Bitcoin Recovers Above $85K, Is a ‘Santa Rally’ Still Possible?

Bitcoin has rebounded from last week’s $80,000 low, but caution remains as investors weigh macroeconomic pressures and shifting derivatives positioning ahead of the Federal Reserve’s next policy decision.

Bitcoin Market Sentiment Remains Divided

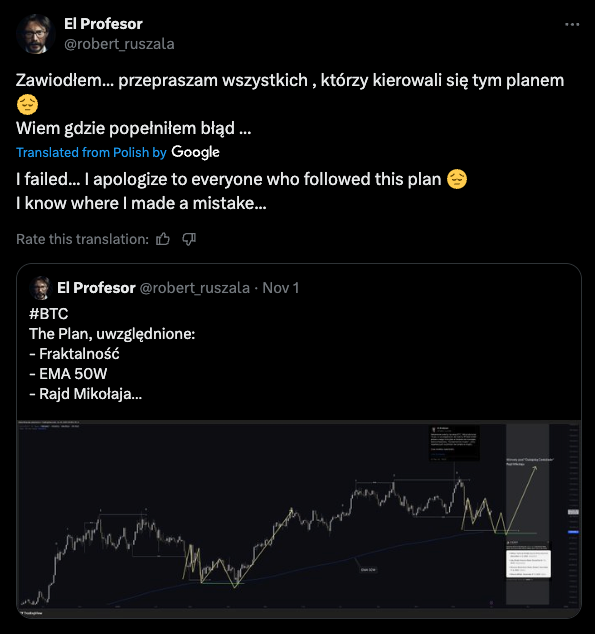

After steep losses in November, Bitcoin traders are watching closely for signs of stabilization and a potential late-year rebound. The so-called “Santa rally” thesis, popularized by analyst Robert Ruszale, hinged on Bitcoin holding its 50-week exponential moving average (EMA). That support failed earlier this month as BTC fell to $80,000 before recovering above $85,000.

Despite the bounce, near-term sentiment remains cautious. Option market data from Deribit shows elevated demand for protective puts, signaling lingering fear of renewed downside. However, notable open interest remains concentrated around the $90,000 and $100,000 strike prices, hinting at optimism for a recovery into December.

Options Data Reflects Mixed Positioning

Deribit Insights observed that a major institutional participant, likely a fund or miner, who had been actively selling calls and buying puts during the downturn has recently reduced hedging activity. This reduction could indicate expectations of short-term stability, though continued put buying has kept skew levels high.

Recent option flows reveal bullish exposure at $90,000 and $100,000 strikes, while hedging remains concentrated around $84,000 and $70,000. The positioning underscores a cautious optimism: participants see room for upside but remain protected against another sharp decline.

Macro Conditions Still in Play

According to Amberdata’s Greg Magadini, broader macroeconomic dynamics continue to influence crypto markets. He linked Bitcoin’s weakness to U.S. tech sector underperformance and potential global credit tightening, partly triggered by Japan’s rising bond yields.

Magadini downplayed fears of a major liquidity unwind, noting that Japan is unlikely to raise short-term rates due to its high debt burden. If monetary policy stabilizes globally, risk assets like Bitcoin could benefit, potentially allowing BTC to regain ground toward $90,000–$100,000.

Outlook: What’s Next for Bitcoin?

While Bitcoin’s recovery above $85,000 provides relief, confidence in a December rally remains fragile. Derivatives positioning and macro trends suggest cautious optimism, a setup where BTC could grind higher if risk sentiment improves, but downside risks persist if global liquidity tightens further.