Arbitrum (ARB) price has fallen more than 28% in the last 24 hours to hit a new low. Meanwhile, crypto market leaders Bitcoin (BTC) and Ethereum (ETH) have also seen their prices drop due to today’s crypto market events. At the time of writing, the altcoin is trading at $0.51. This is the all-time low for Arbitrum (ARB).

Arbitrum Falls, Traders Sell Off

Arbitrum (ARB) is showing interesting dynamics: the token is falling in price, but the daily trading volume has increased sharply. And by 151% at once – up to $589 million. In this case, this most likely indicates that many investors are selling the asset due to negative news or a general decline in the market.

The opposite movements in ARB’s price and its trading volume create a negative divergence, indicating significant bearish sentiment towards the token.

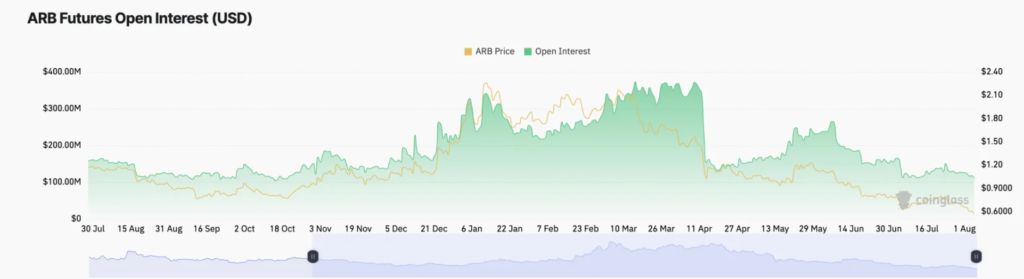

The significant drop in ARB – down almost 28% in the last 24 hours – has also affected activity in the derivatives market, with trading volumes soaring by more than 200% over the period.

At the same time, open interest (OI) has decreased by 30%. Thus, OI for ARB futures at the time of writing is $109 million. The indicator is at its lowest level since October 2023.

This scenario suggests that many market participants are leaving the ARB futures and options market to avoid further losses.

Additionally, the price drop has triggered liquidations of long positions. According to Coinglass, forced long liquidations on ARB have reached $2.01 million at the time of writing. The last time such a high level of daily liquidations was seen was on June 7.

About ARB

The Arbitrum project is a protocol for scaling the Ethereum chain. It is similar in functionality to Ethereum, it also allows you to run smart contracts, use web3 applications, rely on the security measures of the underlying network, but the transaction speed will be higher and their cost will be lower.

Arbitrum Rollup can solve a number of problems in Ethereum, but developers have the option to use other tools, such as AnyTrust chains. Such chains do not have the same level of security and decentralization as rollup, but can offer lower fees. The key difference: in the case of rollup, all data is located on layer 1, and in AnyTrust – autonomously, offline. Hence the lower fee.

Arbitrum Airdrop is the highest governing body of the Security Council will be the Arbitrum DAO, which will be elected twice a year. The Arbitrum DAO will have the ability to control the future of the protocol and its technological decisions. For example, developers who want to launch chains using the Arbitrum stack can submit a proposal to the DAO, and the DAO can approve or reject these ideas.