Solana and XRP exchange-traded funds continued their inflow streak on November 14, contrasting sharply with the ongoing outflows from Bitcoin and Ethereum ETFs. Updated data shows a widening divergence in investor behavior across major digital asset products, with institutional capital shifting away from the two largest cryptocurrencies.

Bitcoin and Ethereum ETFs face multi-day redemptions

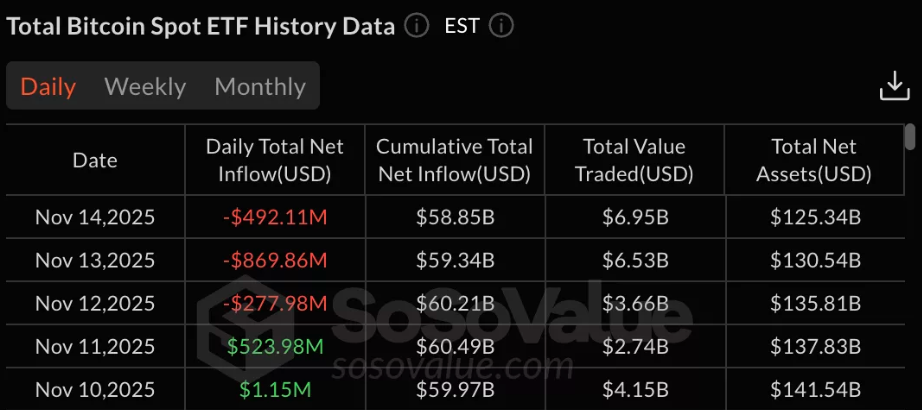

Bitcoin ETFs saw another day of significant withdrawals, losing $492.11 million on November 14. This followed a steep $869.86 million outflow the day before and $277.98 million on November 12, marking three consecutive days of redemptions.

The recent downturn comes after brief inflows earlier in the month, including $523.98 million on November 11. Despite the outflow streak, total cumulative net inflows for Bitcoin ETFs remain positive at $58.85 billion, with collective assets reaching $125.34 billion.

Ethereum ETFs also recorded another day of losses, extending a four-day outflow streak. Withdrawals reached $177.90 million on November 14, following larger redemptions of $259.72 million on November 13 and $183.77 million on November 12. Total cumulative net inflows for Ethereum ETFs now stand at $13.13 billion, with assets under management at $20 billion.

Solana ETFs maintain steady inflows

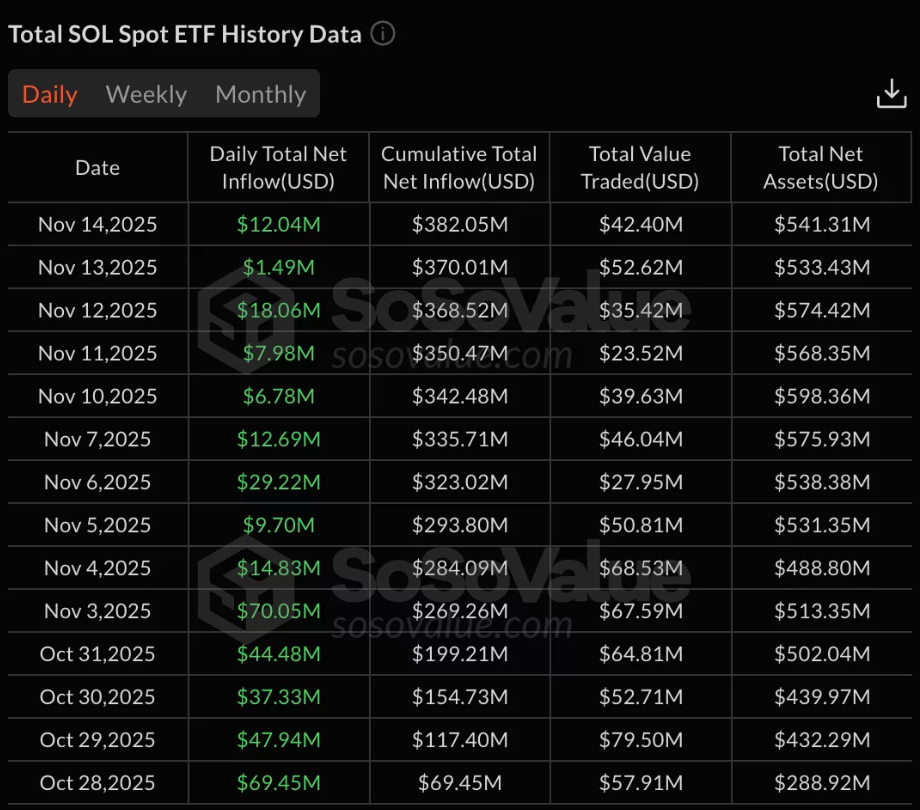

Solana funds have recorded consistent inflows since late October. On November 14 alone, Solana ETFs added $12.04 million, continuing the positive trend seen throughout the week. Earlier inflow days included $1.49 million on November 13 and $18.06 million on November 12.

Total cumulative inflows have reached $382.05 million, with assets under management rising to $541.31 million. The persistent interest suggests that investors continue to view Solana as a strong alternative amid volatility in larger-cap assets.

XRP ETFs see strong early demand

XRP ETFs, launched on November 13, posted no inflows on their listing day but saw a quick turnaround with $243.05 million added on November 14. The new funds reached $248.16 million in assets after just two days of trading.

The early inflows highlight investor interest in gaining exposure to XRP through regulated products, even as broader crypto markets remain mixed.

Altogether, the contrasting flows across Bitcoin, Ethereum, Solana, and XRP products underscore shifting market sentiment as investors reassess risk and opportunities across asset classes.