Bitcoin Rebound and Gold’s Pullback Reflect Shifting Market Mood

Bitcoin steady rebound and Gold’s sharp decline suggest investors may be gradually rotating out of defensive assets and back into risk exposure. Over the past five days, Bitcoin has climbed back above $115,000, while Gold has fallen nearly 9% from its all-time high, reflecting a potential recalibration of market sentiment.

Diverging Price Trends

Bitcoin is trading around $115,071 after recovering from its mid-October lows. The recent advance pushed its daily relative strength index (RSI) to 55, signaling improving momentum. A sustained close above $115,000 could confirm a short-term bullish breakout, though resistance between $115,000 and $118,000 remains key.

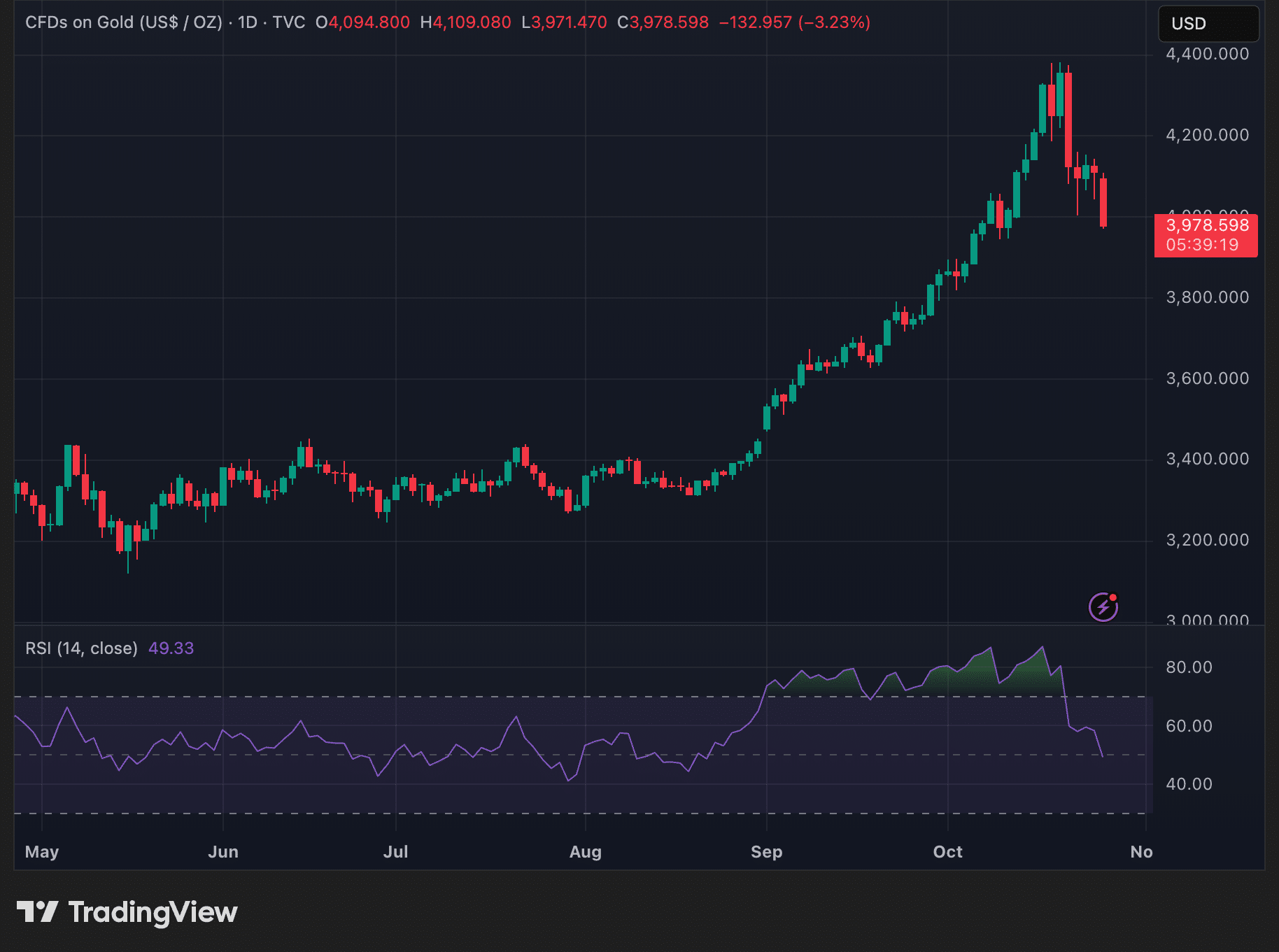

Gold, on the other hand, has slipped from its peak of $4,381 to near $3,980. The metal’s RSI has dropped below 50, indicating fading buying pressure and possible near-term consolidation around the $3,900–$3,950 range.

Bitcoin Risk Appetite Gradually Returning

The contrasting moves between Bitcoin and Gold reflect a shift in investor positioning following months of caution. Gold’s surge earlier in October was driven by demand for hedges amid geopolitical and monetary uncertainty. Now, with volatility easing and ETF inflows stabilizing, investors appear more open to reallocating toward higher-risk assets like BTC.

Still, the transition remains tentative. BTC’s resilience suggests improving risk sentiment, but confirmation of a broader rotation will depend on sustained institutional inflows and stable macro conditions.

What the Market Signals

Bitcoin’s recent higher lows form a constructive short-term recovery pattern supported by increased trading volume on up days. Meanwhile, Gold’s pullback lacks heavy selling volume, implying a possible stabilization attempt near support.

If BTC maintains its footing above $112,000, the current momentum could extend toward $118,000. However, a break below support would risk a move back toward $108,000.

Outlook: Whats Next for Bitcoin and Gold?

The coming weeks will likely reveal whether this rotation develops into a lasting shift or remains a temporary adjustment. ETF flows and institutional behavior will play a critical role in determining whether risk appetite holds or retreats back into safe-haven assets.