Vitalik Buterin is raising an important question about Ethereum long-term survival. His idea, known as the “walkaway test,” asks whether the network could continue functioning even if active development slowed or stopped.

At the same time, most of Ethereum’s real activity is concentrated among a small group of large application builders. Confidence in the network appears to come less from constant upgrades and more from the ecosystem that already exists.

What the Walkaway Test Means

In a recent post on X, Buterin argued that Ethereum should behave more like a tool than a service. In his view, users should be able to rely on the network without depending on ongoing updates or a central group of maintainers.

The walkaway test suggests that Ethereum’s value should come from what is already built into the protocol today. If developers could step away and the network still worked as intended, that would signal true resilience.

Ethereum itself must pass the walkaway test.

Ethereum is meant to be a home for trustless and trust-minimized applications, whether in finance, governance or elsewhere. It must support applications that are more like tools – the hammer that once you buy it’s yours – than like…

— vitalik.eth (@VitalikButerin) January 12, 2026

To move closer to this goal, Buterin highlighted long-term priorities such as stronger security, better scalability, and a design that can last for decades rather than years.

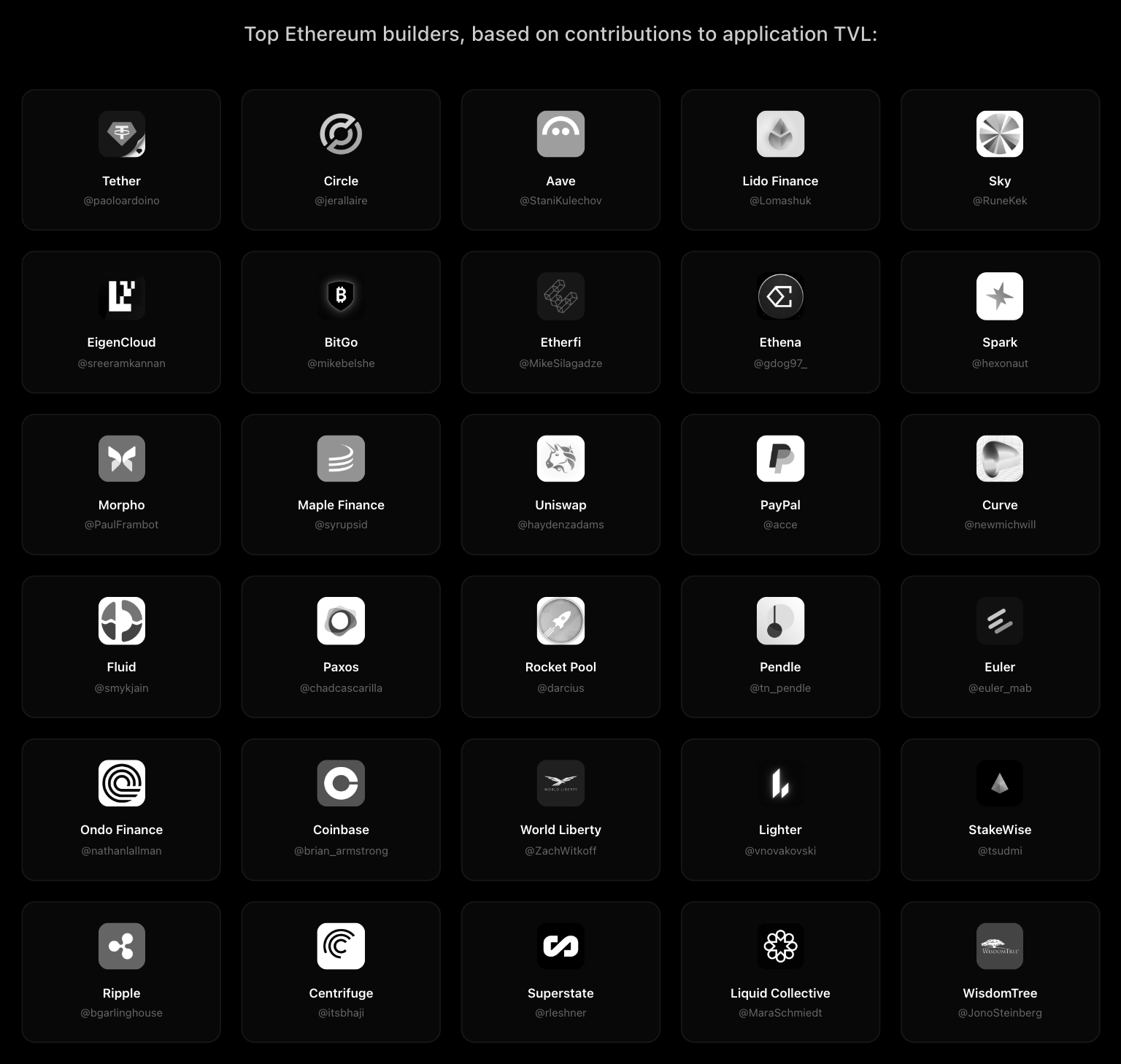

A Small Group Drives Most Network Activity

While ETH is often described as highly decentralized, most of its economic activity is supported by a relatively small number of major players. More than 90 percent of the value locked on the network comes from large application builders.

These include stablecoin issuers, decentralized finance platforms, staking providers, and traditional finance companies such as PayPal and Coinbase.

These applications continue to operate regardless of frequent changes to the base layer. Their ongoing use shows that ETH already functions in a way that aligns with the walkaway test idea.

Institutional Capital Signals Long-Term Confidence

Recent activity from institutional investors also reflects confidence in Ethereum’s staying power. Tom Lee’s firm, Bitmine, increased its Ethereum exposure by $75.6 million last week.

This brought Bitmine’s total ETH holdings to more than $13 billion. Rather than holding passively, the firm has been actively staking its Ethereum.

In just one day, Bitmine staked around $340 million worth of ETH, bringing its total staked amount to roughly $3.69 billion. That represents close to 1 percent of Ethereum’s total supply.

What This Says About Ethereum’s Future

Together, these trends suggest that Ethereum’s strength may now come from its existing users and infrastructure rather than constant innovation alone. Large applications keep the network active, while major investors continue to commit long-term capital.

Whether or not ETH ever truly passes the walkaway test, current usage shows that the network already plays a critical role in the digital asset ecosystem.