2025 has so far been one of the most difficult periods for digital assets since the 2022 downturn. As the final quarter approaches its close, the total cryptocurrency market capitalization remains under pressure, reigniting debate around whether crypto has moved beyond speculative cycles. Solana finds itself at the center of that discussion.

From a performance perspective, SOL has struggled relative to its large-cap peers. The token is down roughly 27% year to date, making it the weakest performer among the top five cryptocurrencies by market value. By comparison, Binance Coin has gained approximately the same percentage over the same period. This places Solana on track for its poorest annual showing since the 2022 bear market.

On-chain metrics reflect growing stress among holders. Solana’s Net Realized Profit and Loss indicator has turned sharply negative, suggesting that many investors are selling at a loss. Historically, this type of reading has aligned with capitulation phases, where confidence weakens and market participants either wait for clearer conditions or exit positions altogether.

Despite this technical weakness, Solana appears to be approaching an important inflection point. While price action continues to trend lower, activity within the broader ecosystem suggests a different narrative is developing beneath the surface.

Real World Assets Shift Solana Strategic Direction

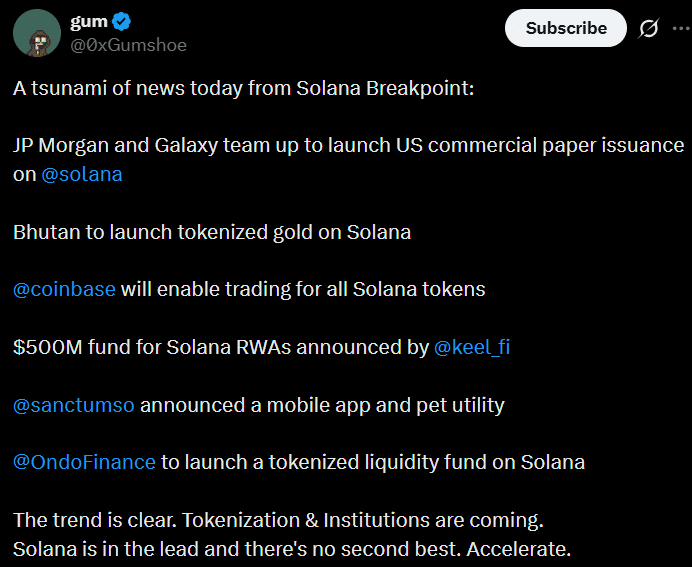

Recent ecosystem developments indicate that Solana is increasingly positioning itself around real world asset infrastructure. A significant portion of its latest partnerships are tied to tokenized assets rather than speculative applications.

Several initiatives illustrate this shift. Bhutan has introduced tokenized gold products, while institutional allocator Keel has announced a fund valued at approximately $500 million. Ondo Finance is also preparing to deploy a tokenized liquidity fund on Solana. These projects rely on Solana’s ability to process transactions quickly and operate at scale, reinforcing its appeal for on-chain financial infrastructure.

Real world assets represent tokenized versions of tangible or financial instruments such as commodities, funds, or fixed income products. Their expansion on Solana suggests an effort to move beyond short-term speculation and toward utility-driven use cases.

Network Activity Signals Ongoing Interest

Blockchain data shows that market participants continue to engage with the network despite price weakness. On-chain tracking platforms observed a new wallet withdrawing around 37,000 SOL from Binance, while address growth has accelerated since the mid-October market downturn. Approximately two million new addresses have joined the network during that period, pushing total addresses to around 6.5 million.

A newly created wallet 6pj7c4 just withdrew 37,002 $SOL($4.84M) from #Binance.https://t.co/Ri1mtQFO85 pic.twitter.com/wxh4rvYajP

— Lookonchain (@lookonchain) December 11, 2025

This contrast between declining prices and expanding ecosystem activity highlights the tension currently surrounding Solana. While technical indicators remain bearish, infrastructure development and user growth continue to support interest in the network.