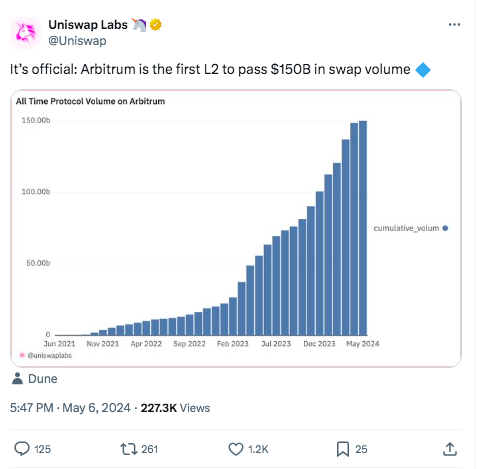

Trading volume through Arbitrum on the decentralized exchange (DEX) Uniswap broke through $150 billion, making the protocol the first layer-2 (L2) network to reach this milestone. However, Arbitrum has become the most used network on Uniswap. The record trading volume reflects its growing dominance in the decentralized finance (DeFi) market. Meanwhile, A new memecoin called WienerAI launched its crypto presale on April 25th, and in a feat, it has already raised over $1 million in just a matter of days.

Arbitrum is The most used L2 network on Uniswap

Since its inception, the Arbitrum project has focused on two of the most significant challenges facing the Ethereum (ETH) network. Namely, by increasing the speed of transactions and reducing commission fees.

Arbitrum is currently the leading layer 2 protocol. Moreover, according to DefiLlama, its total value locked (TVL) now stands at $2.64 billion. The L2 network is second only to the major layer 1 blockchains: Ethereum, Solana, Binance Smart Chain and TRON. In addition, Arbitrum’s most recent success is that the network has become the most used layer 2 solution on Uniswap.

“It’s official. Arbitrum is the first L2 network to surpass the $150 billion mark in swap volume,” DEX representatives wrote on X (formerly Twitter).

What happened to the price of Arbitrum (ARB)?

The network’s record operating performance does not have much impact on the dynamics of Arbitrum’s native token – ARB. Immediately after the news appeared, the price of the asset briefly increased from $1.06 to $1.13. However, after that she quickly returned to her previous levels.

According to CoinGecko, ARB is in 41st place in the ranking of cryptocurrencies by capitalization. At the time of writing, the coin is trading at $1.06. Over the past 24 hours, the value of the token has dropped by 5.6%, and over the past month it has fallen by almost 30%. Daily cryptocurrency trading volume, meanwhile, increased by 22% to $344.9 million. ARB’s market value is now $2.8 billion. Earlier it became known that the Arbitrum community decided to take advantage of the hype around memecoins and proposed creating a special fund for “memecoins”. According to the authors of the proposal, such an initiative will have a positive impact on the L2 network ecosystem.

WienerAI: The Memecoin of the Future

This quirky project, blending artificial intelligence, canine loyalty, and a generous helping of humor, might potentially be well-positioned to have a decent presale and a successful launch down the road. In addition, at the heart of WienerAI lies its native token, $WAI, an ERC20 token built on the battle-tested Ethereum blockchain.

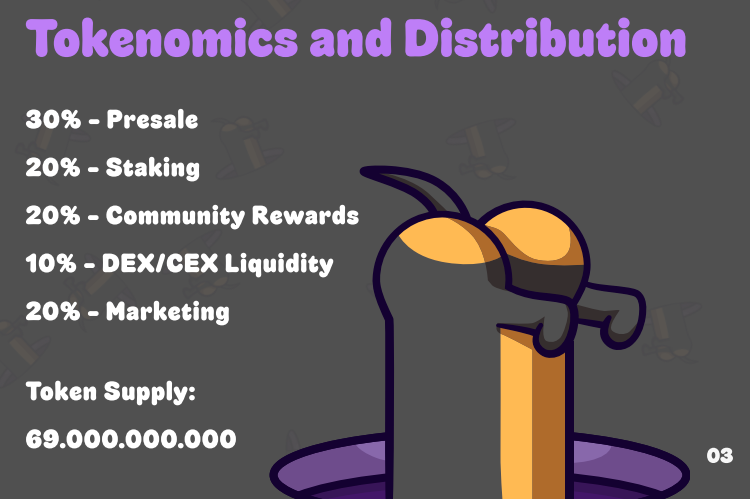

The project’s tokenomics are designed to foster community engagement, provide liquidity, and fund ongoing marketing efforts. During the ongoing first stage of the presale, 1 $WAI is priced at $0.000701, offering early investors an attractive entry point. Furthermore, the project has not set a predetermined hard cap, allowing for flexibility in presale. Investors can purchase $WAI tokens using Ethereum (ETH), Tether (USDT), or conveniently via credit/debit card. What’s also worth noting to potential investors is the new trading bot feature WienerAi’s team added last week.

WienerAI Background and Project Audits

The theme behind WienerAI is set in the future, in the year 2132, where a mad scientist known as The Architect is working tirelessly in the New Silicon Valley to create a highly advanced cybernetic canine AI. The project’s ambitious goal is to bridge the divide between AI and “Pup,” two integral components of the crypto-verse, and is aptly described as “Part Dog, Part AI, Part Sausage.”

To ensure the safety of investing in the project and to mitigate the risks associated with the rising number of rug pulls in the memecoin front, WienerAI has undergone an audit conducted by Coinsult, a reputable blockchain security firm. Moreover, this audit further enhances investor confidence and demonstrates the project’s commitment to transparency and security.