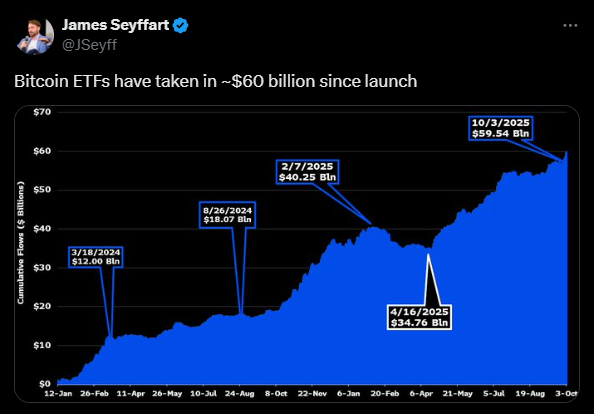

The development underscores a growing comfort among institutions treating Bitcoin as both a store of value and a financial instrument. Institutional Bitcoin ETF holdings now exceed $60 billion in 2025, while BTC-linked insurance and retirement products are expected to surpass $10 billion by mid-2026

This marks a shift from speculative use toward Bitcoin’s integration into mainstream financial infrastructure, blending compliance with blockchain-native products.

Technical Bitcoin Outlook

Bitcoin currently trades near $122,800, showing consolidation within an ongoing uptrend. A harmonic Bearish Butterfly pattern nears completion between $128,000 and $130,000, a potential reversal zone. The 50-day SMA at $114,311 and 100-day SMA at $107,702 remain upward, supporting broader bullish momentum.

Short-term resistance stands at $126,240, with a breakout possibly driving prices toward $130,000. On the downside, $121,700 and $118,500 serve as immediate support levels.

Long-Term Structure Remains Bullish

The weekly trend remains strong within an ascending channel. With higher lows supported by the 50-week SMA at $101,161 and long-term support near $44,729, Bitcoin maintains positive structure. A breakout above $134,487 could lead to an extended rally toward the $171,000 Fibonacci target, aligning with post-halving cycles seen in previous market expansions.