IRGC and Citizens Drive Crypto Growth in Iran’s Turmoil

Crypto use in Iran surged in 2025, reaching about $7.78 billion in total transaction value, according to blockchain analytics firm . This growth happened amid rising political unrest, severe economic stress, and a sharp drop in the value of the Iranian rial.

Crypto Activity Responds to Unrest and Economic Crisis

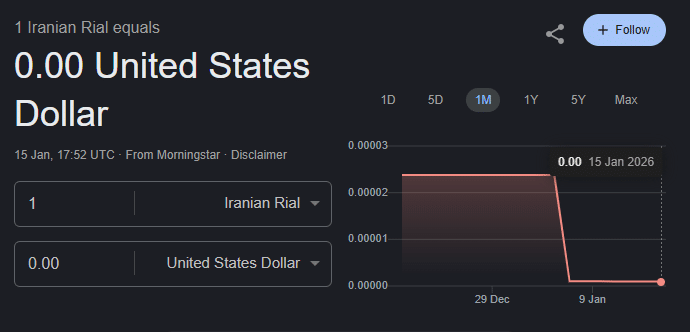

As protests spread across the country starting in late December 2025, many Iranians turned to Bitcoin and other digital assets to protect their savings. The rial has lost most of its value against major currencies, leaving local savings effectively worthless and pushing people toward alternative stores of value.

Chainalysis data shows notable increases in cryptocurrency transfers during periods of domestic and geopolitical tension throughout the year. Spikes in activity have lined up with events such as military clashes and other regional conflicts, suggesting that crypto behavior often reflects broader instability .

Iran Shift From Exchanges to Personal Wallets

On-chain movement data indicates that many users have been withdrawing Bitcoin from Iranian exchanges and sending it to private wallets. Analysts describe this as a rational response to both economic collapse and fears over local exchange security during unrest .

Withdrawals include both large and small amounts, suggesting that a wide range of holders are choosing self-custody over leaving crypto on platforms during instability.

State Actors and Crypto Use

The report also highlights a significant role for state-linked actors in Iran’s crypto ecosystem, especially the Islamic Revolutionary Guard Corps (IRGC). Addresses associated with the IRGC accounted for about half of the total crypto value received in late 2025, showing that government entities have also increased their on-chain activity .

This involvement reflects how crypto has been used in part to work around international sanctions and limited access to global financial systems. In regions under sanctions, digital assets like Bitcoin and stablecoins offer a way to move value with fewer controls, though they also raise compliance and regulatory challenges internationally .

Crypto as a Safe Haven Amid Inflation in Iran

For many Iranian citizens, the rise in crypto use represents an attempt to preserve wealth while local currency purchasing power collapses. Stablecoins and Bitcoin provide alternatives to holding the rial, especially when traditional banking options are constrained .

Despite government restrictions and ongoing internet disruptions, crypto activity has continued to grow, with both private holders and state-linked entities participating in on-chain transactions.