Introduction

If you’re still camping out with snacks waiting for the next big altseason to arrive — bad news: it might’ve already popped in, partied, and left without saying goodbye. The days of retail-driven, week-long moon missions across the altcoin galaxy may be behind us. In 2025, the game has changed. Instead of slow-building euphoria, the market’s now hosting fast-paced, intraday rallies — some lasting mere minutes. And guess who’s catching those moves? Not the average trader.

Zoom In or Miss Out

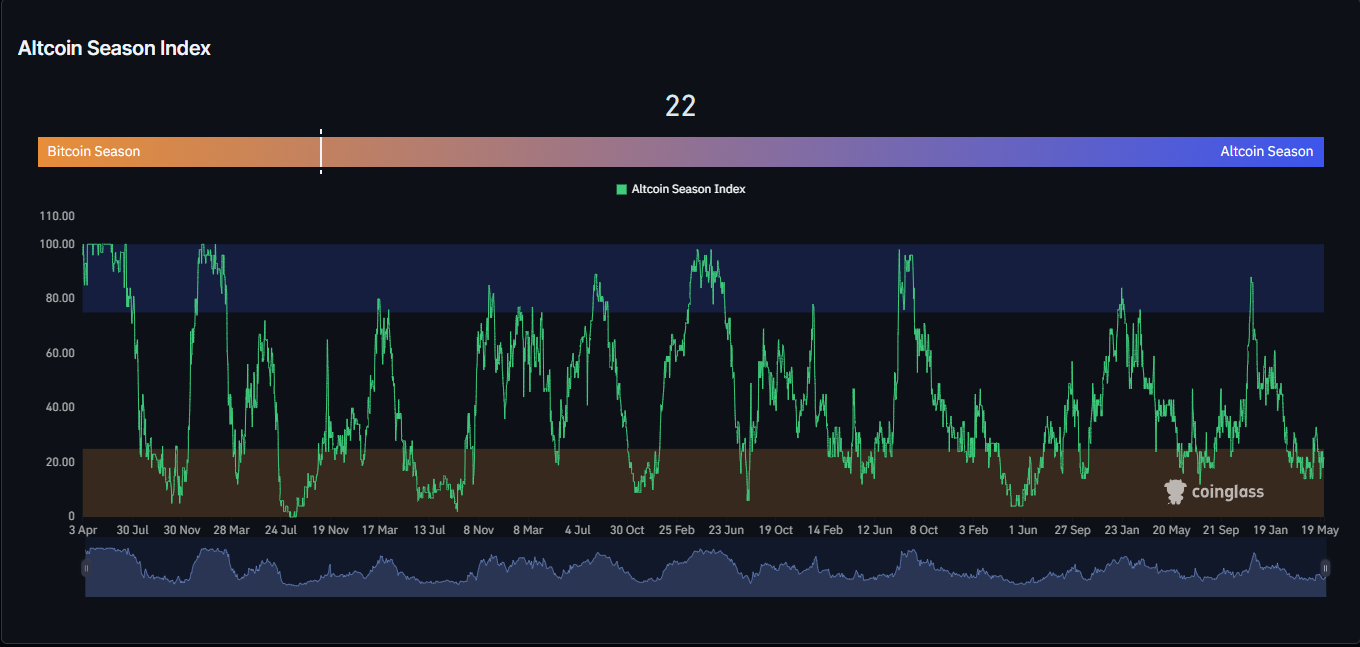

While Bitcoin continues to strut above $100K and dominance holds around 64%, altcoins are staging ambushes — short, sharp bursts that register on 1-hour or even 1-minute charts. Between April and late May, the altcoin season index spiked five times above 75%, each time signaling that altcoins were momentarily outperforming BTC. But if you were staring at the daily candles? You probably saw… nothing.

These aren’t the meme-fueled surges of 2021 where DOGE barked to the moon and every random token rode the hype wave. Today’s “altseasons” are surgical strikes. The pros are slicing through the market, executing fast rotations into alts, collecting gains, and funneling the profits back into Bitcoin or stablecoins before retail can even hit refresh.

Smart Money’s New Strategy: Altcoin Scalping

What’s fueling this stealthy rally pattern? Algorithms, volume-tracking tools, and a strategic approach to risk. Institutional traders and whale wallets aren’t playing the long game anymore when it comes to altcoins — they’re scalping them like digital sushi chefs.

They’re watching for sudden bursts of liquidity in specific sectors — AI, DeFi, meme coins — and they pounce before retail even wakes up. This rapid rotation is now the norm. It’s clean, fast, and surgical. The money doesn’t stay in the altcoin market long enough to spark broad rallies. Instead, it cycles right back into BTC, keeping Bitcoin dominance high even as alts flirt with breakout moments.

The New Altseason Playbook

This isn’t to say altcoins are dead. Far from it. But the definition of “altseason” is undergoing a complete makeover. Think less “months-long bull run,” and more “hourly sniper shots.”

To navigate this new landscape, traders need to adapt. That means watching 1-minute charts, using alerts to catch volume spikes in obscure trading pairs, and staying tuned to Bitcoin dominance like it’s the market’s heartbeat. If BTC.D dips even slightly, there’s a chance a micro-altseason is brewing somewhere.

Final Thoughts: Altseason Speed Kills — or Profits

Altseason hasn’t disappeared. It’s just evolved into something most retail traders aren’t built to chase. Micro-rallies are now the market’s favorite trick — they’re profitable, fast, and completely invisible unless you’re watching closely.

So the next time you wonder where the fireworks are — maybe you just blinked.